Automated Income Tax Preparation Software in Excel for the All Govt and All Non-Govt Employees

Taxpayers are entitled to get the benefit of tax deduction U/s 80C as per the Income Tax Act for a LIC

policy, fixed deposit, superannuation / PF, tuition fee.

Taxes are an integral part of our country, accounting for a large portion of the revenue earned by the government, the income that is used to provide certain basic provisions to citizens. According to the existing tax slab, people earning more than a certain amount are expected to pay tax. Although these taxes can be strict on a taxpayer's bank balance, the government also provides some provisions where one can save taxes. Tax cuts can help a person reduce their taxable income, reduce their overall tax liability and, in turn, help them save tax. The deduction that one is eligible for depends on many factors, different limits are set for different purposes.

Tax deduction under section 80C

Maximum limit Rs. 1.5 Lakh with

80C,80CCD,80CCC(1) additional deduction U/s 80 CCD(1B) Rs.50,000/- and 80CCD(2)

Employers Contribution to the Employees Pension Fund.

You can also, like-

Automated Income Tax Preparation Software in Excel for the Private Employees for the F.Y.2021-22

Tax deduction under section 80D

Section 80D of the Income Tax Act

allows deduction on the amount spent by an individual for the premium of a

health insurance policy. This includes payments made by the spouse, children,

parents or on behalf of the central government's health plan. An amount of Rs

15,000 can be claimed as a deduction when paying for insurance for spouse,

dependent child or oneself, while this amount is Rs 30,000 if the person is

over 60 years of age (Union Budget 2017).

On February 1, 2018, Finance

Minister Arun Jaitley presented the Union Budget 2018 with some changes in the

tax cuts applicable to senior citizens. Under Section 80D, the limit of the

income tax deduction for senior citizens has been fixed at Rs 50,000 for

medical expenses.

Both the individual and the Hindu

undivided family are eligible for this deduction, subject to payment in a

manner other than cash.

Subsection under section 80D

Section 80D is further divided into

two sub-sections, providing clarity on the benefits available to taxpayers.

You can also, like-

Automated Income Tax Preparation Software in Excel for the Assam State Employees for the F.Y.2021-22

80 Section 80DD: Section 80DD

provides a tax deduction in two cases, Rs. 75,000 for general disability and

Rs. 1.25 lakh for severe disability. This discount can be claimed for the

following expenses.

On the money made for the treatment

of dependents with disabilities

The amount paid as a premium for

purchasing or maintaining an insurance policy for such dependents

75,000 for general disability and

Rs. 1.25 lakh for severe disability Both Hindu undivided families and residents

are eligible for this exemption. Dependents, in this case, can be either a

spouse, siblings, parents or children.

Section 80DDB may be used by HUFs

and residential persons and provides for deduction on expenses incurred by the

individual/family for the treatment of certain diseases. The approved deduction

is limited to Rs 40,000, which can be increased to Rs 60,000.

Tax deduction under section 80E

Section 80E of the Income Tax Act

is designed so that educating oneself does not become an additional tax burden.

Under this provision, taxpayers are eligible for a tax deduction on interest

payments on loans taken for higher education. This loan can be sponsored by the

taxpayer himself or his ward/child for education. Only individuals with

approved loans for tax benefits from approved charities and financial

institutions are eligible for this deduction.

You can also, like-

Automated Income Tax Preparation Software in Excel for the Jharkhand State Employees for the F.Y.2021-22

Tax deduction under section 80G

Section 80G encourages taxpayers to

donate funds and charities, providing tax benefits on financial contributions.

All appraisers are eligible for this deduction, subject to the provision of

proof of payment, including the deduction limit set based on certain factors.

100 % without any limit: Debt:

Grants donated to funds like National Defense Fund, Prime Minister's Relief

Fund, National Illness Assistance Fund, etc. are eligible for 100 % remission.

100 with qualification limit: Grant

to local authorities, associations or organizations for the development of

family planning and sports 100 াক

qualification for the post, subject to certain qualification limits.

You can also, like-

Automated Income Tax Preparation Software in Excel for the Andhra Pradesh State Employees for the F.Y.2021-22

50% deduction without eligibility

limit: Grants to funds like PMs Drought Relief Fund, Rajiv Gandhi Foundation,

etc. are eligible for 50 %Diction.

Eligibility limit 50 % deduction:

Donation to a religious organization, family planning and other charities in

addition to donations to local authorities for the purpose 50 % Eligible for

voting, subject to certain eligibility limits.

The eligibility limit refers to 10

% of a taxpayer's total income.

Tax deduction under section 80TTA

The deduction under Section 80TTA

can be claimed by Hindu undivided families and private taxpayers. This allows

the department to deduct Rs 10,000 per annum on interest earned on money

invested in bank savings accounts in the country.

Tax deduction under section 80U

Tax deductions under section 80U

can only be claimed by resident individual taxpayers who are a disability.

Persons certified by the relevant medical authority as persons can claim a

maximum discount of Rs 75,000 per annum. Individuals whose disability is above

80 % maximum exemption of Rs 1.25 lakh,

Tax deduction under section 87A

Maximum discount allowed Rs. 12,500 / - Those whose taxable income is below Rs. 5 lakhs can avail of this facility.

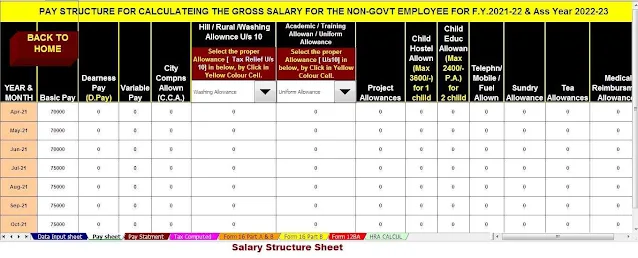

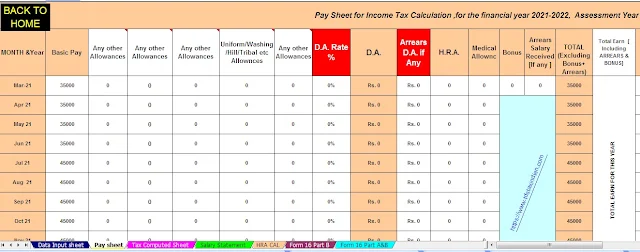

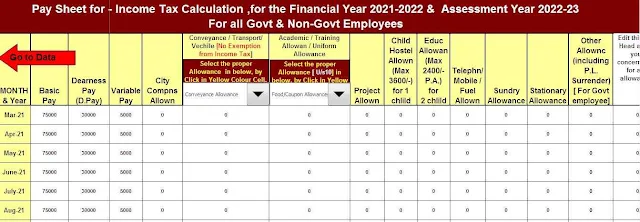

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Section as per Budget 2021

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7) Individual

Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount into the in-words without any Excel Formula