10 major changes to the Income Tax Act from 1st April 2021 | The Finance Minister has announced some major changes in income tax during the presentation of the 2021 budget which will be effective from April 1, 2021. High TDS / TCS rate for non-filers of income tax return (ITR), bill submission under LTC cash voucher scheme, Senior over 5 years old No tax filing for citizens.

In this article, we will look at the significant changes that are going to take effect from 1 April 2021.

You may also, like- Prepare

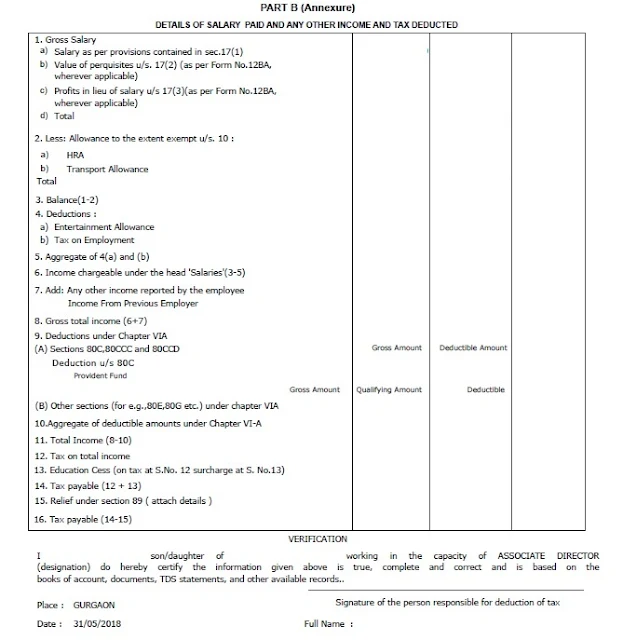

One by One Automated Income Tax Revised Form 16 Part A&B and Part B for the

F.Y.2020-21 as per New and the Old tax regime U/s 115 BAC.

The major changes in income tax are as follows:

As per the Finance Act 2021, a change in the ITR form is expected, i.e. pre-filed ITR XML will be introduced. The pre-filed ITR form was available to salaried employees where income was reflected on the basis of Form 16, but from the upcoming assessment year, the opportunity has been further widened. This step is aimed at making it easier to file returns.

2. Employee Provident Fund TaxRules

Under the Finance Act for the financial year 2021-22, the Minister of Finance has cashed up to a maximum of Rs. 5,00,000/-In one year, the finance minister raised 5 Lack to raise the tax-exempt limit on interest earned on provident fund contributions by employees in certain cases, in contrast to the proposed 2.5 Lack. The 5 5 Lack contribution does not include employer contributions.

You may also, like- Prepare One by One Automated Income Tax Revised Form Part B for theF.Y.2020-21 as per New and the Old tax regime U/s 115 BAC.

3. Punishment will be issued for not connecting Aadhaar and PAN

The last date for attachment of Aadhaar and Income Tax PAN were 30th March 2021, which has been further extended to 30th June 2021. If the evaluator or PAN holder fails to link his PAN to Aadhaar, this type of PAN card will not be activated.

Failure to provide connection may result in a fine of Rs 5,000 for the Income Tax Department. And Rs.1,000 under Section 272B of the Income Tax Act

4) Option to choose 'new tax system' instead of the old tax system

The government introduced a new tax system in the Finance Act 2020 last year. However, the assessee can choose one of the tax arrangements for the fiscal year 2022-21 by April 1, 2021. Taxpayers had until March 30, 2021, to plan taxes - save, however, they will be able to choose a beneficial arrangement when submitting tax returns for 2010-2011 fiscal year.

5. Senior citizens above the age of 75 are exempted from filing ITR:

To reduce the balance burden on senior citizens, the Finance Minister exempted people over the age of 75 from filing income tax returns (ITRs) under the Finance Act 2021. The exemption will be available for illegal citizens who have no income other than pension and interest on fixed deposits should be deposited in the same bank.

You may also, like- Prepare at

a time 50 Employees Automated Form 16 Part A&B for the F.Y.2020-21 as per New

and the Old tax regime U/s 115 BAC.

6.In. ITR / TCS High Rate for IncomeTax Return (ITR) Non-Filers

Income Tax Returns has introduced a new section in Budget 2020 under the Income Tax Act as a special provision for higher rates for TDS for non-filers.

The proposed flat for non-filers is more than the following:

% 5%

7. Twice the fixed rate as per the relevant provisions of the Act

Rate or double the rate of the ball

Similarly, a new Second 206CCA has been inserted in the Income Tax Act, as a special provision, to provide higher rates for TDS for non-filers of income tax returns.

The proposed flat for non-filers is more than the following:

% 5%

Twice the fixed rate as per the relevant provisions of the Act

You may also, like- Prepare at

a time 100 Employees Automated Form 16 Part A&B for the F.Y.2020-21 as per

New and the Old tax regime U/s 115 BAC.

L. Submission of bills under LTC cash voucher scheme

To avail tax benefits under the LTC Cash Voucher Scheme, the assessor must ensure that the required bills must be in the correct format and must contain the amount of GST and the seller's GST number must be submitted to your employer (provided by the employer). Under the Holiday Travel Cash Voucher Scheme on or before March 2021, an employee is required to spend three times as much as the LTA fare on goods and services that attract 12% or more GST.

8. Advance tax on dividend income

To provide relief to small taxpayers from April 1, 2021, under the Finance Act 2020, the assessee has to pay dividends or pay advance tax on the dividends after declaration. Relevant amendments in this regard have been made under section 234C, i.e. advance payment of dividends is made only on the basis of receipt.

You may also, like- Prepare at a time 50 Employees Automated Form 16 Part B for the F.Y.2020-21 as per New and the Old tax regime U/s 115 BAC.

9. Unit Combined Insurance Products(ULIP) Tax Changes:

Under the Finance Act 2021, the Ministry of Finance announced that the maturity gain of the Unit Linked Investment Plan (ULIPS) will be taxed where Rs. 2,50,0000 or more. Maturity will be taxed at 10% for long-term capital gains and 15% for short-term capital gains. Earlier, the maturity of ULIP schemes was exempted under the Income Tax Act. This move will only affect ULIP policies purchased after February 1, 2021, and original

Send feedback

Side panels

History

Saved

Contribute

5,000 character limit. Use the arrows to translate more.

10. Reduced period for filing of billed ITR or revised income tax return

Earlier, if the assessee fails to file the ITR within the due date i.e. 31st July or any other due date, the assessee can still file a ballot return on or before 31st March of a financial year with a late fee, where the assessee targets any note. The same amount given or incorrect can be corrected by filing a revised return on or before March 31 of the financial year. However, in the Finance Act, 2021, this period has to be reduced to three months and therefore the assessee has to file a billed ITR by December 31 of the same financial year or amend your ITR.