What is the PAN?

The full form of a PAN card is a

permanent account number. It is known as a way to identify different taxpayers

of the country or track the financial transactions of the citizens. It is a

unique identification number assigned to a taxpayer in

What is the necessity of the PAN card?

The PAN card is equivalent to the

Social Security Member or SSN used in the

Why Need a PAN card!

You will need a PAN card to file an IT returns. This is the main reason why everyone applies for a PAN card.

The PAN card is important when you are planning to apply for a loan. Details of PAN card are required for approval of loan application of every bank and other institution which provides banking institution. Not only this, for educational and personal loans also a PAN card is required for verification.

You can open your Bank Account if you have a PAN card. It does not matter whether it is a cooperative bank, a public sector bank or a private sector bank.

According to RBI rules, if you deposit more than Rs 50,000 in cash at a time, PAN card details are being made mandatory.

If you plan to invest more than Rs 50,000 in a bank in the form of a fixed deposit, you will also need to provide PAN card details. This is very important because TDS is being deducted by the bank on the interest received through FDs.

If you want to go to buy a mutual fund, debenture or bond for a transaction of more than Rs 50,000, then the PAN card is also a necessary document.

The banking institution, Money Exchange Bureaus also seems to need the details of the PAN card for currency conversion.

It is mandatory to provide PAN card details when applying for a credit card or debit card.

For more than Rs.5, 00,000 vehicles, both PAN card details are required when buying or selling.

The PAN card also served as identity proof so that it could be used when applying for other official identity proofs.

If you have purchased more than, 500,000 worth of jewellery, you will also need to provide details of the pan.

In order to provide insurance for exceeding Rs. 50,000 per annum, it is necessary to provide PAN card details

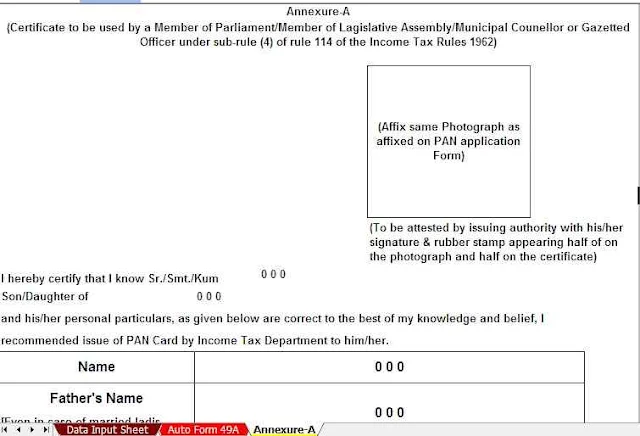

Download Automated Pan Card Application Form 49A in Excel (Modified Version)