To enforce retailers to less interest on 5 Years fixed deposits, the Finance Minister has

announced in 2006 that all fixed deposits with a maturity of more than 5 years can be

entitled to exemption U/s 80C as per Income Tax Act.

Tax Savings Fixed Deposits: Guidelines

The Ministry of Finance has issued the following guidelines

for investment in tax-saving fixed deposits.

Maturity: 5 years

Minimum investment: Rs.100 and its multiples

Maximum Investment: Rs.1,50,000

Discounts available: Private, HUF

Premature withdrawal: Not available

Loan facility against this FD: Not available

Tax on interest earned: According to the income tax slab rate

of the individual

10% TDS on interest

The interest rate on this tax-saving fixed deposit is determined by the bank in which the investment is made.

You may also, like- Automated Income Tax PreparationExcel Based Software All in One for the Non-Government (Private) Employees for the Financial Year 2021-22 and Assessment Year 2022-23 U/s 115BAC

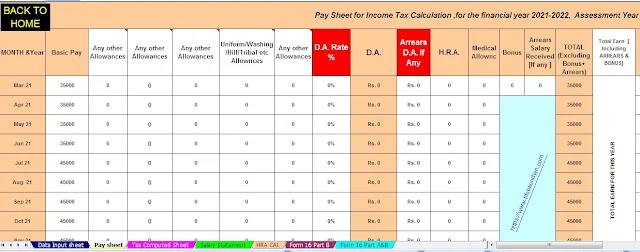

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Section as per Budget 2021

3)

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Non-Govt (Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount into the in-words without any Excel Formula

Tax savings Effective annual the interest rate on fixed deposits

The below-given table showing the interest earned.

|

S. No. |

Particulars |

Amount (Rs.) |

||

|

Slab Rate – 30% |

Slab Rate – 20% |

Slab Rate – 10% |

||

|

A |

Amount Invested |

10,000 |

10,000 |

10,000 |

|

B |

Immediate Tax Saving (assuming 30% Slab Rate) |

3090 |

2060 |

1030 |

|

C |

Effective Investment (A-B) |

6910 |

7940 |

8970 |

|

D |

Maturity Amt of Original Investment (Interest @8.5% p.a.) |

13,382 |

13,382 |

13,382 |

|

E |

Total Pre-Tax Benefit on Deposits (D-C) |

6,472 |

5,442 |

4,412 |

|

F |

Effective Annual Yield (5 years) |

14% |

12.50% |

10.50% |

In order to invest in such tax-saving fixed deposits which are allowed as exemption under section 80C, the investor has to submit an application for the same at the time of deposit and the banker has to provide a copy of his PAN card.

These investments can be made in a single name or joint name. If the investment is made in a joint name, only the 1st holder is eligible to claim the deduction and the second holder cannot make a deduction for Section 80C for such tax savings fixed deposit investment.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Assam State Government Employees for the Financial Year 2021-22 and Assessment Year 2022-23 U/s 115BAC

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Section as per Budget 2021

3)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

4)

Individual Salary Structure as per the

5)

Individual Salary Sheet

6)

Individual Tax Computed Sheet

7)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount into the in-words without any Excel Formula

The difference between investing in PPF vs. Tax Saving Fixed Deposit

PPF, which is the best tax-saving option rather than a fixed deposit,

Read the proposal: The benefits of investing in a PPF account and the PPF interest rate

However, look at the below table difference between P.P.F. and F.D:-

|

Particulars |

Tax Saving Fixed Deposit |

PPF |

|

Maturity |

5 years |

15 years |

|

Deduction is available u/s 80C |

Rs, 1,50,000 |

Rs. 1,50,000 |

|

Interest Rate |

Fixed by the Bank* |

Fixed by the Govt* |

|

Tax on Interest earned |

As per Income Tax Slab Rate |

Exempt |

|

Premature Withdrawl Facility |

Not Allowed Maturity after 5 years |

Available from 5th year onwards but

only to a certain extent |

|

Loan Facility |

Not Allowed Maturity after 5 years |

Can be availed from 3rd year

onwards |

However, the main difference between tax-saving fixed deposit and PPF is that the maturity of tax-saving FD is 5 years which is much less than the 15-year maturity of PPF.

Another big difference is that tax savings are taxable on interest earned in FDs where interest earned in PPF is tax-free. However, the major difference between PPF and Tax Saving F.D is its duration also the fact that the earned interest from the F.D will be taxable but the earned interest PPF is tax-free.

You may also, like- Automated Income TaxPreparation Excel Based Software All in One for the Bihar State Government Employees for the Financial Year 2021-22 and Assessment Year 2022-23 U/s 115BAC

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Section as per Budget 2021

3)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

4)

Individual Salary Structure as per the

5)

Individual Salary Sheet

6)

Individual Tax Computed Sheet

7)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount into the in-words without any Excel Formula

Since the interest on PPF is tax-free, the effective interest on PPF is higher than the effective interest on savings FDs. However, the extra interest comes with higher maturity. Both tax-saving fixed deposit and PPF accounts can now be opened in banks as well.

PPF is a better instrument than a tax saving fixed deposit. He should choose PPF otherwise he should choose tax saving fixed deposit.

And if you have already invested a maximum amount of Rs 1.5 lakh in PPF, then you can invest in a tax-saving fixed deposit.

You may also, like- Automated Income TaxPreparation Excel Based Software All in One for the West Bengal State Government Employees for the Financial Year 2021-22 and Assessment Year 2022-23 U/s 115BAC

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Section as per Budget 2021

3)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

4)

Individual Salary Structure as per the

5) Individual

Salary Sheet

6)

Individual Tax Computed Sheet

7)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount into the in-words without any Excel Formula

Tax Saving Fixed Deposit vs. Tax-Free Bond

Tax-free bonds are bonds that are issued with the permission of the central government and the issue is open for a certain period of the year as compared to a fixed deposit of tax protection which can be opened at any time of the year.

Interest earned on these tax-free bonds is completely tax-exempt. However, the money invested cannot be claimed as a deduction under section 80C.

Read the proposed: Tax-free bonds: You should invest in them

Tax-free bonds and tax savings fixed deposits are compared here: -

|

Particulars |

Tax Free Bonds |

Tax Saving Fixed Deposit |

|

Deduction under Section 80C for amt invested |

Not Available |

Available |

|

Option to invest |

Can only be invested when the issue opens |

Can be invested

anytime |

|

Tax on Interest earned |

Exempted |

Taxable |

|

Maturity |

10-20 years |

Min 5 years |

|

Option to sell before maturity |

Can be sold on Stock Exchanges |

Cannot be redeemed before maturity |

Conclusion,

Tax saving fixed deposit and tax-free bonds are 2 completely different instruments that cannot be compared. The advantage of tax-saving fixed deposit is that the principal investor is exempt from tax i.e. it can be claimed as exemption under section 80C and the advantage of a tax-free bond is that the interest is exempt from income tax collection.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22