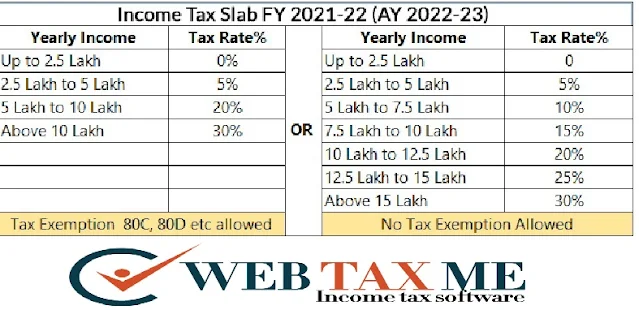

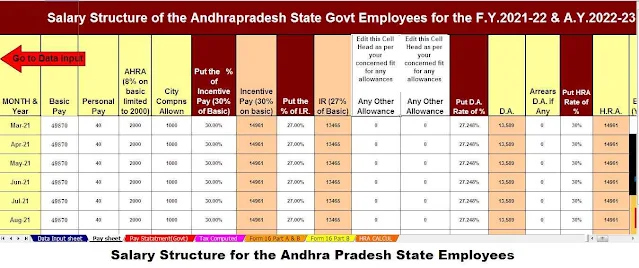

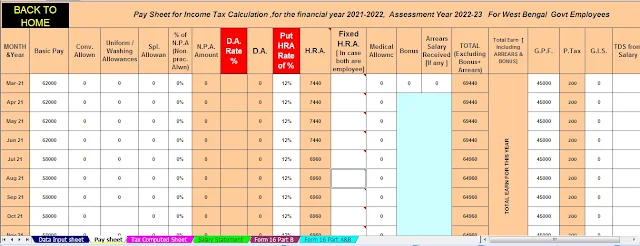

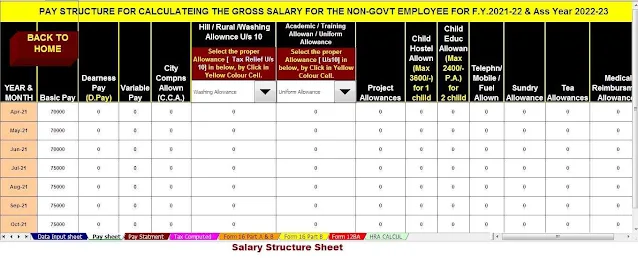

Automatic Salary Arrears Relief Calculator U/s 89(1) with Form 10 E for F.Y 2021-22. With the introduction of the new tax system in Budget 2021, many are not confused as to which of them can get an income tax reduction. Let's take a look at the complete list of income tax reductions for the current fiscal year 2021-22 under the old or new tax system.

However, when investing or making cuts, our idea is to focus on our financial goals first, not just on tax savings. Therefore, it is very important to understand the available options.

List of Income Tax Reduction for F.Y 2020-21 - Under New / Old Tax System

Let us now discuss the list of income tax exemptions for the fiscal year 2021- 22

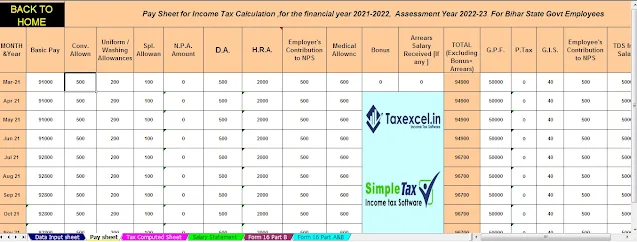

# Section 80CCD (2)

Under this section, the employer's contribution to the employee's account can be claimed up to Rs.1.5 Lakh.

An employer can contribute to his EPF account an amount equal to 12% of the employee's basic monthly salary. Similarly, an employer can pay 10% of the employee's basic salary to the NPS's Tier-I account (for central government employees it is now 1% effective from April 2019 to 14% of the basic + DA). On a salary account, an employer can contribute a maximum of Rs 1.5 lakh tax-deductible in a financial year.

Individuals with a taxable income of up to Rs 5 lakh will be eligible for tax exemption under section AA up to Rs 12,500, making zero tax payable under the new tax system.

Allowance is available under the old tax system: -

# Leave travel allowance

Your travel bills can be claimed for a discount against the LTA. It is allowed to claim twice in a four-year block. The present block is from 2019 to 2022. You can ask your employer not to deduct tax on it and you can claim it next year.

