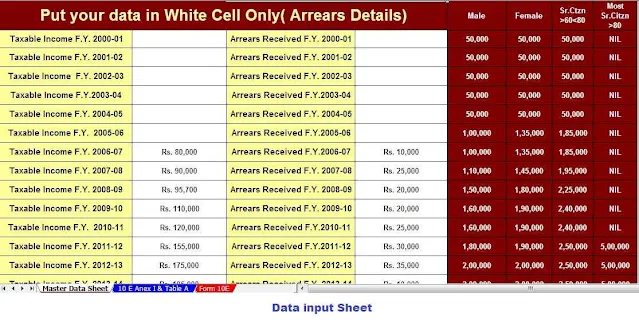

Arrears of Salary and Relief Calculator in Excel U/s 89 (1) with Form 10 E for the F.Y.2021-22.In

the section on salary, we discuss Section 89 (1) which provides relief in tax for those receiving salary for

earlier years. In cases where this happens, the Government has provided relief if there is an increase in

your tax liability in this year due to such arrears.

Relief under this section can be claimed where a person has received arrears of salary. Remember, salary is taxable only upon receipt by the individual. The amount of arrears will be mentioned in Form 16.

Calculating

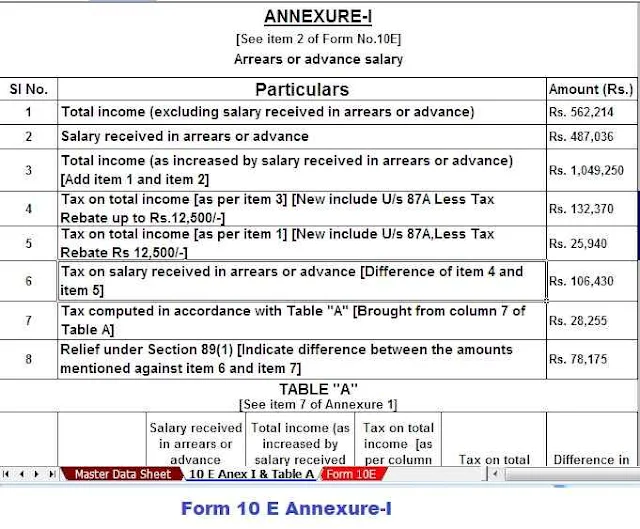

Relief under 89 (1) is complicated and involves the following steps:

First – calculate the tax payable for the current year in which arrears are received including arrears less the tax payable including arrears.

Second – calculate the tax payable for the current year in which arrears are received excluding arrears less the tax payable including arrears.

Third – Calculate the Difference between the taxes payable in the year of receipt.

Fourth – calculate the tax payable for the year to which arrears relate excluding arrears less the tax payable including arrears.

Fifth – Calculate the tax payable for the year to which arrears relate excluding arrears less the tax payable including arrears.

And lastly, calculate the difference between the taxes payable in the year to which arrears relate.

The excess of difference in tax payable in the year of receipt versus the year to which arrears relate will give the amount of relief under 89 (1).

Also, Form 10 E needs to be filed if arrears are to be claimed.

You may also, like – Automated Income Tax Challan ITNS 280 in Excel for Self and Advance Tax Payment through Bank

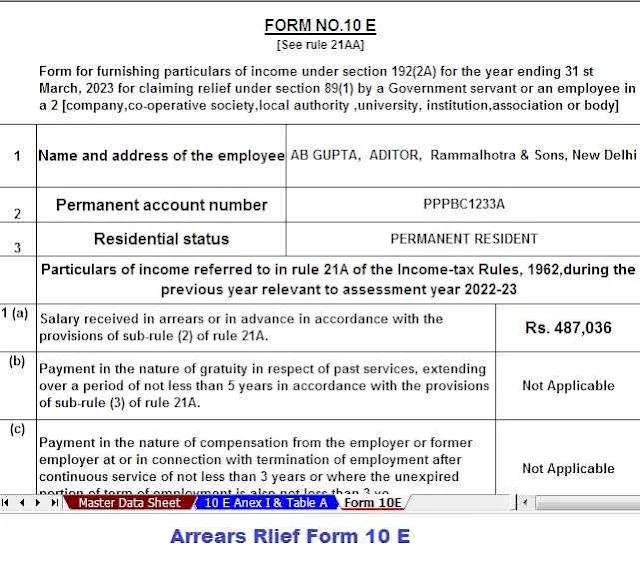

Form 10E

Form 10E is an important form to save tax on income generated through arrears by applying the provision of Section 89(1).

