Section 80 Income tax deduction. Worried about paying huge taxes every year? Learn about these deductions that can reduce your taxes.

Section 80C - Decrease in investment from taxable income

Some of your investments give you more than you expected. You can also save on taxes. Section 80C investments are an important example of such investments. This cut is eligible for one person and one Hindu Undivided Family (HUF). Cuts are available for some large investments, such as:

Public Investment in Public Provident Fund (PPF)

Unit Integrated Investment Plan (ULIPs)

Equity Linked Savings Schemes (ELSS)

The fund is part of the employee's future fund contribution

National Savings Certificate (NSC)

• Life insurance premium payment

Children's tuition fees

Home loan repayment principal

Senior Citizens Savings Scheme (SCSS)

Maximum Discount: 1,50,000 *

* Maximum discounts offered here are for specific categories only. Please note that, in addition, under Section 80C, Section 80CC and 80CCD (1), a maximum waiver of `1,50,000 may be claimed. On top of this, an additional tax deduction of Rs 50,000 can be claimed for investing in a National Pension Scheme (NPS) account under Section 80CCD (1B).

Section 80CCC - Decrease in contribution to the pension fund

It is designed to reduce income tax liability in pension schemes provided by various public and private sector insurers. It pays a deduction to a person who has paid or deposited in an insurer's annual plan to receive a pension (income) from a fund determined by an insurer. Deduction of premium paid in a year can be claimed as deduction from taxable income.

Maximum Discount: 1,50,000 *

You may also, like- Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E from theF.Y.2000-01 to F.Y. 2021-22

* Maximum discounts offered here are for specific categories only. Also, please note that, in addition, the maximum deduction that can be claimed under Sections 80C, Section 80CC and 80CCD (1)) is 1,50,000. On top of that, an additional tax deduction of Rs 50,000 can be claimed for investing in an NPS account under section 80CCD (1B).

Section 80CCD - Reduction of contribution to Central Government Pension Scheme

Deductions under section 80CCD are allowed to a person who keeps a deposit in his pension account. 10% of salary (in case of salaried persons) and 20% of total income (in case of self-employed persons) or `1,50,000- whichever is less, maximum discount is allowed. Under subsection 1b, an additional discount of up to, 50,0000 is available for contributions by individuals to the NPS.

Maximum discount: `2,00,000 *

* Maximum discounts offered here are for specific categories only. Please note that, in addition, under Section 80C, Section 80CC and 80CCD (1), a maximum waiver of `1,50,000 may be claimed. On top of that, an additional tax deduction of Rs 50,000 can be claimed for investing in an NPS account under section 80CCD (1B).

Both the above-mentioned sections are associated with pension plans and annual plans. But there is a difference between the two. Where Section 80CCC includes deductions for money paid for an insurer's annual plan, section 80CCD provides a rebate for money paid in pension schemes: NPS and Atal Pension Scheme.

Section 80D - Deduction of premium paid for medical insurance

Under Section 80D, the taxpayer is allowed a rebate of up to Rs 25,000 for insurance of his / her own, spouse and dependent children. If the insured is 60 years of age or above, the discount is available up to Rs 30,000. An additional 25% of the parent (for both parents, or both) (30,000 if the parent is 60 years of age or older) is allowed. Anyone can also get a discount for preventive health check-ups up to `5,000 under the limits set above.

Maximum discount: 60,000

Section 80E - Decrease in interest on education loan taken for higher education

If you have taken an education loan for higher education, you can claim a tax exemption under section 80E. This applies even when a loan may be taken out for a spouse, child or student for whom the taxpayer is the legal guardian. Deduction of the amount of interest is allowed and until the maximum years or interest is paid, whichever is earlier is available. If you take out a loan to finance a foreign study, you can claim a deduction under it.

Maximum discount: No barriers. Discount granted for 8 years.

Section 80GG - Tax deduction on paid rent

Under Section 80GG, you can claim a discount for the paid house rent if you do not receive the House Rent Allowance (HRA) salary. The taxpayer, spouse or minor child should not own residential housing at the place of employment. The taxpayer should live in the rent and pay the rent. Also, the taxpayer should not have self-occupied residential property elsewhere.

The minimum available to cut under this category is:

Rent minus 10% of total income

5,000 `5,000 per month

25% of total income

Maximum discount: 60,000

Loss of interest on a savings account - Section 80TTA

Under Section 80TTA, a discount can be claimed against interest income received from a savings bank account. Interest from a savings bank account should first be included in the heading 'Other Income' when calculating and may benefit from the total interest earned or '10,000- whichever is less. Interest income from a fixed deposit, recurring deposit or interest income from corporate bonds, cannot be claimed under this section.

Maximum discount: `10,000 / -

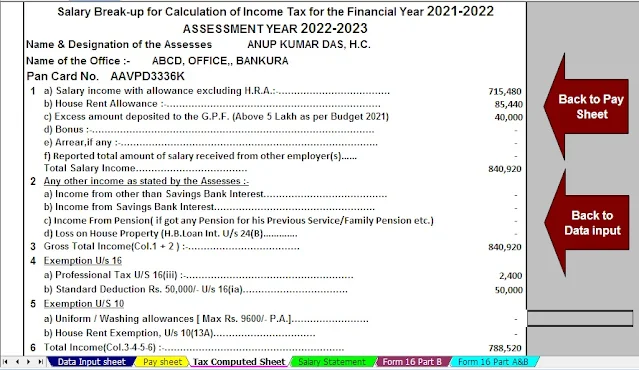

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure as per W.B.Govt Employee’s Salary

Structure.

4) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22

7) Individual Salary Sheet