Income Tax Exemption/Deduction Health Insurance U/s 80D for the F.Y 2020-21.

NOTE:- AS PER THE INCOME TAX NEW SECTION 115 BAC, INTRODUCED IN BUDGET 2020 AS NEW AND OLD TAX REGIME, THIS SECTION 80D MEDICAL INSURANCE IS NOT ENTITLED TO THE NEW TAX REGIME BUT THIS SECTION CAN AVAILED TO THE OLD TAX REGIME.

Health insurance (or) medical insurance is a must for everyone. It is important to have adequate medical insurance coverage considering the rate at which medical expenses are increasing. Medical inflation in India is rising at a significant rate, from about 12% to 15% per year. Therefore, criticized for having adequate health cover, it is more important for senior citizens.

The absence of health insurance can wipe out your savings. Having adequate coverage will protect you and your dependents from falling into financial crisis during hospitalization or treatment of a serious illness or accident.

In addition to medical coverage, health insurance plans can give you tax benefits. The premium paid for medical insurance can be claimed as a health insurance tax exemption under section 80D of the Income-tax Act,1911.

However, a new income tax has been proposed in the 2020 budget. Under this new amendment, the applicability of section 80D tax benefits depends on whether you are opting for the old (or) new tax structure.

Section 80D tax benefits under the new tax regulator A.Y 2021-22

Can I claim Health Insurance Premium Section 80D Income Tax Benefit under the new insurance system?

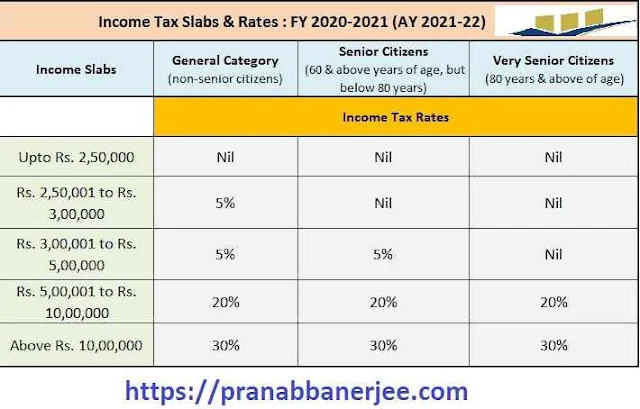

According to the Finance Bill 2020-21, you can now opt for the new income tax slab rate of 15% and less than 25% in addition to the 10%, 20% and 30% slab rates.

Pre and old tax slabs

The person who is reluctant to pay tax under the new proposed personal income tax system will have to cancel almost all the tax breaks (tax benefits) claimed in your old tax regime.

All income tax exemptions under Chapter VIA IB, 80-IBA, etc.) Those who petition on behalf of the new tax discipline will not be entitled.

Thus, the medical insurance premium will not be claimed as U/S 80D.

Health Insurance U/s 80 D Tax Exemption Financial Year 2020-21 Old tax regimes

In that case, if you want to opt for the old income tax slab rate (shown in the table below) then you can claim your IT discount and discount.

Income tax rates for financial year 2020-21 (if tax deduction / exemption is claimed)

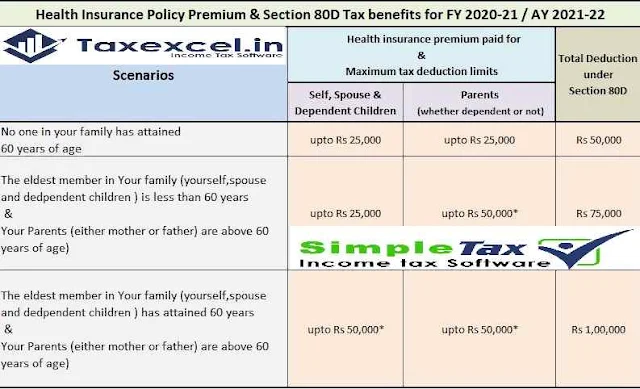

In the Union Budget 2018, the Government of India has implemented the following changes in respect of exemptions for health insurance and / or medical treatment. The same provisions apply to the fiscal year 2020-21 (AY2021-22).

The following limits apply to the financial year 2020-2021 (or) assessment year (2021-2022) u / s 80D.

The cost of preventive health checkup (medical checkup) per family can be claimed as tax deduction of Rs.5000 /- per family. Remember, this is not more than the individual limit as described above. (Includes family: self, wife, parents and dependent children).

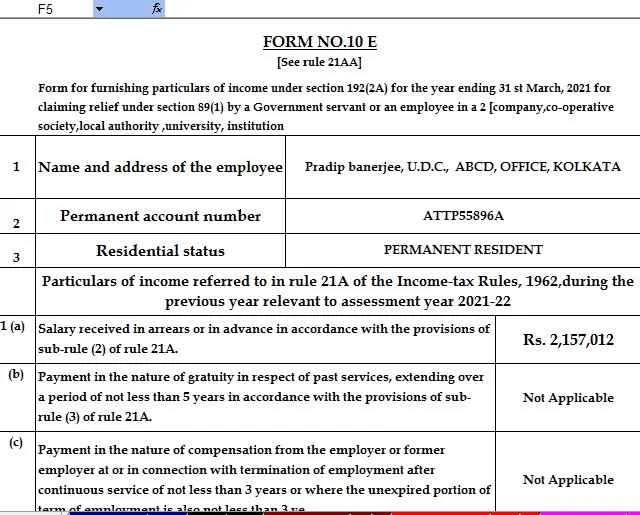

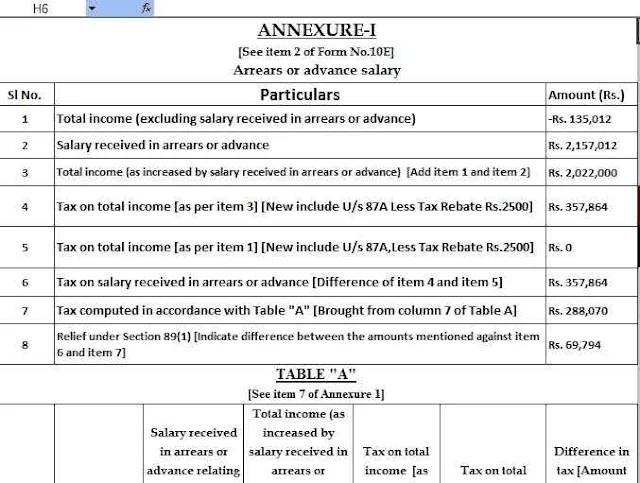

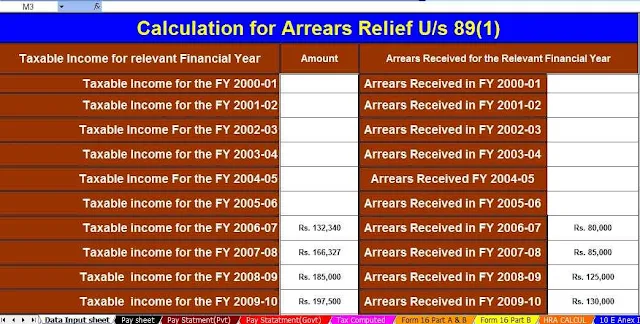

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 as per New Section 115 BAC