It is mandatory for an assessee to file Form 10E for claiming relief under section 89(1).

An assessee who fails to file Form 10E, will not be allowed the relief under Section 89(1). If the Income-Tax Return is filed without filing Form 10E and it is showing defective, the ITR should be revised after filing Form 10E. The ITR can be revised before the end of the assessment year, i.e. 31 March 2020 for the financial year ended 2018-19.

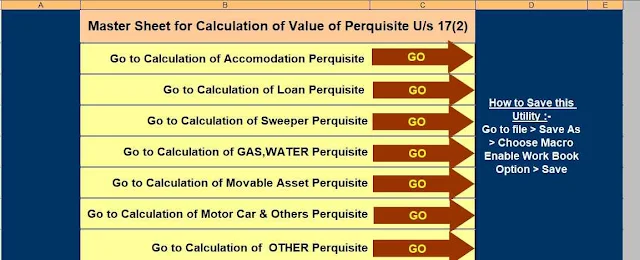

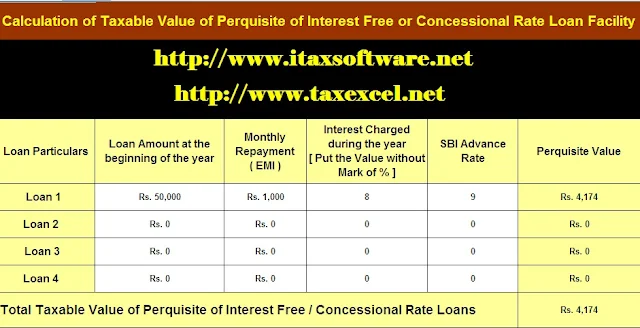

You may also, like – Automated Income Tax Value of Perquisite Calculator All in One U/s 17(2)

How to

claim relief

To claim relief under section 89

(1) of arrears of salary, a person has to fill and submit Form 10 E. Check out

our easy guide to filling out Form 10E online:

1. See the official website for

Form 10E - www.incometaxindiaefiling.gov.in file.

2. Log in to your account using

your user ID and password, including your date of birth.

3. After successfully logging in,

Click on the 'File' tab.

4. Now, select the option of income

tax form.

5. A drop-down list will appear on

the screen. Select Form 10E from it.

6. You must enter the assessment

year (the year in which the salary or pension arrears were received).

7. Once you have filled in your

name, PAN and other details, instructions for filling out Form 10E will appear

on the screen.

8. After following the guidelines

carefully, you can start filling out the form which is divided into four

paragraphs.

o Annexure-I: Fill in this title if

you claim relief in case of pension or arrears of salary or premature

withdrawal from your future fund.

o Annexure-2: If you have received

a gratuity amount for providing your services as an employee for 5 to 15 years,

fill in the details in this annexure.

o Annexure-IIA: This attachment

seeks relief on the amount of gratuity received for service for more than 15

years.

o Annexure-III: You can claim

relief on compensation for termination of employment by fulfilling paragraph

three.

o Annexure-IV: In case of change of pension, if relief is claimed, it has to be met.

You may also, like – Automated Income Tax House Rent Exemption Calculator U/s 10(13A)

9. Once you have completed the

form, you can preview it before finally submitting it.

10. If you are unable to fill out

the form at once, you can save it. The 'Save Draft' button at the bottom of the

screen lets you save the entered information so that you can fill out the form

later.

11. To memorize the saved draft,

you need to follow the same steps as described above.

12. Since Form 10E has been

submitted online, you do not need to attach a copy of it with your income tax

return. But, for your own future reference, you can keep a hard copy with your

financial paperwork.

It is mandatory to file Form 10E online if you want to claim an approved relief under section 89 (1). When filing your income tax return, if you claim relief without filling out the form, the Income Tax Department will send you a circular to that effect.