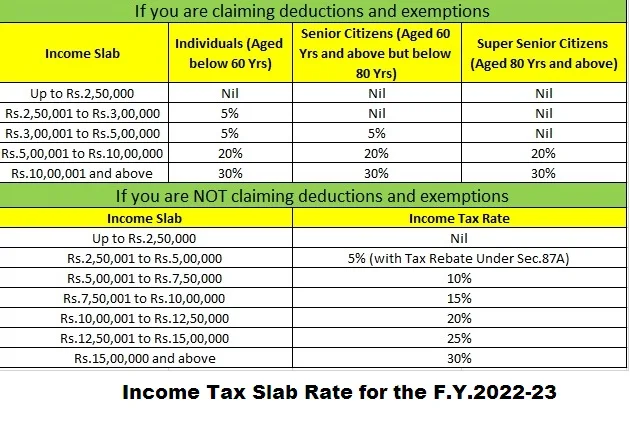

Download Automated Income Tax Calculator All in One for the Govt and Non-Govt (Private) Employees for the F.Y.2021-22|Introduce a new section 115 BAC in the 2020 Budget for the 2020-21 fiscal year. This section 115BAC has an option that allows you to continue with the old tax system with all income tax exemptions as in fiscal year 2021-22 and you can opt for the new tax regime except any income tax exemption as in the previous financial year. power. 2021-22 As clearly indicated in the Budget 2020 U / s 115BAC.

As per budget, the new U /s tax slab is shown under 115BAC which was introduced in the 2021 Budget.

At the same time, it is also clear that according to section 115BAC (New Tax Regime), there is no exemption for the elderly in the new tax plan.

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2021

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

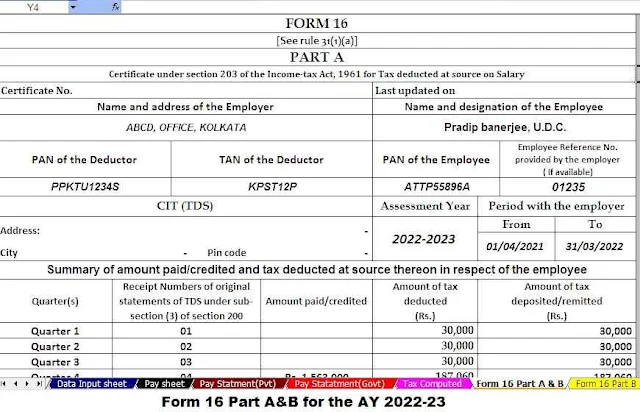

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount in to the in-words without any Excel Formula