Necessary of Income Tax Form 16.

Form 16 is the most indispensable tax documents for both a salaried person and his employer. In this article, we have covered every topic related to Form 16.

What is Form 16?

Form 16 is a document issued to the salaried persons of their employer at the time of a hodgepodge of duty from the salary of the employee. Simply put, it is a recognition that you have submitted your deductible to the Income Tax Department.

Form 16 is an important document issued under the provisions of the Income Tax Act, 1961. Form 16 details how much tax has been deducted from the source (TDS) on your employer's salary as the salary is deducted for the financial year. In short, it can be said that Formal 16 is a document of proof of TDS deducted and submitted by your employer.

Download One by One

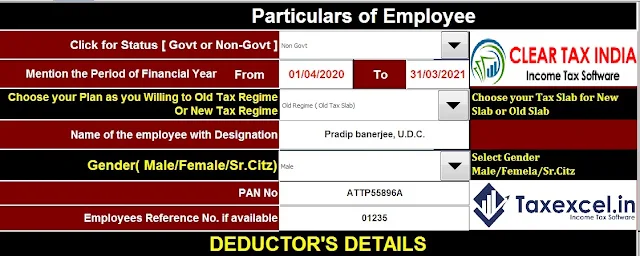

Prepare Automated Income Tax Revised Form 16 Part A&B and Part B For the

F.Y.2020-21[This Excel Utility prepare One by One Form 16 Part A&B and Part

B]

Why is Form 16

required?

Form 16 is an important document like this:

Proof acts as proof that the government has deducted taxes from your employer.

Tax assists the Income Tax Department in the process of filing your income tax return.

Many banks and financial institutions demand Form 16 for verification of individual certificates at the time of using form 16.

Who issues Form 16?

The Income Tax Act orders the employer to have a TAN number and deduct tax on the employee's salary and issue Form 16. If your tax is not stuff deducted, your employer may refuse to requite you Form 16.

Download One by One Prepare Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21[This

Excel Utility prepare One by One Form 16 Part B]

Will Form 16 be

issued?

It must be issued for June 15 of the year for which it is stuff issued. For example, for F.Y 2017-18, the due stage for issuance of Form 16 was June 15, 2018. If an employer delays or fails to submit Form 16 within the specified date, he continues to default liable to pay a penalty of Rs 100 per day till the date.

How to read/understand your Form 16?

Form 16 is very easy to understand and learn how to fill out. It is divided into two-part - Form 16 Part A and Form 16 Part B.

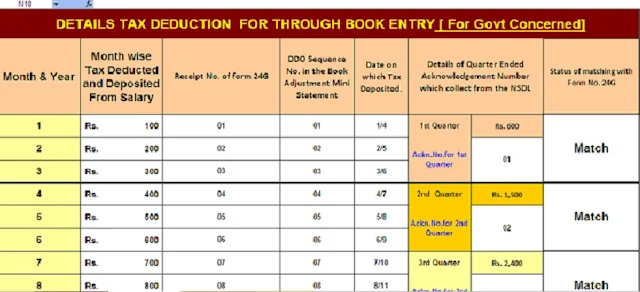

Form 16 Part A: This Part A mandatory to download from the Income Tax TRACES PORTAL

This part of Income Tax Form 16 includes the details of payment of employer, employee, TDS. It displays the quarterly details of your taxes submitted to the government. Here are some of the details:

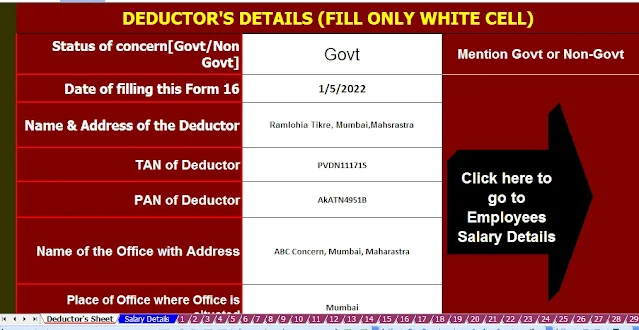

Employer's pan and tan.

Name and write of the employee

Employee pan

Tax statement paid by the employer.

Download and prepare at a time 50 Employees Automated Income Tax Revised Form 16 Part B For the F.Y.2020-21[This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

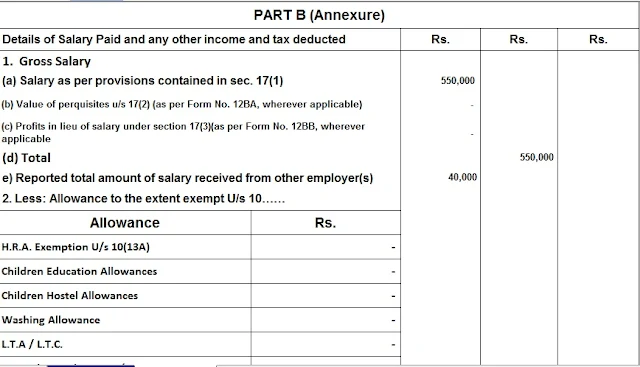

Form 16 Part B:- This Part B prepare by the Employer/Deductor.

This section shows a detailed numbering of income, based on which taxes are unswayable and deducted by your employer. It includes salary deductions, various discounts, discounts (if any) and tax calculations you have earned without considering all items based on the current income tax slab rate.

A. Gross Salary (1): Form 1. This section requires details of salary as per the provisions of Section 1 (1), underage of salary and any goody received in lieu thereof.

B. Discounts and Solatium Considered (2): Prior to this part of the form, the combined information of all exemptions under Section 10 was required, but with the introduction of the new Form 16, a list of solatium has been provided, and details need to be filled in. The list of solatium is as follows:

Death-cum-Retirement Gratuity under Section 10 (10)

The modified value of the pension under section 10 (10a)

Cash equivalent to leaving pay encashment under section 10 (10AA)

House rent wage under section 10 (13A)

Amount of any other exemption under section 10

C. Total value of salary received from the employer (3): This part of the form calculates the total salary received with solatium and other permissions.

D. Exemptions under Section 16 (ia): Budget 2018 announces standard deduction in lieu of transport and medical expenses received by employees. In the new Form 16, a separate section has been introduced for the standard deduction. All unbeliever columns are listed below:

Entertainment wage under section 16 (II)

16 Tax on employment under 16 years of age (iii)

E. The value of total exemption under section 16 (5)