Here are the steps on how to submit Form 10E:

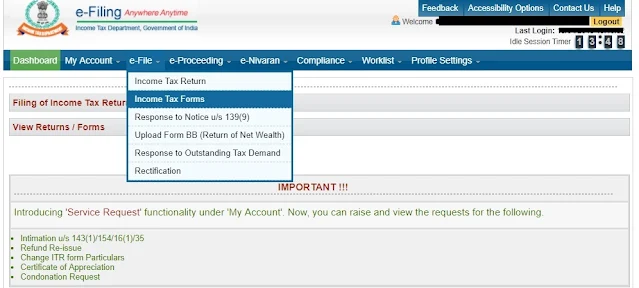

1. Log in to your income tax e-filing account with a valid certificate

2. Select E-File >> Income Tax Forms

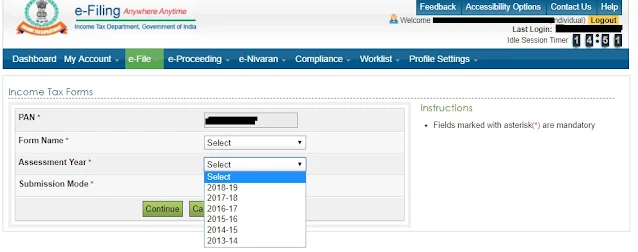

Under "Form Name", select

"Form No. 10 - Form Instantly for 89 years.

Select the assessment year for which you need to file Form 10E.

1. Select the submission mode

2. Click "Continue"

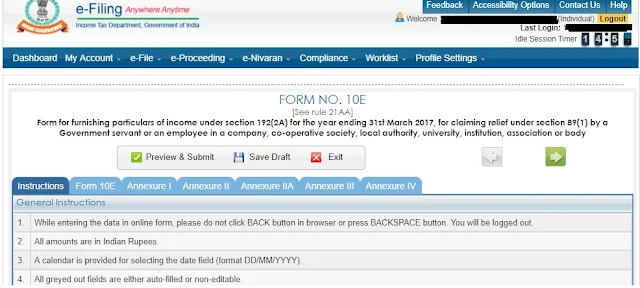

3. Fill in the required details. And click "Save Draft" to save the form.

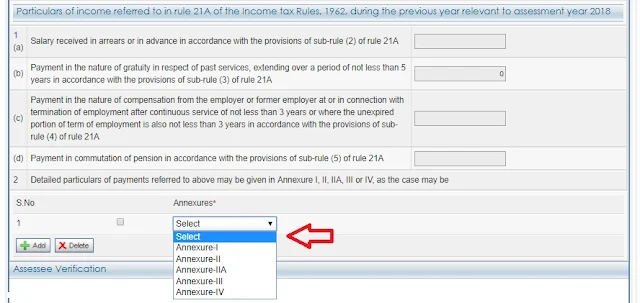

On the Form 10E tab, select the addition you want to fill out. The selected addition will then be available in an editable format. For arrears of pay, please select Attachment-1

Addition-2 for gratuity (more than last five years but less than 15 years)

Addition - For IIA gratuity (past service for 15 years or more)

