ELSS vs. ULIP - Which tax-saving option is better? The most popular and beneficial tax saving

the method adopted by individuals is the use of exemptions approved under section 80C. Section 80C

allows a rebate of up to Rs 1.5 lakh per person per annum is invested in certain financial instruments.

There are various financial instruments approved for this purpose and investments made in any one of them can be claimed as a discount under Section 80C.

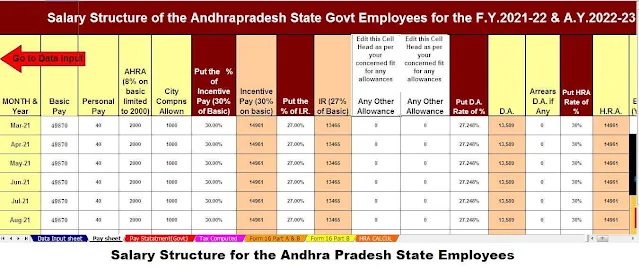

You may also, like- Automated Income Tax Preparation Software All in One in Excel for the Andhra Pradesh State Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure + Individual Salary Sheet + Automated Income Tax House Rent Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for as per Budget 2021]

Some investment gives a return on investment when others give the different type of money return. The most popular investment gives a fixed return like fixed deposits and PPF accounts but also gives a lot of money from the ELSS Mutual Fund and ULIP.

Apart from these, a person can also claim a waiver for the registration charges paid for the purchase of property and insurance premiums paid for a life insurance policy.

However, in this article, we will mainly discuss ELSS Mutual Funds and ULIPs and which of these 2 is better.

ELSS Mutual Fund

An ELSS Mutual Fund means Equity Linked Savings Scheme Mutual Fund and these funds are basically investments in this fund that can be claimed as a discount under Section 80C

In other words, investments made in other types of mutual funds cannot be claimed as discounts under section 80C and investments made only in ELSS tax saving mutual funds can only be claimed as a maximum of Rs. 1.5 lakh per year.

These ELSS tax savings mutual funds have a mandatory lock-in of 3 years and an investor cannot prematurely invest in these funds before 3 years. In addition, the ELSS fund must invest 65% of its total assets in the stock market.

You may also, like- Automated Income Tax Preparation Software All in One in Excel for the Jharkhand State Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure + Individual Salary Sheet + Automated Income Tax House Rent Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for as per Budget 2021]

ULIP's an investment plan and invested money also deduction U/s 18 C maximum Rs. 1.5 lakh

ULIPs are an investment and insurance plans in the sense that they give you the dual benefit of returning the invested capital and provide an insurance cover to the investor. ULIP has a longer lock-in period than ELSS with a lock-in period of only 3 years. This means that no investor can redeem his investment before 5 years from the date of investment.

ELSS Mutual Fund vs. ULIP – Which is

better?

Both ELSS are mutual funds, as well as ULIP money invested in the stock market and the proceeds from such investments are shared with investors.

However, along with the return on investment, ULIP's offer of insurance is that it looks like a lucrative deal for investors and this is why investors are sometimes tempted towards ULIPs compared to ELSS mutual funds.

You may also, like- Automated Income Tax Preparation Software All in One in Excel for the Bihar State Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure + Individual Salary Sheet + Automated Income Tax House Rent Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for as per Budget 2021]

However, the truth of the matter is that the returns generated by ELSS mutual funds are much better than the returns generated by ULIP. This is not a one-sided case and in all cases, it has been observed that the returns generated by ELSS mutual funds are much better than those of ULIP.

Some investors believe this is true because ULIPs also offer insurance benefits and are therefore willing to compromise on the return on investment. While this is somewhat true, since investors are also receiving insurance benefits, the returns from ULIPs are not too small for any investor to consider investing.

You may also, like- Automated Income Tax Preparation Software All in One in Excel for the West Bengal State Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure + Individual Salary Sheet + Automated Income Tax House Rent Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for as per Budget 2021]

And so instead of investing in ULIPs, if the same investor puts some money into ELSS and balances the purchase of term insurance - he will not only get a better return on his investment but also a higher cover insurance policy.

For an example: -

Case 1: Invest Rs100 in ULIPs

Case 2: Invest Rs 90 in ELSS Mutual Fund and the balance is Rs 10/- In Term Insurance

In the 2nd case, the returns generated will be much higher than in the 1st case and the sum insured will also be higher. In both cases, the amount of investment is the same i.e. Rs. 100 but in the 2nd case - the income is expected to be higher. In both cases, the duty will remain the same till the exemption as term insurance can also be claimed as exemption.

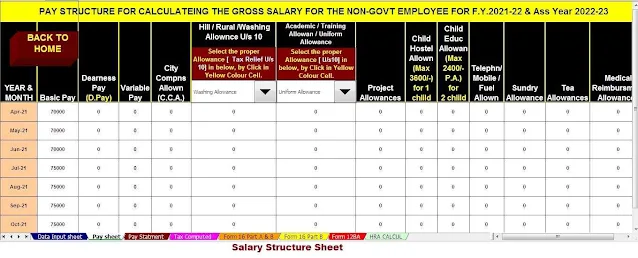

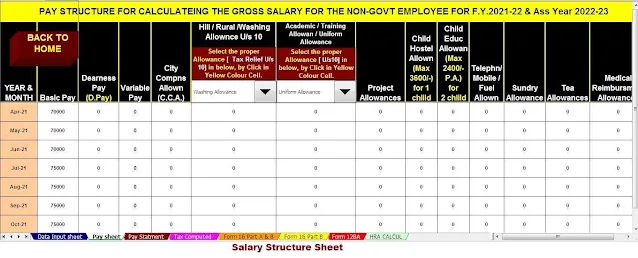

You may also, like- Automated Income Tax Preparation Software All in One in Excel for the Non-Govt(Private) Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure + Individual Salary Sheet + Automated Income Tax House Rent Exemption Calculation U/s 10(13A) + Automated Income Tax Form 12 B.A. + Automated Income Tax Revised Form 16 Part A&B and Part B for as per Budget 2021]

The higher returns generated in 2 cases have been observed and observed in almost all cases in the past and will continue in the future due to the innate nature of ULIP.

A very large proportion of the money collected as commissions is paid to ULPs and hence the amount they have for investment is less. ELSS Mutual Funds do not pay such high commissions and the amount they have after paying the commission is much higher and hence the income generated by the investors is also higher.

Since the commissions paid by ULIP are very high, most bankers will try to sell you ULIP by showing you pink pictures. They will try to show and prove that ULIPs are better than ELSS but it is true that ELSS + term insurance is always muchbetter than ULIPs.

You may also, like- Automated Income Tax Preparation Software

All in One in Excel for the Govt & Non-Govt(Private) Employees for the

F.Y.2021-22

Main Feature of this Excel

Utility-

# This Excel Utility can prepare at a

time your Income Tax Computed Sheet

# Individual Salary Structure

# Individual Salary Sheet

# Automated Income Tax Arrears Relief

Calculation U/s 89(1) with Form 10 E for F.Y.2021-22

# Automated Income Tax House Rent

Exemption Calculation U/s 10(13A)

# Automated Income Tax Revised Form 16

Part A&B as per Budget 2021]

# Automated Income Tax Revised Form 16 Part B as per Budget 2021]