In the case of a salaried person, there may be occasions when the company may delay payment of

salary. If this happens, the tax burden for salaried employees may change or increase due to the

understanding of past arrears paid in the current year. Acknowledging this hardship, the government

has made provisions to provide relief to salaried employees in case of arrears of salary in a particular

year. It also covers tax relief pay arrears and advances payments under section 89.

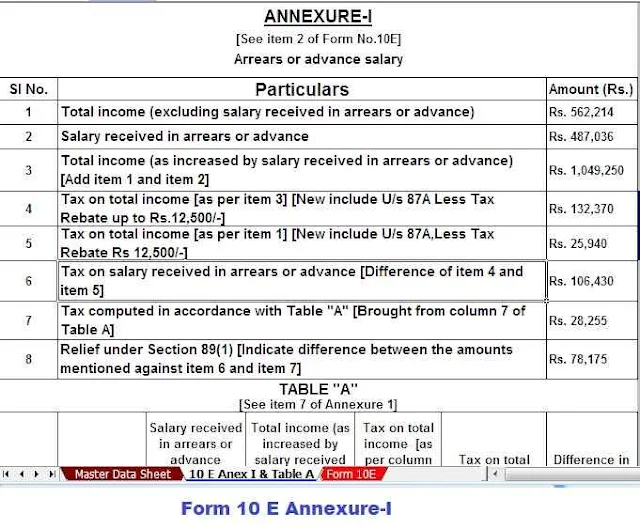

Section 89(1) calculates the tax relief available to a salaried employee. Here are some steps to calculate tax relief:

Step 1:

You will need to calculate the tax payable on the total salary amount, including any arrears or advance payment. The Form 16 that you will receive from your employer will contain details of any arrears or advance payments.

You will need to calculate the tax on salary considering standard deduction under section VI such as section 80C for investment deduction, section 80D for health insurance, section 80TTA for interest income, section 80G for grants and any other deduction applicable to the assessee. Taxes including cess must be calculated and based on the existing slab rate.

Step 2:

In Step 2, you need to calculate the total tax on your salary income without considering the salary arrears or advance. You will need to subtract this amount from your salary and calculate the tax after executing the deduction as per step 1 calculation.

Step 3:

You need to calculate the difference between the tax payable in step 1 and step 2. You will have to pay an extra tax burden due to arrears or salary advances.

Step 4:

You need to calculate the total tax payable based on the slabs and rules for the year in which the arrears are related. For example, if your company pays you your salary from 2015-16, you need to calculate your tax based on income from 2015-16 after adding the amount due. The deduction must give an effect for this calculation.

Step 5:

The amount of your tax for the year you are in arrears is already available based on past returns. In our example above, the tax paid for 2015-16 can be deducted from your past income tax return.

Step 6:

You need to calculate the difference between the actual tax payable from the year of arrears and the tax that will be payable, including the arrears.

If the tax difference due to arrears exceeds the tax difference from the salary arrears year, the additional sanction is given as relief under section 89. For example, if in 2019-20 there are additional taxes due to arrears of 5,000 and from 2017-18 there are additional taxes with arrears of money. 4,000, then relief of Rs. 1,000 will be paid to the taxpayer.

To get this relief, the taxpayer must fill out Form 10E

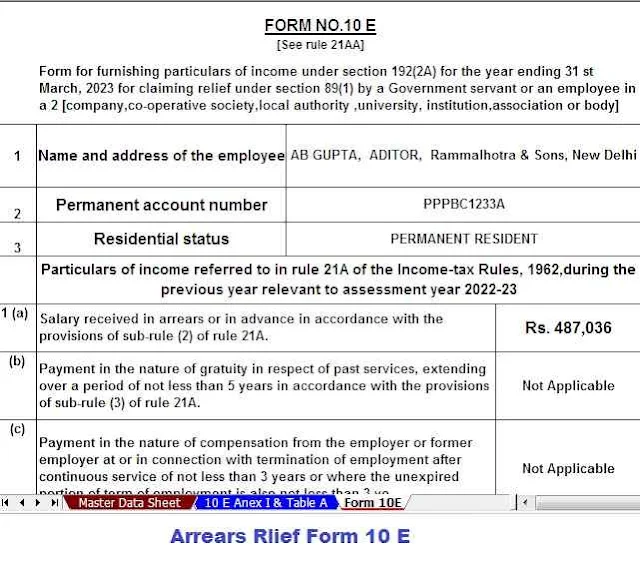

Know to abut Form 10 E

You can fill up Form 10E online by logging in to the Income Tax e-filing website and going to the Income Tax Forms section. The Income Tax website has rules and guidelines on how to fill out Form 10E. Details of the form are required such as:

Name and address of the employee

Pan

Residential status

• Salary arrears or advance received

Paying gratuity

Payment by the employer in case of termination of employment before the expiry of the notice

Commuted pension payment

It must be signed by the employee.

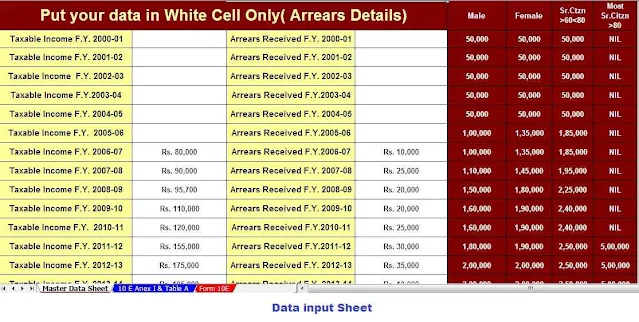

Detailed information on salary arrears or advances is also required to calculate relief.

Actual salary received in arrears

Additional tax for the current financial year

Excess tax in arrears year

Differential tax or additional tax paid due to arrears or advance pay

Relief under section 89

In addition to salary arrears or advances, the form also deals with relief in the case of gratuity, termination compensation or commuted pension.

Form 10E income tax must be filled and submitted online. Salary employees will get relief only after filling the form. The process is fairly simple and can be easily done online to get tax relief.