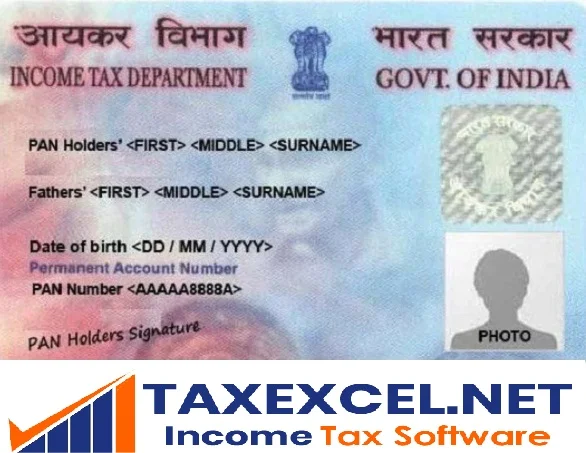

You can get a New Pan Card Online from the Income Tax NSDL Web Site or You can Fill the Form 49

A in Paper, as you like, Both are discussed:-

Through the Online:

The internet can be applied for a new pan. After applying for changes or corrections for deposits once in PAN data or request for re-printing of pan card (for existing pan) can also be applied through the Internet. Online application NSDL (HTTPS://tin.tin.nsdl.com/ Pan / Index HTML) or UTIITSL (https://www.utiitsl.com/ should be done by the unit / UTI / new app / new-pan-) JSP).

Through the general paper:

Form 49 (Indian citizens, Indian

companies, for non-governmental organizations formed in

Download Automated New Pan Application Form 49 A in Excel Format