Home loan tax benefits. Purchasing your own home is a dream come true for everyone. The

Government of India has always shown a great tendency to encourage citizens to invest in a home.

This is why a home is eligible for tax deduction under section 80C. And when you buy a home on a

home loan, it comes with multiple tax benefits that significantly reduce your non-taxable benefits.

Many schemes, such as the Prime Minister's Jan Dhan Yojana, is giving the green light to the Indian housing sector in an attempt to bring down the problems of affordability and accessibility.

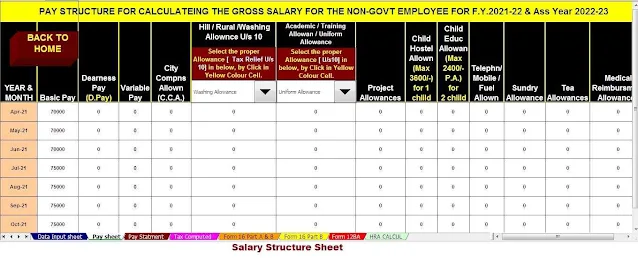

You may also, like- AutomatedIncome Tax Preparation Software in Excel for the All Non-Govt Employees for theF.Y.2021-22 as per New and Old Tax Regime U/s 115 BAC [This Excel Utility can prepare at a time your Tax Computed

Sheet + Individual Salary Structure as per Non-Govt Employees Salary Pattern +

Automated Income Tax Form 12 B.A. + Automated H.R.A. Calculation U/s 10(13A) +

Automated Income Tax Revised Form 16 Part A&B and Part B for the

F.Y.2021-22]

A home loan must be taken for the purchase/construction of a house and the construction of the house must be completed within 5 years of the end of the financial year in which the loan is taken.

If you pay EMI for a housing loan, it has two components -

Interest payments, and principal payments.

The interest of the EMI paid for Financial Year can be claimed as an exemption of Rs 2 lakh under Section 24.

From the assessment year 2018-19, the maximum deduction for interest paid on the self-occupied home property is Rs 2 lakh.

For leaving the property, there is no upper limit for claiming interest.

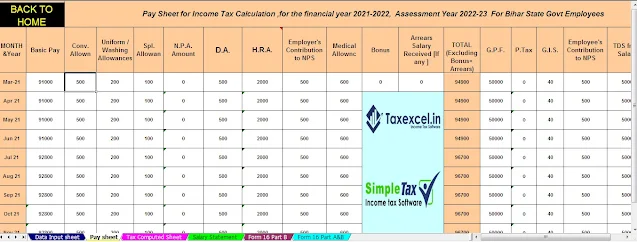

You may also, like- AutomatedIncome Tax Preparation Software in Excel for the Bihar State Govt Employees for the F.Y.2021-22 as per New and Old Tax Regime U/s 115 BAC [This Excel Utility can prepare at a time your Tax Computed

Sheet + Individual Salary Structure as per Non-Govt Employees Salary Pattern + automated

H.R.A. Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part

A&B and Part B for the F.Y.2021-22]

However, anyone who can claim overall loss in the title of house property is limited to only Rs 2 lakh. This deduction can be claimed from the year the house is completed.

Deduction in interest paid for a home loan during the pre-construction period

Say, you bought a property under construction and haven't gone yet. But you are paying EMI. In this case, your eligibility to claim interest on a home loan starts only after the construction is completed or if you have purchased a fully constructed property.

Does this mean that you will not get any tax benefit on the loan and the interest paid during the construction period? No.

Let's understand why. The Income-tax Act also provides for this type of interest claim, called pre-construction interest, as a deduction in five equal instalments starting from that year, where the property is acquired or completed, on deductions and above you otherwise claim from your home property income. Worth doing. However, the maximum qualification is limited to Rs 2 lakh.

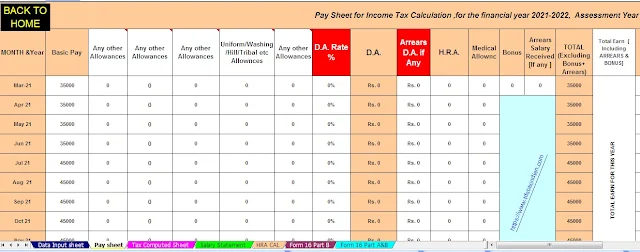

You may also, like- Automated Income Tax Preparation Software in Excel for the Assam State Govt Employees for the F.Y.2021-22 as per New and Old Tax Regime U/s 115 BAC [This Excel Utility can prepare at a time your Tax Computed

Sheet + Individual Salary Structure as per Assam State Govt Employees Salary

Pattern + automated H.R.A. Calculation U/s 10(13A) + Automated Income Tax

Revised Form 16 Part A&B and Part B for the F.Y.2021-22]

Discount on original payment

The principal amount of the rebate under section 80C of Rs. 1.5 Lakh.

Whether to demand this discount, the house property should not be sold between 5 years of possession. Otherwise, the previously claimed deduction will be added to your income in the year of sale.

Exemption for stamp duty and registration charges

In addition to claiming deductions for the original payment, a rebate for stamp duty and registration charges can also, be claimed under 80C but within the overall limit of Rs 1.5 lakh.

However, this can only be claimed in the year where these costs are incurred.

Additional exemption under section 80EE

Additional discounts are allowed under Section 80EE for home buyers up to a maximum of Rs 50,000. To claim this discount, the following conditions must be met

The loan amount should be Rs 5 lakhs or less and the value of the property should not be more than Rs 50 lakhs.

You may also, like- AutomatedIncome Tax Preparation Software in Excel for the Andhra Pradesh State Govt Employees for the F.Y.2021-22 as per New and Old Tax Regime U/s 115 BAC [This Excel Utility can prepare at a time your Tax Computed

Sheet + Individual Salary Structure as per Andhra Pradesh State Govt Employees

Salary Pattern + automated H.R.A. Calculation U/s 10(13A) + Automated Income

Tax Revised Form 16 Part A&B and Part B for the F.Y.2021-22]

And on the date of loan approval, the person is not the owner of any other house i.e.

Section 80 EE has been implemented from the F-Y fiscal year. Previously, the concession approved under Sec E0 EE was only available for 2 years for FY 2019-20 and FY 2021-22

Additional exemption under section 80EEA

Budget 2019 has introduced additional discounts under Section 80EEA for home buyers up to a maximum of Rs 1,50,000.

To claim this discount, the following conditions must be met:

The stamp value of the property is not more than Rs 45 lakh.

You may also, like- AutomatedIncome Tax Preparation Software in Excel for the Jharkhand State Govt Employees for the F.Y.2021-22 as per New and Old Tax Regime U/s 115 BAC [This Excel Utility can prepare at a time your Tax Computed

Sheet + Individual Salary Structure as per Jharkhand State Govt Employees

Salary Pattern + automated H.R.A. Calculation U/s 10(13A) + Automated Income

Tax Revised Form 16 Part A&B and Part B for the F.Y.2021-22]

On the date of loan approval, the person does not own any other home

A person claiming a deduction under this section should also not be eligible to claim a deduction under section 80EE.

Discount for a joint home loan

If taken jointly, each loan holder can claim up to Rs 2 lakh for interest on each home loan in their individual tax returns and up to Rs 1.50 lakh for principal repayment of 80C.

To claim this discount, they must be co-owners of the borrowed property.