Advances or dues received from an employer affect taxes and are reflected in the year of receipt. The exemption under section 89 (1) under the Income Tax Act saves you from the burden of additional tax if you are late in receiving your income.

To claim compensation under this

section, an employee must meet certain conditions. To begin with, Section 89

exemption may be sought on any of the following received during a particular

year:

a) Arrears Salary Received from

previous financial year

b) Advance withdrawal from the

pension fund

c) Free

d) Commuted value of the pension

e) arrears of the family pension

f) Termination from the service

Section 89 (1) - Wage reliefs

The tax is calculated on the total

income of the taxpayer earned or received during the year. The Income Tax Act

allows you to apply for tax relief under section 89 (1) if the assessor has

received a waiver from his "past or early" salary or has received the

family pension in arrears.

Tax liabilities for a taxpayer are

calculated by the income earner during that financial year. This income can

include overdue paid in the current year. Tax rates tend to increase over the

years and in such cases the valuer may have to pay more tax. The Income Tax Act

provides relief to assessors under section 89 (1) in such situations.

Section 89. seek relief under

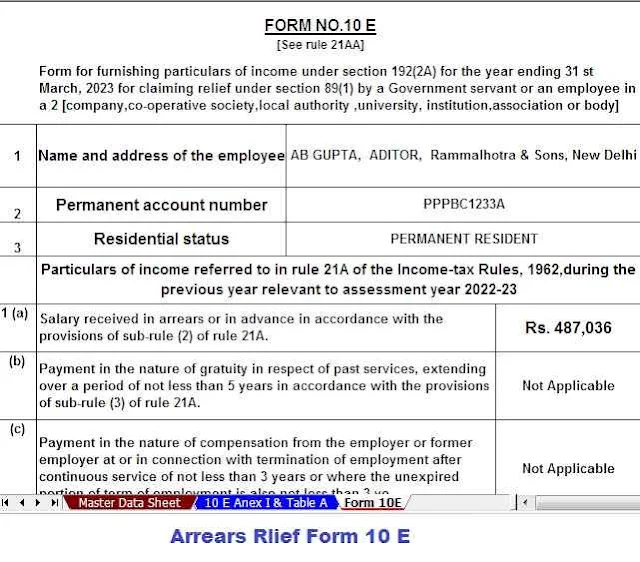

An employee entitled to claim

exemption under Section 89 must submit Form 10E. It must be filed online on the

electronic filing portal of the Revenue Agency. Pursuant to Article 89,

paragraph 1, the tax relief is provided by recalculating the tax relating to

the year in which the arrears are received and the year from which the arrears

are due; And the taxes are adjusted in the year they were due.

Note: Form 10E must be submitted

before filing the tax return.

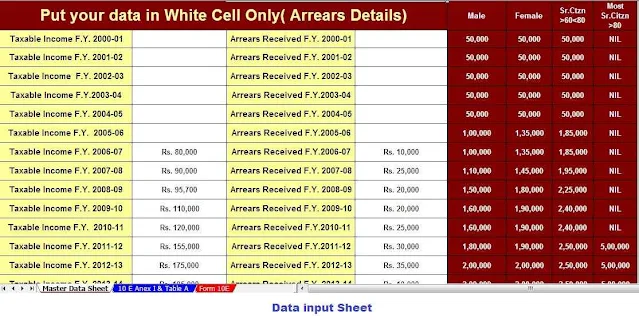

Form 10E. Characteristics of Form 10E contains details regarding an employee's total income and arrears received.

1. The submission of Form 10E is simple and completely digital, available on the electronic portal of the Department of Income Taxes. If you are a new user all you have to do is visit the portal and log into your account or create an account

2. Form 10E is available in the

Income Tax Forms section of the portal. Fill out the form carefully and take

care of the attachments provided when filling out the form.

3. You must select and fill in the

relevant annex (Annex I is for arrears, Annex II for gratuity and Annex III for

compensation received in the event of termination of employment).

How to calculate the tax relief

under section 89 (1) on wage arrears?

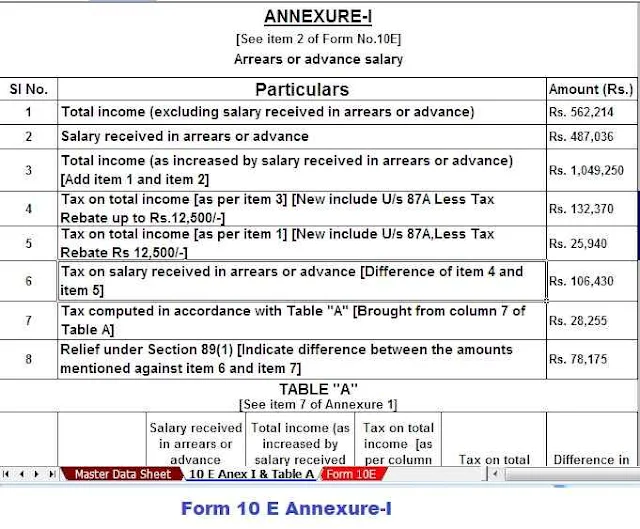

1) Calculate the tax payable on

total income, including excess wages, arrears or allowances, in the year in

which it is received.

2) Calculate the tax due on total

income, excluding any additional remuneration in the year in which it is

received.

3) Subtract the calculation

obtained from step 2 from the total salary calculation from step 1.

4) Calculate the total income tax,

excluding arrears, for the year to which the arrears refer.

5) Calculate the tax due on the

total income, including arrears, of the year to which the arrears refer.

6) Now deduct between step 4 and

step 5 and find the difference.

7) The amount exceeding Step 6 at

Step 3 is the tax relief that will be granted to you, while no relief will be

granted if the amount at Stage 6 exceeds the amount at Step 3.

Five things to remember as you

apply for relief on arrears

1. Form 10E must be submitted online. All taxpayers who applied for relief in the previous year but did not submit Form 10E will be notified by the Income Tax Department of non-compliance, however, your return will not be available until you submit the form. it will not be processed.

2. Wages are generally taxable on

due date or upon receipt, but in the event of default, they are usually

declared from a retroactive date, which is why they cannot be taxed on due

date.

3. Submit Form 10E before submitting your ITR. When it comes to choosing the assessment year for arrears, you need to choose the assessment year in which the arrears are received.