# Entertainment allowance

You may be receiving this allowance. However, discounts are only available for government employees. The amount of exemption is the following minimum.

A) 5 thousand rupees

B) 1/5th of salary (excluding any allowance, benefit or another grant)

C) Receiving actual entertainment allowance

# House Rent Allowance (HRA)

This is the famous exemption that many salaried people use. However, the misconception is that what they rent is actually exempt from their income. The reality is different. The amount of exemption is the following minimum.

A) Obtained actual HRA

B) 40% of salary (50%, if the house

is in Mumbai, Kolkata,

C) Rent minus 10% salary

(Salary = Basic + DA (part of retirement benefits) + Turnover based commission)

Download Automated Income Tax House Rent Exemption U/s10(13A) Calculator in Excel

If your employer pays this allowance, you can get a discount of up to Rs 100 per child per month (up to a maximum of 2 children). However, you can yearly save Rs.2400/-. An exemption may seem so low. But why pay taxes?

# Hostel Expenses Allowance - If your employer pays this allowance, you can get a discount of up to Rs. Up to 300 children are exempted per month up to a maximum of 2 children. Therefore, you can save a maximum of Rs.00 from this allowance.

The exemption is available under the old tax system: -

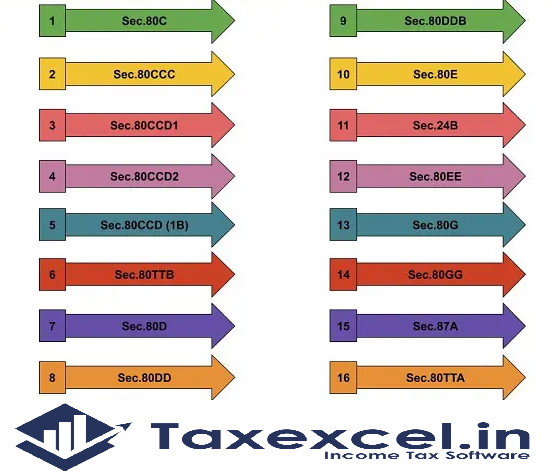

Complete sections can be listed below.

# Standard deduction of Rs. 50,000

In fact, I have to keep it under wraps. However, this standard cut replaced the current allowance.

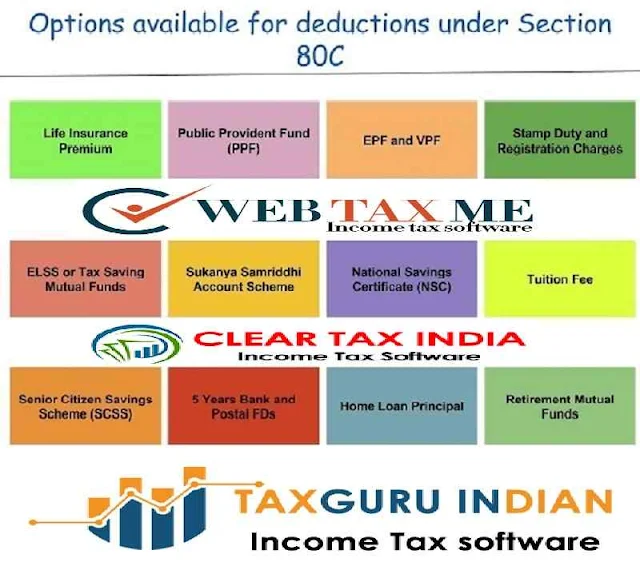

# Section 80C

This is the famous category that is often used by all salaried people. The current limit for the current year is Rs 1,50,000. Therefore, up to Rs 1,50,000, you can save tax on salary income only from this category. The various investments that you make and can also be claimed under Sec 80C.

