What is the importance of Income Tax Form 16? Understand the details about the topic form 16. In this article first, discuss what is form 16, then its components and its importance. First, what is form 16? Each year each and every employer issues Form 16 salary certificate. This is a certificate under Section 203 of the Income Tax Act that provides details about the tax amount that has been deducted by your employer that is called TDS.

However it also contains the details of your salary other incomes and tax benefits available and availed by you in the last financial year. This Revised Form 16 has detailed information about the manner of calculating income as per the income tax laws and tax payable on it. May, 31 is the last date for your employer to issue a Form 16 to you. Now we will discuss the components of form 16 helps us understand the tax paid probable tax refund we can get, and can also help in better tax planning, we can do it next year, and most importantly, can also assist us to file our income tax returns

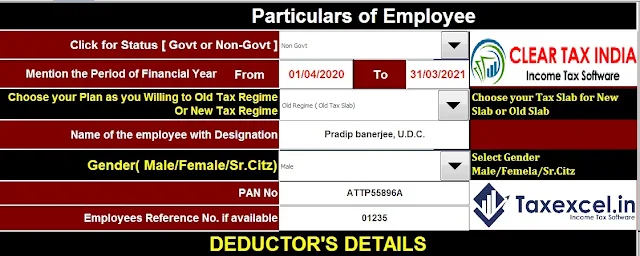

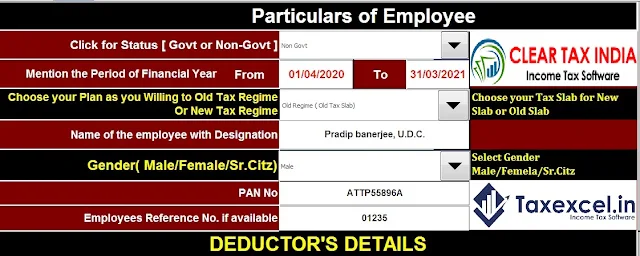

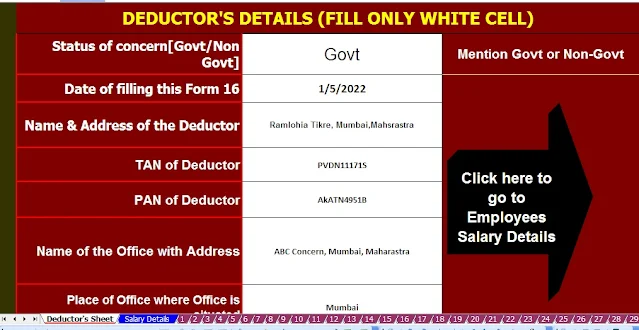

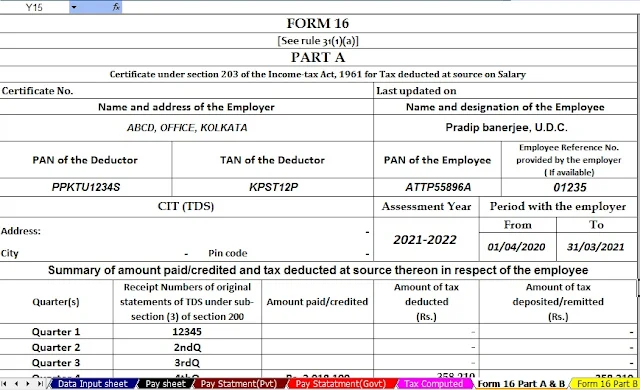

Download Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2020-21 for the F.Y.2020-21 as per New and Old Tax Regime [ This Excel Utility Can prepare at a time 50 Employees Form 16 Part A&B]

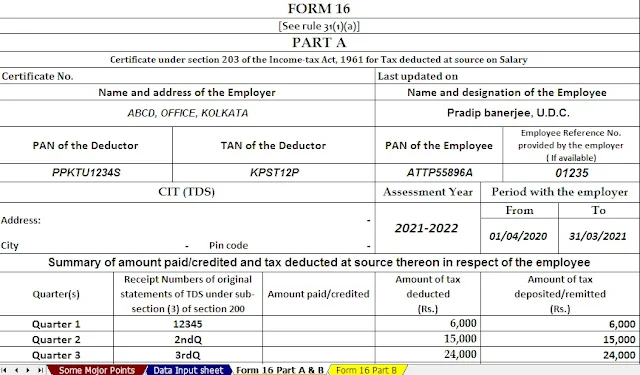

Form 16 comprises mainly of two sections. Form 16 Part A what has in the Part A of Form 16?. It contains our personal information like our name, address, employers name and address pan of both pans of our employer and receipt number of TDs payment. All this information assists the income tax department to keep a track of money flow from our own as well as our employer's account.

