Finance

Minister Nirmala Sitharaman announced the inclusion of a new clause in the 2020

Union budget, known as 115BAC, in the income tax law. The second 115 BAC,

following fiscal year 2020-21, identifies a new discretionary income tax

structure for Hindu individuals and undivided households (HUF).

What

is Section 115 BAC?

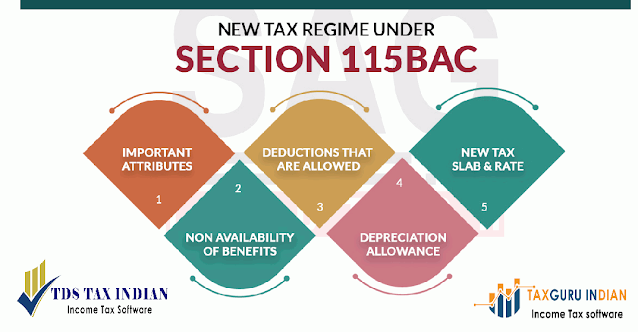

Section

115 BAC is a recently introduced clause in the Income Tax Act, 1961, which

guarantees a new income tax discipline. This alternative tax clause and

discipline was introduced in the 2020 Union Budget and concerns Hindu

individuals and undivided families (HUF). An important component of this new

system is that the slab rate of income tax has been substantially reduced.

However, the new rates come with the cost of various basic income tax

exceptions and exemptions, which are now accessible under the old (existing)

income tax framework. The attached table indicates the new slab tariff referred

to in section 115BAC.

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2021

3)

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount in to the in-words without any Excel Formula