Housing loan and deduction of the

principal of the interest portion. Tax benefits on housing. In this article,

you can get full details of principal waiver of housing loan and its interest

such as - waiver under section 80C (for repayment of principal only), full

details of section 24 (for part of full interest), a summary of section 24 and 80 CCE Etc. Now you can scroll down to check out the full details of "Housing

Loan and Principal's Discount on Interest"

Housing loan and its principal

discount

Exemption U/s-80C (for payment of

original principal only)

The main retaliatory element is Rs. 150,000 clubs can be set up in the total range of taxable devices eligible under Section 80C.

You may also, like-

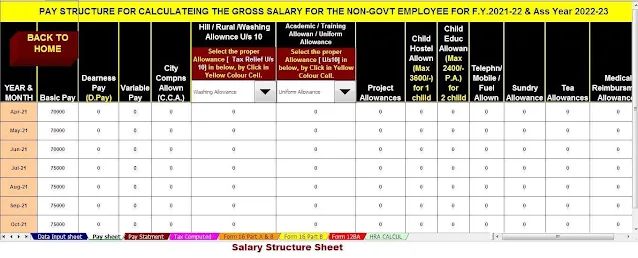

Automated Income Tax Preparation Excel Based Software All in One for the Non-Government Employees for the F.Y. 2021-22 [This

Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual

Salary Sheet + Individual Salary Structure as per Private Concern’s Salary

Pattern + Automated H.R.A. Exemption Calculator U/s 10(13A) + Automated Income Tax Form 12 BA +

Automated Income Tax Form 16 Part A&B and Part B as per the Budget 2021]

Only available for purchase or

construction of the residential property

Discounts are only available for

self-occupied property.

This discount is available only on actual payment (i.e. on a cash basis and not on an earnings basis), so the paid EMI and the principal earned on the EMI are not eligible for the discount.

The tax exemption claimed would be

reversed if the property was sold within 5 years of the year in which such the national property was acquired at the end of the financial year.

Section 24(B) (for interest only)

Discounts are available on a consolidated

basis.

The discount is available if the residential property is purchased / constructed / repaired / renovated / rebuilt.

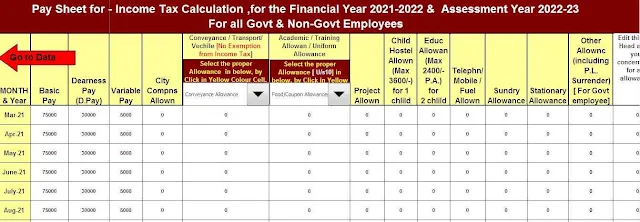

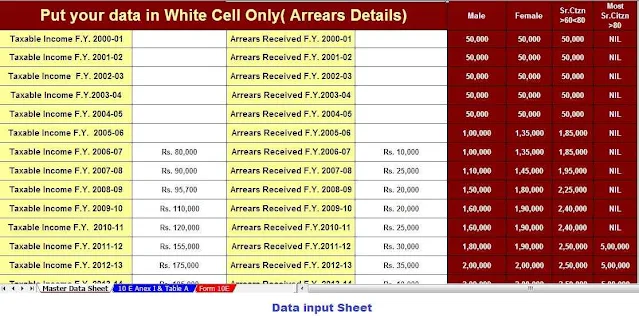

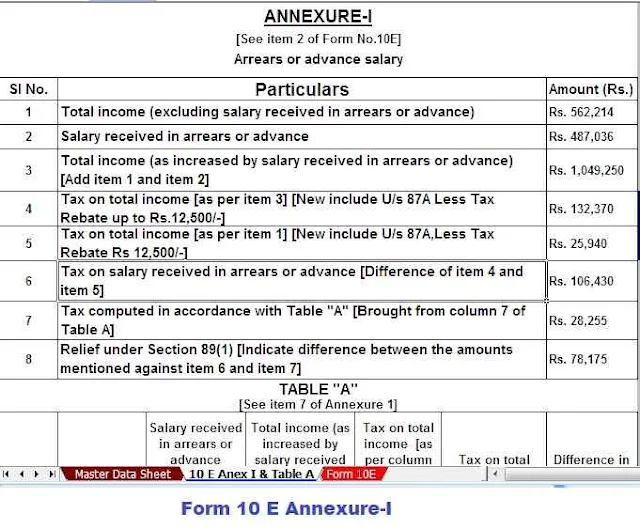

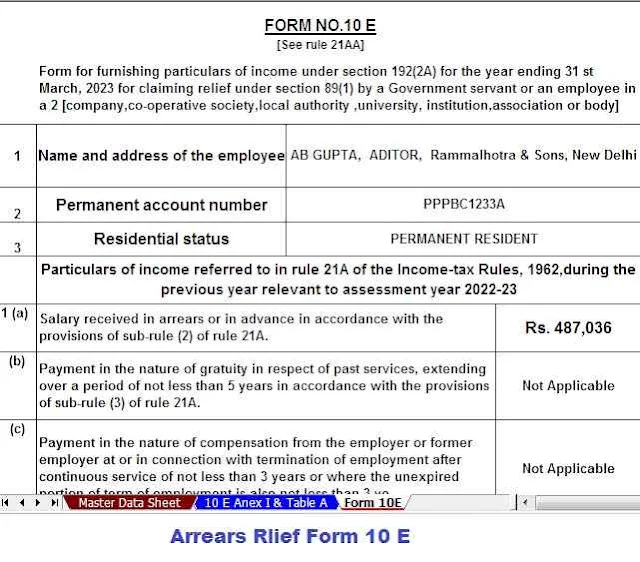

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Government and Non-Government Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure as per Government & Private Concern’s Salary Pattern +Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10-E + Automated H.R.A. Exemption Calculator U/s 10(13A) + Automated Income Tax Form 12 BA + Automated Income Tax Form 16 Part A&B and Part B as per the Budget 2021]

The annual interest component is Rs. 200,000 (Rs. 3,00,000 for senior citizens) can be claimed as a rebate against income. (If completed within 3 years from the end of F.Y, the discount will be reduced to Rs. 30,000

There is no maximum limit unless

the property is self-occupied.

Discounts under 80EE (Materials of

interest only)

An additional tax deduction of Rs.

50,000 / - is available for first time home buyers in case of interest in home

loans (Income Tax Act 91).

Terms & Conditions:

1) This is your first home

purchase.

2) The value of this house is 40

lakh rupees or less.

3) The amount received for this

house is Rs. 25 lakhs or less.

4) It has also been approved by a financial

institution

Summary of discounts for components of interest

|

Particulars |

Self Occupied Property |

Non-Self Occupied Property |

|

Section 24 |

Rs 2,00,000 |

No Limit |

|

Section 80 EE |

Rs 1,00,000 |

Rs 1,00,000 |

|

Particulars |

Section 24 |

Section 80C |

|

Tax Deduction Allowed |

Interest |

Principal Amount |

|

Basis Of Tax Deduction |

Accrual Basis |

Paid basis |

|

Quantum |

SOP=2,00,000 Non-SOP=No limit |

Rs 1,50,000 |

|

Purpose Of Loan |

Purchase/ Construction/ Repair/ Renewal/ Reconstruction of a Residential House Property. |

Purchase / Construction of a new House Property |

|

Eligibility of Claiming Tax deduction |

Purchase/ Construction should be completed within 3 years |

N/A |

|

Restriction on sale of property |

Tax Deduction claimed would be reversed if Property sold within 5 years |