Attachment-3I for compensation for termination of employment

Attachment - For Commitment of IV Pension

1. Hit “View & Submit" and submit form 10 E.

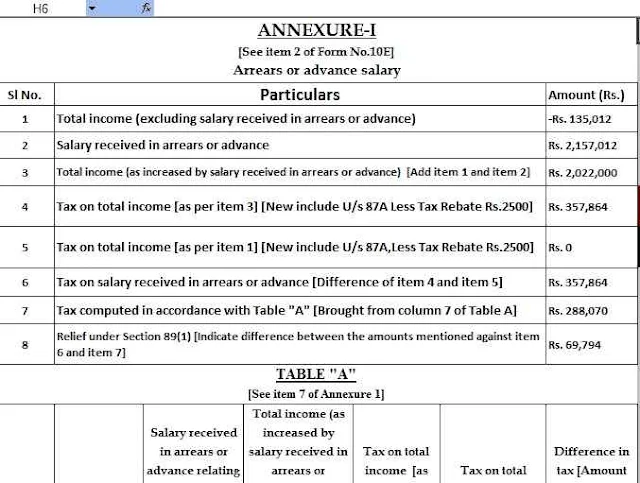

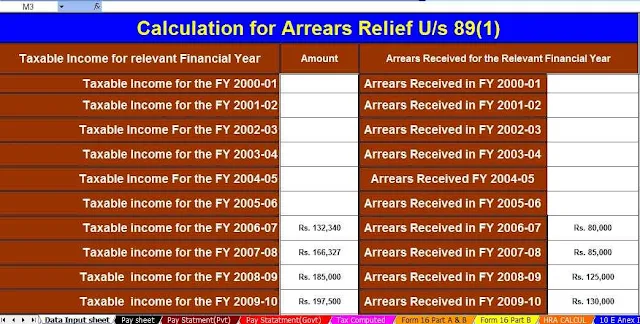

Relief under section 89 (1) for arrears is available in the following cases:

The advance salary was received as advance or arrears

Family pension received late as arrears

Received salary for more than 12 months in one financial year

Receive compensation from the employer as compensation for termination of employment

You may also, like- Prepare One by One Income Tax Automatic Form 16 Part A&B and Part B for the F.Y.2020-21 as per new and old tax regime

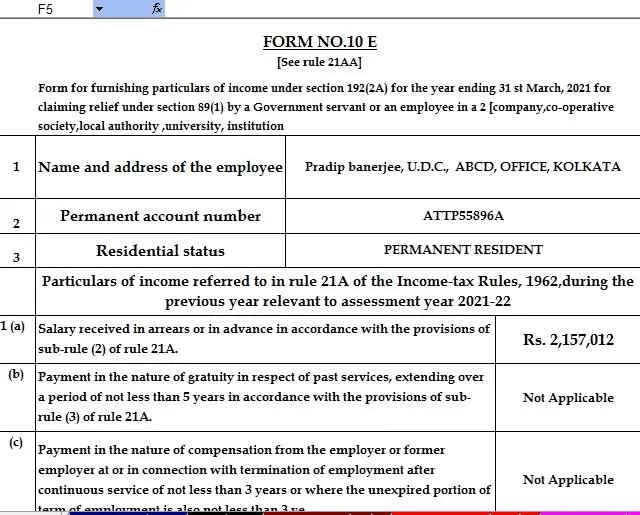

Tax relief is an effective measure to ensure that taxpayers do not face problems with additional duties due to arrears. You will need to submit Form 10E to avoid paying additional taxes that you might otherwise pay. It should also be noted that relief is only allowed if the taxpayer's duty liability increases. No relief is provided unless liability is increased.

Also, keep in mind that if an employee receives VRS compensation, no relief will be provided under Section 89 if the taxpayer claims an exemption under section 10 (10C) for a VRS. Only one of these discounts can be claimed and the two cannot be clubbed together.

The 10th form for arrears is a simple form and does not require lots of input from your end. You must file Form 10E before filing your return. And if you fail to do so, you can expect a notice from the income tax department on the same subject.

If you wish to claim benefits under section 89 (1), submission of Form 10E is mandatory.

The steps outlined above will also help you file your Form 10E so that you do not have to worry about payments in arrears. For any problem related to arrears or reliance under section 89 (1) for tax filing, expert advice can help and assist in filing a return properly without any problems.

FAQs

1. Is it mandatory to file Form 10E?

Section 89 (1) will help you avoid additional taxes if you are receiving arrears of salary or pension. And for this to happen, you need to submit Form 10E. Therefore, it is mandatory to file Form 10E, only if you get the benefit of under 89 (1).

2. How do I submit Form 10E?

You may submit Form 10E through the Income Tax e-filing website. For detailed steps on how to do this, you can refer to the steps described above.

3. Will I be in arrears?

If you file Form 10E with proper details, you will not be charged any additional charges due to arrears. The Assessing Officer may grant a waiver.

4) It is mandatory to attach a copy of Form 10E?

No, a copy of Form 10E does not need to be attached to the tax return. The form must be filled out and submitted online, but it is advisable to keep the document safely on record.

Download Automatic Income Tax Form 10E U/s 89(1) from the F.Y.2020-21 to F.Y.2020-21