Section 80 CCD NATIONAL PENSION SCHEME

Discounts on contributions to the central government's pension scheme- Bare Act

(1) Where an assessor, on or after the first day of January 2004, as a person appointed by the Central Government or any other employer, or as appointed by any other assessor, paid as a person in the previous year or informed by the Central Government or under the pension scheme. Any amount deposited in the account shall be allowed to be deducted from the calculation of his total income in accordance with the provisions of this section and subject to it, in excess of the total amount paid or deposited,

You may also, like Automated Income Tax Form 16 Part B in Excel? You can download the Excel Based Income TaxMaster of Form 16 Part B for the F.Y.2020-21 [This

Excel Utility can prepare at a time 50 Employees Form 16 Part B]

In the case of an employee, 10% of his previous year's salary; And

In any other case, 20% of the total income of the previous year

Any assessor referred to in sub-section (1) shall be allowed to make concessions in the calculation of his total income is there any concession allowed under sub-section (1) of the given amount? Or maybe informed under the pension scheme deposited in his account in the previous year or by the Central Government, not exceeding fifty thousand rupees:

Provided that no concession under this subsection shall be granted without consent in the amount of concession claimed and granted under sub-section (1).

(2) Where in the case of an assessor referred to in sub-section (1), the Central Government or any other employer contributes to his account referred to in that subsection, the assessor may be allowed to deduct his total income, the Central Government or any other employer that Amount means [not exceeded] the full amount of the amount is given by him

14%, where the central government makes such a contribution;

Ten per cent, where such a contribution is made by another employer in his previous salary]

You may also, like Automated Income Tax Form 16 Part B in Excel? You can download the Excel Based Income TaxMaster of Form 16 Part B for the F.Y.2020-21 [This Excel Utility can prepare at a time 100 Employees Form 16 Part B]

(3) Any accountant referred to in sub-section (1) or sub-section (1b) has stood for the credit of the person designated in his account, in which case a waiver has been allowed under sub-section or sub-section (2) And with the money collected, if any, by the appraiser or his nominee, in whole or in part, in any previous year,

Due to termination or adoption of the pension scheme referred to in sub-section (1) or sub-section (1b); Or

Since the pension was taken from the anniversary plan or has been discontinued or chosen,

The full amount of the amount referred to in section (a) or section (b) shall be treated as the income of the assessor or his nominee, as may be, the amount received in the previous year, and shall be taxed according to the previous year's income accordingly

Provided that in the circumstances mentioned under condition (a), the amount received by the nominee after the death of the appraiser shall not be treated as the nominee's income.

You may also, like Automated Income Tax Form 16 Part B in Excel One by One [This Excel Utility can prepare One by One Form 16 Part B]

(4) Where any money paid or deposited by the appraiser has been approved as a waiver under subsection (1) or sub-section (1B),

No waiver shall be allowed with such amount in Article 88 for any assessment year ending before the first day of April 2006;

No deduction will be allowed under section 80 for any assessment year beginning on or after the first day of April with such an amount,

(5) For the purposes of this section, if this amount is used by the appraiser to purchase an anniversary plan in the previous year, it shall be deemed that no money has been collect in the previous year.

Note: Salary includes value-added allowance, excluding all other allowances and permits if conditions of employment are provided.

Note: The Central Government has notified Atal Pension Yojana as a pension scheme, the contribution of which will be eligible for exemption under 80ccd.

80 CCD Division Crew (1B)

80. Whether or not a person claims a waiver under CCD (1), Rs. 50,000 approved.

Note: The aggregate discount of 80 CCD (1) and 80 CCD (1b) shall not exceed the actual amount deposited or paid in the previous year.

Note: The amount of 80 CCD(1B) will not be considered during the calculation of the total limit of Rs.1,50,000 as described in section 80cc.

80 CCD Division Course (2)

Applicability

This sub-section is applicable if the employer contributes to the pension fund informed by the Central Government.

Maximum limit

1. If contributed by the Central Government as the employer

Limit 14% of salary

2. If covered by another employer

Restricted if covered by another employer

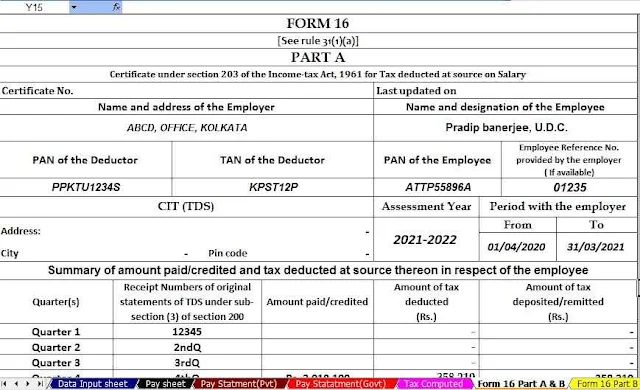

Download and Prepare at a time 100 Employees Master of Form 16

Part A&B in Excel for the F.Y.2020-21 as per New and Old Tax Regime U/s 115

BAC [Who are not able to download the Form

16 Part A from the Income Tax TRACES PORTAL, they can use this Excel Utility]