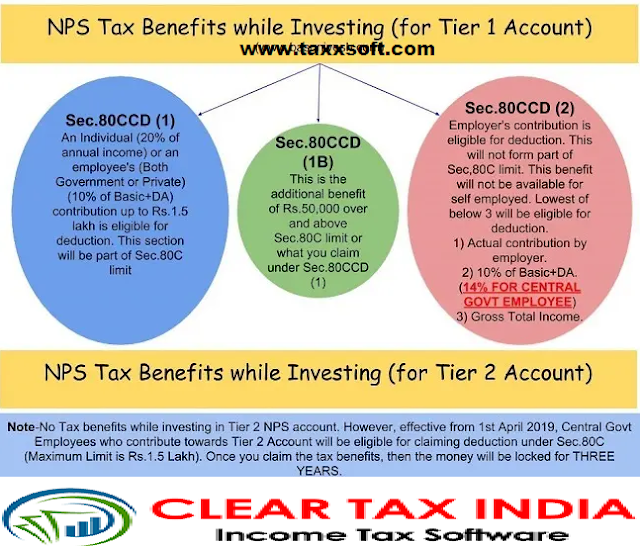

# Sec.80CCD(1)

The maximum benefit available is Rs 1.5 lakh (with a limit of C0C per second).

A maximum of 20% of an individual’s annual income or an employee (10% of Basic + DA) will be eligible for deduction.

# Sec.80CCD(2)

There is a misconception among many that there is no upper limit to this category. However, three conditions can be meet for avail of this benefit 1) the amount paid by an employer, 2) 10% of basic + DA (14% of government employees) and 3) total income

This is an additional cut that will not be part of the Sec.80C limit.

Cuttings under this section will not be eligible for self-employment.

NPS tax facility under Sec.80CCD (1B)

• It is an additional tax benefit of up to Rs 50,000 eligible for an income tax deduction and it was introduced in the 2015 budget

From the financial year 2015-16, anyone can avail the benefit of this section 80CCD (1B).

Sec It is above Sec.80CCD (1).

Explained the three categories of NPS (Sec.80CCD1, Sec.80CCD2 and Sec.80CCD (1B) in the image below for your reference.

Note: - Please note that the limit of reduction under SEC.80C, SEC.80CCC and SEC.80CCD (1) cannot go beyond Rs.1,50,000 for 2020-21 economically.

# Sec.80D

For Medical Insurance Paid exemption from Income Tax Rs.25000/- who are below the age of 60 years and Rs. 50,000/- who are above 60 years of age

2. In the case of a single premium health insurance policy covered for more than one year, it is proposed that subject to the specified year, deduction on a proportional basis will be allowed for the year for which the health insurance cover is provided.

# Sec.80GG

Below are a few conditions to get the benefit of cutting under this section.

1. This section only applies to individuals or HUFs.

2. Taxpayers are either salaried or self-employed. However, of course not getting HRA.

The taxpayer himself or his wife/minor / HUF of which he is a member, should not own any residence in the place where he is working or doing business

4. If the taxpayer owns a house in a place other than the one mentioned above, the exemption is not claimed by him in the case of self-occupied property [Article 23 (2) (a) or 23 (4) (a)].

5. The taxpayer has to submit a declaration in Form No. 10BA which has been spent by him for payment of rent.

How much discount can anyone get under seconds? 80GG?

If the above five conditions are met, the minimum deductible amount under section 80GG will be followed.

5,000 per month;

25% of the taxpayer's total income for the year; Or

Rent less than 10% of total income (rent 10% of total income).

# Sec.80TTA

A discount of up to Rs. 10,000 / - can be claimed by an individual or HUB through interest from the savings account of the bank, interest from the savings account of the cooperative society run by the bank.

# Sec.80TTB

This section is for senior citizens (at any time of the financial year of 60 years or above. The interest income earned from Bank FD, RD (including post office) will be discounted up to Rs. 50,000.

This discount can be claimed under the new Section 80TTB. However, if the taxpayer claims a deduction under Sec.80TTB, he cannot claim a deduction under the existing 80TTA.

# Sec.80U

To claim tax benefits under

Sec.80U, the taxpayer must be an individual and a resident of

Those who are above 40% disabled can claim Rs 75,000. And above 80% disabled person can avail Rs. 1,25,000/-

# Sec.24 (B)

The attractive part of the EMI of your home loan will be claimed under this section. The maximum limit is Rs. two lakh per year (even if you have more than one house). For abandoned property, the full interest payment of the previous home loan (loss from house property) may be allowed to be set up against any other source of income without any limit. However, effective from the fiscal year 2019-1Y, this set-off is now limited to Rs 2 lakh per person (regardless of the amount of property you keep).

# Rebate Under Sec.87A

In Budget 2019, a tax exemption of Rs 12,500 has been proposed for persons earning up to Rs 5 lakh.