Income

tax allowances, as well as deductions of salaried persons | Salaried persons, constitute a major part of the overall taxpayers of the country and their

contribution to tax collection is significant. Income tax deduction provides

many opportunities for tax saving for the salaried class. With these discounts

and rebates and one can significantly reduce his taxes.

Exemption of allowance

House rent allowance

A salaried

person who has rented accommodation can get HRA (house rent allowance) benefit.

However, if you do not live in rented accommodation and still get an HRA, it

will be taxable. If you cannot submit the rent receipt to your employer as

proof of HRA claim,

You can claim

one of the following as an HRA waiver.

A. Total HRA

received from your employer

B. Rent paid

10% less (basic salary + DA)

C. 40% Salary

for Non-Metros (Basic Salary + DA) and 50% Salary (Basic Salary + DA) for Metros

Standard deduction

In Budget

2018, announced a standard discount amounting to Rs. 40,000 for salaried

employees. It was in place of transport allowance (Rs. 19,200) and medical

compensation (Rs. 15,000). As a result, salaried employees can get an additional

income tax exemption of Rs. 5,800 in FY 2018-19.

The exemption

limit has been increased to Rs 50,000 in the interim budget of 2019.

Children's allowance

The employer

can provide an education allowance for your children as part of your salary. Such

allowances received by the employer for the education of children are tax-free.

However, the

employee can claim the maximum amount. 100 per month or Rs. 1200 per annum.

Discounts are allowed for a maximum of 2 children.

Approved deduction

Sections 80C, 80CCC and 80CCD (1)

Section 80C is

the most popular option for reducing the income tax burden. The following are some of

the investments which are eligible for rebates up to a maximum of Rs. 1.5 lakhs

under Sections 80C, 80CCC and 80CCD (1).

Life insurance

premium

Equity Linked

Savings Scheme (ELSS)

Employees

Provident Fund (EPF)

Annual /

Pension Scheme

Payment of

home loan principal

Tuition fees

for children

Contribute to

PPF account

Sukanya

Samridhi Account

NSC (National

Savings Certificate)

Fixed Deposit

(Tax Savings)

Post office

time deposit

National

Pension Scheme

Medical Expenses and

Insurance Premium (Section 80D)

Section 80D is

a deduction that you can claim for medical expenses. One can save tax on

medical insurance premiums paid for the health of oneself, family and dependent

parents.

Section 80D deduction

limits are:

25,000 for

premium for self/family.

Rs 50,000 for

premium for Rupee Senior Citizen Parents.

In addition, health

checks up to Rs 5,000 are allowed and are covered within the overall range.

Discounts up

to 50,000 are subject to medical expenses incurred by senior citizens (60 years

of age or older) or to senior citizen parents if they are not covered by a

Mediclaim policy.

A taxpayer can

claim a maximum discount of 50,000 including the amount of premium and medical

expenses if he is a senior citizen

(60 years or

older). In addition, if he has paid the medical bills of his senior citizen

parents, he can claim an additional discount of up to Rs. 50,000

Your employer

can pay the premium on your behalf and deduct it from your salary. Such premium

paid is deductible under section 80D.

Another key

tax-saving tool is house building loan interest. Homeowners have the option to

claim money 2 lakh discount for home loan interest for the self-acquired property.

If the home property is abandoned, you can claim a deduction for the entire

interest associated with such a home loan.

In addition to

the above, one can claim the principal component of housing loan repayment as a

rebate under section 80C up to a maximum of Rs 1.5 lakh.

Deduction for loans for

higher studies (Section 80E)

The income tax law

provides a deduction for the interest on education loans. Notable conditions

attached to claiming such deductions are that the loan should have been taken

by the person himself or his wife from a bank or financial institution for

higher studies (in

Grants (Section 80G)

Section 80G of

the Income-tax Act, 1961 offers an income-tax exemption to an appraiser who

donates to charities. This discount varies depending on the recipient

organization, which means that anyone can receive a discount with or without a

50% limit on the amount donated.

Deduction on Savings

Account Interest (Section 80TTA)

Section 80TTA

of the Income-tax Act, 1961 offers a rebate of up to Rs.10,000 on income earned

from interest on savings accounts. This discount is available to individuals

and HUFs. If the bank's interest income is less than INR 10,000, the full

amount will be approved as a deduction.

Home Loan Interest

(Section 80EE)

Section 80EE

entitled homeowners to claim an additional exemption of Rs. 50,000 (Section

24) for the EMI interest component of a home loan.

Feature of this Excel

Utility:-

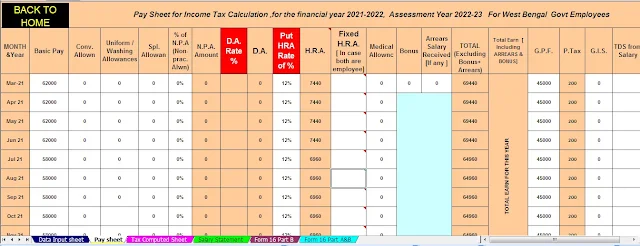

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Section as per Budget 2021

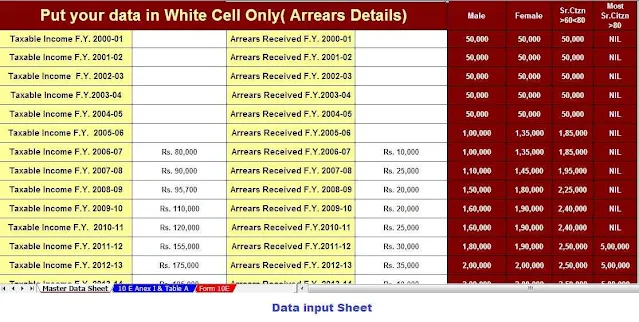

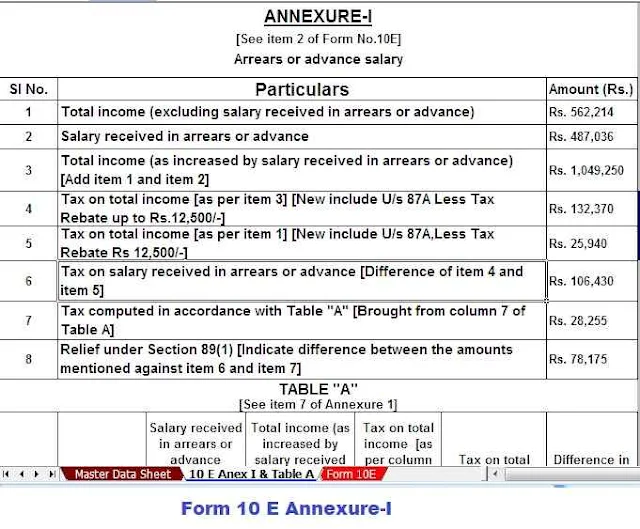

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7) Individual

Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount in to the in-words without any Excel Formula