Major changes in the income tax rules for the fiscal year 2021-22| The government usually changes the

tax rules during the budget presented in February. These changes are effective from the following fiscal

year beginning in April.

Which Tax Regime you Choose U/s 115 BAC.

Selecting your tax regime New or Old?

Last year’s budget gave taxpayers the option to choose between two tax systems. This is the second year when you have to make a choice. What is the difference between the two? The old regime came with a lot of concessions but with a higher slab of tax rates, the new government reduced the tax rate but did not allow specific concessions and concessions. Choose the right slab and get the most out of it.

Less time to file a revised tax return or billed return

Tax return due by 31st July of each year You had the opportunity to file or amend your return by 31st March of the assessment year with a slightly late fee With this financial year, the return correction or billet return submission window has been shortened to 3 months. You just have until December 31st;

You may

also, like- Automated Income tax

Preparation Software All in One for the

Dividend income is featured in ITR

Dividend distribution tax was levied on companies till the financial year and dividend income of domestic companies were exempted up to Rs 2,000. 10 lakh, but between 2010-2011 F.Y, dividends are fully taxable as per slab rate and distribute any dividends payable by the companies. So check the TDS against the dividend income on your Form 26AS and settle it with the dividend credit in your account and pay the tax according to your slab.

Enjoy pre-filled ITR forms

To make the tax filing process easier and more transparent, your ITR forms will be pre-filled with listed securities, mutual funds, dividend income, bank and post office interest, salary income, etc.

Voluntary contributions to the EPF beyond the limit are taxed at interest

Interest earned on provident funds was completely exempt from income tax till F.Y2020-21. During the 2021 budget, FM announced that more than Rs 2.5 lakh would be taxed on interest income on voluntary contributions to the EPF. However, this limit was later raised to Rs 5 lakh if the employer did not contribute to the EPF.

So, if your EPF / VPF deposit exceeds the prescribed limit, interest income will now be taxable. This will start from 1st April 2021.

Tax on ULIPs

Maturity earnings of any ULIP policy are exempt from tax if the premium does not exceed 10% of the insured. However, everything changed in the last budget! This provision will be applicable only when the premium for all the ULIPs you have received does not exceed Rs. This rule applies to ULIPs purchased after 01 February 2021.

Senior citizens over the age of 75 are not required to file ITR in certain cases Senior citizens are exempted from filing IT returns subject to certain conditions if they earn income only from pension and interest income from a bank.

1) This

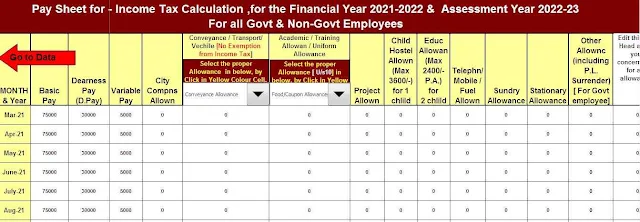

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22