In Budget 2020 has introduced a new system new and old tax regime U/s 115 BAC. A new analysis of available income tax rates, discounts and discounts available

The 2020 budget proposes a new income tax system for individuals and HUFs. This scheme provides taxpayers with an option to pay tax at a reduced rate subject to certain conditions. A new section 115BAC has been introduced in the Income Tax Act to provide lower tax incentives. This will apply from F.Y 2020-21 (A.Y 2021-22).

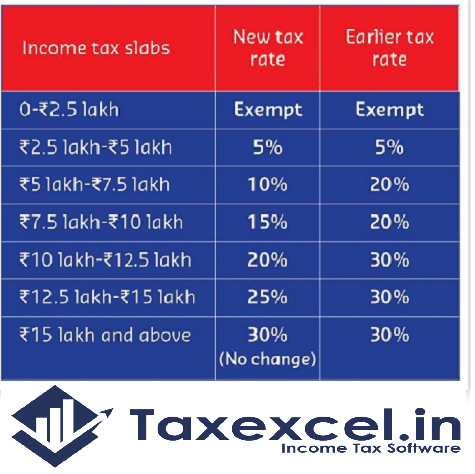

New income tax slab rate under the tax system. They have been allowed to select income tax slabs on the basis of which they would like to collect tax for the financial year 2020-21. Read more to know more about the current tax slab and the new tax slab under section 115BAC.

You may also, like- Automated Income Tax

Revised Form 16 Part A&B and Part B for the F.Y.2020-21 as per new and old

tax regime U/s 115 BAC [This Excel Utility Prepare One by One Form 16 Part A&B

and Part B]

Section 87A the benefit will not be available as soon as your taxable income exceeds Rs 5 lakh and 5% tax will be payable on income above Rs 2.5 lakh but up to Rs 5 lakh.

What are the conditions for lower tax rates?

This option can be taken by individuals or HUFs who do not have business income.

The option used once for the previous year will be valid for the previous year and all subsequent years.

The option will become invalid in the previous year or subsequent years, such as a lawsuit if the individual or HF fails to meet the terms of the Act and other applicable provisions of the Act.

This option in new introduced Form 10-IE can be taken by individuals or HUFs who do not have business income.

The option used once for the previous year will be valid for the previous year and all subsequent years.

You may also, like- Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s115 BAC [This Excel Utility Prepare One by One Form 16 Part B]

The option will become invalid in the previous year or subsequent years, such as a lawsuit if the individual or HF fails to meet the terms of the Act and other applicable provisions of the Act.

(i) travel discount u / s section 10 (5);

(ii) house rent allowance u / s section 10 (13a);

(iii) certain allowances included in section 10 (14);

(iv) Allowance of MPs / MLAs under Section 10 (1 17);

(v) allowances for the income of minors covered under section 10 (32);

(vi) Exemption of SEZ units included in Section 10AA;

(vii) Standard the exemption, recreation allowance and the exemption for employment / professional tax is included in Article 16;

(viii) Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 24. (For a rented house the loss will not be allowed to be deducted on the basis of the principal income of the house property) will be allowed to proceed under any other principal and in accordance with the prevailing law);

(ix) additional depreciation under section 32 (1) (ii-a);

(x) Exemptions under sections 32AD, 33AB, 33ABA

(xiv) Any waiver under section VIA - IB, 80-IBA, etc.). However, section 80 CCD (2) (employer's contribution to the employee's account in the notified pension scheme) and section 80 JJAA (for new employment) may be claimed.

(XV) It is also proposed to amend 3 rules of the rules later so that the employer can remove a discount on free food and drink through vouchers provided to the employee as an alternative exercise person under the proposed part.

Allowances allowed under the new option

Only approved under section 10 (14) for the following or private or HUF:

(A) Transportation allowance is paid to the dividing employee to cover the expenses for the purpose of travel between the place of residence and the place of responsibility.

(B) allowance to meet the expenses incurred in the discharge of duties of any office;

(C) any allowance paid to cover travel expenses during travel or transfer;

(D) To meet the daily allowance due to the absence of an employee from his / her normal position of responsibility.

You may also, like- Automated Income Tax

Revised Form 16 Part A&B for the F.Y.2020-21 as per new and old

tax regime U/s 115 BAC[This Excel Utility Prepare at a time 50 Employees Form 16 Part A&B]

Which income tax slab is applicable for F.Y 2020-21 (A.Y 2021-22)?

For the fiscal year 2020-21 (A.Y 2021-22), the taxpayer can choose between the old and the new tax system. The new tax rate has reduced the income tax rate but slabs can be used with discounts and allowances without the benefit of discounts and allowances and existing taxes. Let us compare the advantages and disadvantages of both tax slabs available to the taxpayer.

Download Automated Income Tax Revised Form

16 Part A&B and Part B for the F.Y.2020-21 as per new and old tax regime

U/s 115 BAC[This Excel Utility Prepare at a time 100 Employees Form 16 Part B]