Income tax benefits are available on home loans. Taking out a home loan can help you save tax under

the provisions of the Income Tax Act, 1961. See the tax benefits available under the Act.

There are 2 components to paying a home loan:

1. Principal and

2. Pay interest

Since there are two different components to paying a loan, the tax benefit on a home loan is regulated by different sections of the Income Tax Act. The following are some of the benefits of taking a home property loan:

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Assam State Employees for the F.Y.2021-22 as per Budget 2021[This Excel Utility can prepare at a time your Income Tax

Computed Sheet + Individual Salary Structure as per the Assam State Employees

Salary Pattern + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated

Form 16 Part A&B and Part B]

1. Discount on Basic Payment The maximum discount allowed under 80C is Rs. ,50,000. This discount is available on a payment basis. But to claim this discount, the home property should not be sold within 5 years of possession. Otherwise, the previously claimed deduction will be added to the total income in the year of sale.

2. Exemption for Stamp Duty and Registration Charge (U/s 80C): A waiver for stamp duty and registration charge paid in case of purchase of a home property can also be claimed under 80C but within the total limit Rs. 1,50,000. This can be claimed in the year in which these costs are incurred.

3. Decrease in interest on home loan: As per section 24, the maximum deduction for interest payable on a loan is Rs. 200,000 where the loan has been taken for purchase or construction of self-occupied property on or after 01-04-1999 and the property has been acquired or constructed within 5 years.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Bihar State Employees for the F.Y.2021-22 as per Budget 2021[This Excel Utility can prepare at a time your Income Tax

Computed Sheet + Individual Salary Structure as per the Bihar State Employees

Salary Pattern + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated

Form 16 Part A&B and Part B]

A maximum tax deduction of 24% interest on a loan in a self-occupied property is allowed at Rs. 30,000 where the loan was taken before 01-04-1999 or repair was taken for repair, renewal or reconstruction. There is no maximum limit for a home loan for which the home loan has been taken if it is not self-occupied and the taxpayer can deduct from the full amount of interest.

Additional deduction of interest under 80EEA: Additional deduction of interest on home loans from any financial institution is available to individuals up to the maximum limit. 1,50,000 provided satisfy the following conditions:

The stamp value of the property is not more than Rs. 45 lakhs.

1st must be approved between 1st April 2019 to 31st March 2021.

On the date of loan approval, the person does not own any other residential home property.

You may also, like- Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E for the F.Y.2021-22 [Updated Version]

5. Additional deduction of interest under 80EE: Additional deduction of interest on home loan from any financial institution, maximum Rs. 50,000 The following conditions are met:

Residential The value of residential house property is not more than fifty lakh rupees.

1st must be approved between 1st April 2016 to 31st March 2017.

The amount of loan approved for the acquisition of residential house property is not more than Rs. 45 Lakh. On the date of loan approval, the person does not own any other residential home property.

Summary

|

Section |

Nature

of Home Loan |

Maximum

amount of Deduction |

Actual Conditions |

|

Home Loan Interest |

Rs. 2,00,000 |

Construction must be

completed within 5 years |

|

|

80C |

|

Rs. 1,50,000 |

Home can not be sold between

5 years of occupied. |

|

80C |

Registration Fee/ Stamp

Duty |

Rs. 1,50,000 |

Demand is allowed in the

year of expense incurred. |

|

Home Loan Interest |

Rs. 50,000 |

Property Value below of Rs.

50 lakhs and the loan amount below of

Rs. 35 lakhs. |

|

|

Home Loan Interest |

Rs. 1,50,000 |

Stamp value of property

below Rs. 45 Lckh |

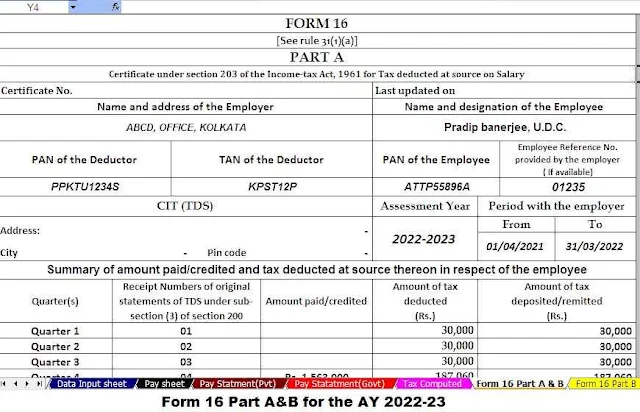

Feature of this Excel Utility-

#This Excel Utility can prepare at a time

your Income Tax Computed Sheet

# Individual Salary Structure as per the Govt

and Non-Govt Employees Salary Pattern

# Automated Income Tax Arrears Relief

Calculator U/s 89(1) with Form 10 E from the F.Y.2000-01 to F.Y.2021-22

# Automated H.R.A. Exemption Calculation

U/s 10(13A)

# Automated Form 16 Part A&B and Part

B]