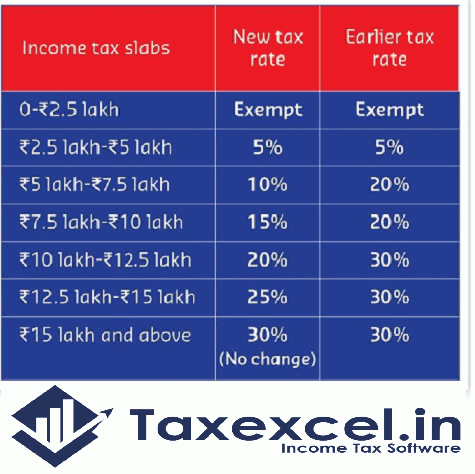

A new income tax system was introduced by our qualified Finance Minister. Nirmala Sitharaman in the 2020 budget with more tax slabs and lower tax rates. It was introduced to remove citizen dependence on tax advisors and to simplify the tax structure. The new tax system is separate and has reduced the tax slab for HUF taxpayers with some duty waivers or waiver conditions.

Taxpayers will have a choice to choose in the new prescribed Form 10-IE the old or new tax discipline. Although the option must be applied at the time of filing the return, this option must be determined at the beginning of the financial year for the purpose of paying advance tax or TDS on salary so that your employer can deduct TDS accordingly. However, the employee will still be able to choose to file an ITR without providing the employer with any alternative. So, you can switch between the new and old tax system when filing an income tax return.

You may also, like- Automated Income TaxPreparation Excel Based Income Tax Software All in One for the Non-Govt(Private) Employees for the F.Y. 2020-21[This Excel Utility can prepare at a time

Tax Computed Sheet + Individual Salary Structure as per the Non-Govt Employees

Salary Pattern + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated

Income Tax Form 12 BA + Automated Income Tax Revised Form 16 Part A&B +

Automated Form 16 Part B as per the New and Old Tax Regime U/s 115 BAC]

Discounts are not allowed in the new tax system

Note that if the taxpayer chooses the new tax discipline, he will not be able to claim most of the number of concessions and exemptions he enjoyed in the old tax system. This will be an opportunity for the taxpayer as he will not be able to enjoy the discount benefits mentioned below.

Salary allowance and house rent allowance depending on the rent paid

Leave the travel allowance and permit

• Pay professional tax - maximum Rs. 2,500 / -

• Special assignments are granted except for your / 10 (14):

(A) Transportation allowance has been provided to the disabled employee

2. B) Vehicle allowance

3. C) Any allowance paid to cover travel expenses on travel or transfer

You may also, like- Automated Income TaxPreparation Excel Based Income Tax Software All in One for the Andhra Pradesh State Employees for the F.Y. 2020-21[This Excel Utility can prepare at a time Tax

Computed Sheet + Individual Salary Structure as per the Andhra Pradesh

State Employees Salary Pattern +

Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax

Arrears Relief Calculator U/s 89(1) with Form 10E + Automated Income Tax Revised

Form 16 Part A&B + Automated Form 16 Part B as per the New and Old Tax

Regime U/s 115 BAC]

Special discounts in special economic zones. 10 AA

Ed discounts 32

AD, 33 AB, 33

Earlier in the years ahead or continuous devaluation

- Maximum discount on interest paid on a home loan in the self-acquired house is 200,000

All exemptions except for Chapter VIA (60 CCD (2) and 80 JJA

. 80-C: LIP, Tuition Fee, PPF, EPF, Tax Saving FDR, Home Loan Repayment, Mutual Funds (ELSS), NSC etc. 1,50,000

. 80-D: Premium Maximum Discount of Mediclim Insurance 25,000 to 100,000

80-G: Grants

. 80-DD: Maximum discount of 75,000 to 1,25,000 depending on the variety

• 80-DDB: Expenses for specific treatment

• 80-E: Interest in education

. 80-TTA: Interest in keeping bank accounts

You may also, like- Automated Income Tax Preparation Excel Based Income Tax Software All in One for the Jharkhand StateEmployees for the F.Y.2020-21[This Excel Utility can prepare at a time Tax Computed Sheet

+ Individual Salary Structure as per the Jharkhand State Employees Salary Pattern + Automated H.R.A.

Exemption Calculation U/s 10(13A) + Automated Income Tax Arrears Relief Calculator

U/s 89(1) with Form 10E + Automated Income Tax Revised Form 16 Part A&B +

Automated Form 16 Part B as per the New and Old Tax Regime U/s 115 BAC]

The benefits listed below are still available under the new government:

Office Post Office Savings Account Interest Received 10/15 (i) Maxi Rs. 3,500

Salary up to 12% of employers contribution in NPS or EPF and interest up to 9.5% PAA in EPF

The amount of interest and maturity of PP PPF or Sukanya Smriti Yojana

Pension Commissions

Gratuity from employer maximum of Rs. 20 lakhs

Amount received from LIP for maturity 10/10 (10d)

The choice to choose tax on a yearly basis is available to taxpayers earning from salary, the home property, capital gain or other sources. However, if a taxpayer has income from business or profession, he or she cannot select the tax system year by year.

Both old and new tax systems have their own advantages and disadvantages. The new tax system does not encourage taxpayers' investment habits. This is better for taxpayers who have low incomes and low investments, so low discounts and discounts will allow each person to evaluate which tax structure is best for them depending on their income tax level and discounts so that they can choose the appropriate system accordingly.

Download Automated Income Tax Preparation Excel Based

Income Tax Software All in One for the Govt & Non-Govt Employees for the F.Y.2020-21[This Excel Utility can

prepare at a time Tax Computed Sheet + Individual Salary Structure as per the

Govt & Non-Govt. Employees Salary Pattern + Automated H.R.A. Exemption

Calculation U/s 10(13A) + Automated Income Tax Arrears Relief Calculator U/s

89(1) with Form 10E + Automated Income Tax Revised Form 16 Part A&B +

Automated Form 16 Part B as per the New and Old Tax Regime U/s 115 BAC]