In addition, the party provides information like assessment tier, that is a year in which tax liability is computed for the income earned during the previous year. Assessment year here means taxes calculated on the income from first April 2013, to 31st March 2014. It has a summary of tax deducted by the employer on our behalf.

This amount is deducted by the employer from our salary every month as tax and credits the same to the income tax department to know why this TDs is deducted you should watch our video on what is tedious. The most important information in Part A is a tab. That is, tax deduction account number of employer and total tax deducted, as both of this information has to be correctly mentioned in our income tax return, so that if there is any tax credit, we can get that.

Now let's discuss Part B. This part of form 16 provides major information that you require to file your income tax return. First of all, the total salary given by the employer in the financial year is mentioned, then prerequisite, or perks is an additional benefit provided by the employer. In addition to the salary. It is any benefit granted free of cost, or at confessional rates, such as rent-free home motorcar facility loans at subsidized rates, etc.

Download Automated Income Tax Revised Form 16 Part A&B &B for the Financial Year 2020-21 for the F.Y.2020-21 as per New and Old Tax Regime [This Excel Utility Prepare One by One Prepare Form 16 Part A&B and Part B]

Then this field, profit in lieu of salary means any payment due to, or received by the employer in connection with the termination of employment. For example, gratuity committed value of pension etc. Then there are allowances. They are the amount paid by the employer, in addition to salary to meet some service requirements such as DNS allowance house rent allowance. Live travel allowance conveyance allowance children's education allowance etc allowance can be fully taxable. Partly or non-taxable. Here the person has got only a child allowance, which is fully tax-deductible. in this case, and hence is deducted from total salary before tax calculations, then here are the details of tax benefits we get on our home loan interest payments as per section 24(B) of Income Tax Act.

So after deducting all the expense allowances, and money paid on home loan interest EMI, we get our cross income. Then, deductions are disclosed deductions include those under Section 80 C, 80CCC and 80CCD, whose total sum deductible under these respective sections must not go beyond rupees 1.5 lakhs. In this case, the person has not taken complete rupees 1.5 lac tax benefit in this year, which means has paid higher tax than he or she should have.

Download Automated Income Tax Revised Form 16 Part B for the Financial Year 2020-21 for the F.Y.2020-21 as per New and Old Tax Regime [This Excel Utility Prepare One by One Prepare Form 16 Part B]

Then after this deduction under Section 80 D add and others are also mentioned here, the person has taken, none of them. The entire deductions are then subtracted from gross income so as to arrive at taxable income. Hence, tax is then computed on this amount based on the current tax lap of the IRS, which in this example is this much relief under the section, 89 means, if you have received any portion of your salary in early years, or in advance, you are allowed some tax relief under this. In simple words, you are saved from paying more tax because of delaying payment to you.

Now let's go about the importance of form 16 serves as a source document during filing of income tax return, as it comprises details about your income deductions tax calculated and TDs deducted as per income tax rules. It serves as an important document for claiming credit of tax deducted by employers, and you might require it to produce before income tax authorities. If you don't get a credit of TDs properly form 16 can also be used if you wish to apply for home loans, there are some banks that asked for form 16 for income proof form 16 is needed for visa processing as well.

And it is an authenticated certificate for income proof. Before we close a few other important information about the form 16 hours. If TDs is not deducted, then it is not mandatory to issue form 16 to the employer. If the organization does not possess the Tan. Then they are not entitled to deduct TDS, and then in this situation, they will obviously not give form 16. Self-employed person cannot acquire form 16.

Download Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2020-21 for the F.Y.2020-21 as per New and Old Tax Regime [ This Excel Utility Can prepare at a time 100 Employees Form 16 Part A&B]