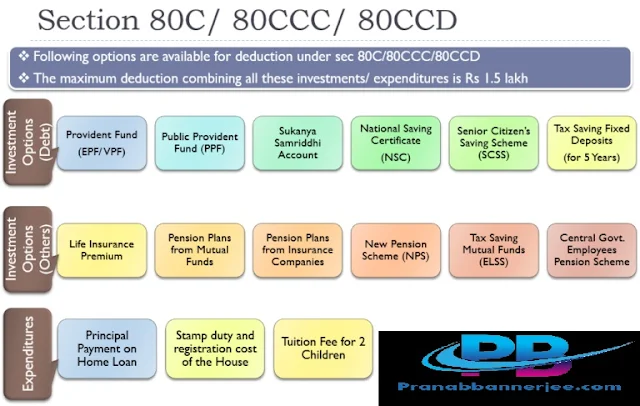

Tax Exemption U/s 80c for income tax. This article discusses Section 80C discounts or rebates from total income to save

income tax. The maximum exemption of Rs 1.5 million can be claimed under

Section 80C of the Income Tax Act. If any of the proposed proposals for the

2021 budget are taken care of in this article, please update.

1. Life Insurance Premium:

Insurance You will receive a discount on any amount paid as a premium on a life insurance policy. If the premium is also paid for your spouse or children, the discount is available. Please note that the premium paid for parents is not eligible for the discount.

H may even claim a waiver for life insurance for its members.

You may also, like-

Download and prepare at a time 50 Employees Automated Form 16 Part A&B for

the F.Y.2020-21

• Also a myth that should be insured from Life Insurance Corporation Please note that the life insurance of any private player is also suitable for U/ s 80C discount.

Cash cannot be paid in cash.

2. Provident Fund

Employees have discounts for contributions to the Provident Fund or Voluntary Provident Fund.

Interest earned from Indent Provident Fund is exempt from income tax. However, recently in the 2021 budget, it has been proposed to pay interest of Rs 2.5 lakh on employees' contributions to the Provident Fund.

You may also, like-

Download and prepare at a time 100 Employees Automated Form 16 Part A&B for

the F.Y.2020-21

3. Unit Combined Insurance Plan (ULIPs)

L ULIPs only as insurance. They have two types of investments. One promises a stable return and the other rises in the performance of the equity they invest in.

80 Section 80C exemption is applicable for investment in ULIP.

4. Equity Linked Savings Scheme (ELSS)

L Discount is available for investment under ELSS.

ELSS has the lowest lock-in period compared to 80 other 80C investment options.

There are many types of ELSS options available in the market such as Axis Mutual Fund, ICCI Prudential Mutual Fund etc.

You can pay for these projects through SIP (Systematic Investment Plan).

You can turn off SIP if you think ELSS is not performing well. However, there will be a 3-year lock-in for the amount already invested through SIP.

5. Pay school fees or college or university fees.

There are discounts for tuition fees paid for school/college or university. However, there is no discount for any grant or development fee payable by these organizations.

Discounts are allowed for fees of up to 2 children.

No discount is allowed for tuition fees paid for spouses.

You may also, like-Download and prepare at a time 50 Employees Automated Form 16 Part B for theF.Y.2020-21

6.Home. Payment for the principal amount of the house

If the purchased property is not sold for five years, then there is a discount for the main part of the loan

7. Pay stamp duty for the purchase of the property.

There are discounts for house stamp duty and payment for registration charges for the purchase or construction of the home property.

8 . Certificate of National Conservation

• Certificate of NSE or National Conservation can be opened with Post Office.

The Certificate earns a fixed interest income. The discount is available for investment in NSC. However, the interest earned is still taxable.

9. Fixed deposit

Tax Bank has a system of discounts for taxable deposit deposits.

Fixed These fixed deposits come during a five-year lock-in period. Interest earn will be taxable as per the Income Tax Act.

10. Sukanya Samriddhi Project

The discount amount for 21 special accounts is open until a girl child reaches the age of 21.

Investment The minimum amount of investment is up to Rs. 1000

Premature deposit of marriage or education of the girl child is allowed at the age of 18 years.

Investment Interest income from this investment is also exempt from tax.

You may also, like-Download and prepare at a time 100 Employees Automated Form 16 Part B for theF.Y.2020-21

11. Veterans Conservation Project

Discounts are available for special accounts opened for senior citizens over 60 years of age.

A minimum investment of Rs.1000 is required. Maximum investment of Rs. 2,000. 15 lakh can be made.

Citizens 55 years of age or older who have opted for voluntary retirement will also be able to take advantage of this scheme.

Scheme Interest income from this

project is taxable under income tax.