How to claim 80 TTA deductions for FY 2021-22 Under Section 80TTA, if you earn your bank deposit,

it will be discounted (but not fully).

Income received in the form of

interest from a bank savings account is taxable, however, up to Rs. 10000

discount is given u / s 80 TTA discount limit.

Interest on income from bank

deposits are taxable under "Income from other sources" if it exceeds

Rs.10,000.

How to

calculate 80tta discount amount

Calculating the amount of interest

earned on a bank deposit is not rocket science.

Quarterly, half-yearly or annual

post office savings are counted as savings and the amount of the savings bank

account is treated as interest income.

Deduction under section 80TTA is

not available to senior citizens.

The process of deducting furniture

claims

Income from interest should be

arranged under income from other sources of ITR form.

Declare actual interest income

under section 80TTA of the ITR form.

Sometimes the taxpayer forgets to

disclose the details like income and as a result inconsistencies in the form

occur.

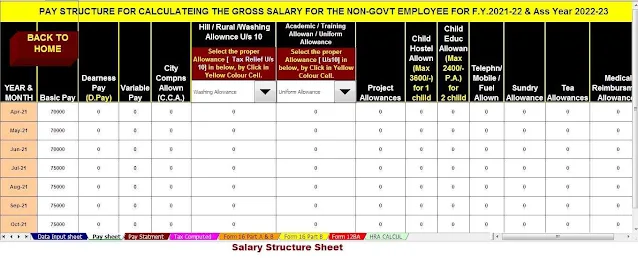

You may also, like- Automated Income Tax Calculator All in One in Excel for the Non-Govt Employees for F.Y.2021-22 asper new and old tax regime[This Excel Utility can

prepare at a time your Tax Computed Sheet + Individual Salary Structure as per

Non-Govt Employees Salary Pattern + Automated H.R.A. Exemption Calculation U/s

10(13A) + Automated Income Tax Form 12 BA + Automated Income Tax Form 16 Part

A&B and Part B]

The interest earned on the deposit

at the time of this deposit is not allowed. Time deposit means refundable

deposit after the expiry of the specified period. Will not be allowed -

Interest from fixed deposits

Interest from recurring deposits

No other time deposit

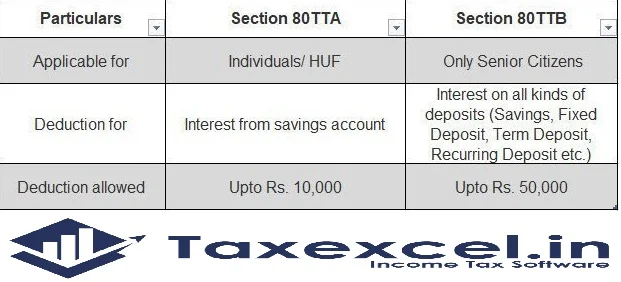

Section 80TTB for senior citizens

Section 80TTB is a new amendment

introduced in the 2018 budget for senior citizens.

Senior citizens can avail themselves an interest

income up to Rs 50,000 U/s TTB on all types of interest income.

Let's consider the following income

for a senior citizen:

Interest on bank deposits (savings

or fixed).

Interest on deposits held in

cooperative societies.

Interest in post office deposits.

Tax exemption under section 10 (15)(i)

Up to Rs.10,000/- Earned from Post Office Savings Bank under Section 10 (15) (i). 3500 for individuals and Rs. 7000 for joint accounts.

The best part is the growing effect of Section 10 (15) (i) and 80TTA that exemption can be claimed under Section 10 (15) (i) in addition to deductions under Section 80TTA.

The difference between section

80TTA and 80TTB

Important Note: - Section 80TTB has

been introduced in the 2018 budget for senior citizens.

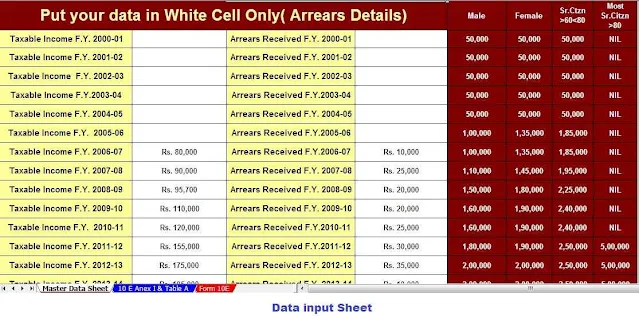

Examples of tax savings between 80TTA and 80TTB

|

Particulars |

Normal taxpayer |

Senior Citizen |

|

Interest Income from Savings account |

15,000 |

5,000 |

|

Interest Income from Fixed Deposit |

50,000 |

50,000 |

|

Interest Income from Recurring Deposit |

20,000 |

20,000 |

|

Total Income |

85,000 |

75,000 |

|

Less: Deduction under Section 80TTA |

10,000 |

N/A |

|

Less: Deduction under Section 80TTB |

N/A |

50,000 |

|

Taxable Income |

75,000 |

25,000 |

|

Tax |

As per Tax Slab |

As per Tax Slab |

How to claim 80 TTA deductions for FY 2021-22 on interest income bank deposits.

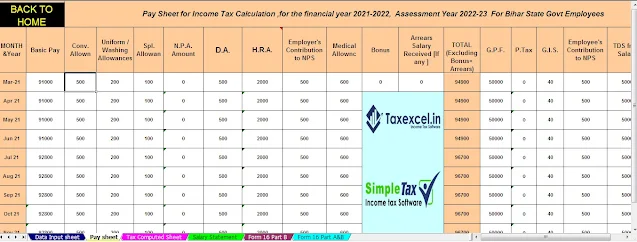

You may also, like- Automated Income TaxCalculator All in One in Excel for the Bihar State Govt Employees for F.Y.2021-22 as per new and old tax regime[This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as per Bihar State Employees Salary Pattern + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B]

However, you can avoid deducting TDS on interest income by equipping Form 15G / 15H.

FAQ U/ s 80TTA and 80TTB

Q: If there is more than one

savings account is the interest income of each account eligible for tax

deduction?

A: No, you need to add all the

interest income to all your savings accounts, and then apply u / s 80 TTA &

80 TTB

Q: Does the bank deduct TDS from

interest from savings account for a senior citizen and general taxpayer?

Answer: No, TDS is not applicable

on interest on the savings account, but the bank deducts TDS from the interest

paid against the fixed deposit or recurring deposit. Submission of 15G /15 H Tds

form to the account holder FD or RD will not be deducted.

Q: If the interest income from the

savings account exceeds the deduction limit i.e. 10,000 for the general

taxpayer and 50,000 for the senior citizen. What will be the tax context?

Ans: You have to enter the maximum

exemption account in the 80TTA / 80TTB column of the income tax form and the

remaining amount required to specify income from other sources.

Q: Is interest from a savings

account in

Answer: Interest from a savings account is discounted up to 80tta maximum limit of Rs.10,000 for the general taxpayer and up to 50,000 u / s 80ttb for senior citizens. It is also mandatory to disclose your full income from the savings account interest under income from other sources.