Section 80U - Tax Exemption for Disable Person | There are certain sections of the Income Tax Act of India that offer tax advantages to individuals if they or any member of their family has a disability.

Section 80U provides tax benefits if a person is a victim of a disability. This article focuses on discussing the tax benefits available in section 80U.

Who can apply for an exemption under section 80U?

A taxpayer who has been certified that he is a disabled person by any medical authorities can claim tax benefits under section 80U. For the purposes of this section, a disabled person is defined as having at least 40 percent of the disability certified by the health authorities.

For the purposes of this section, a disability is defined as any of the following:

blindness

low vision

leprosy treatment

Hearing problem

motor disability

mental delay

mental disease

This section provides a definition of severe disability which refers to a condition in which the disability is 80% or more. Severe disabilities include multiple disabilities, autism, and cerebral palsy.

Amount of exemption under 80U

The 75,000 exemption is allowed for people with disabilities and Rs. 1.25,000 exemption for people with severe disabilities.

Obligation to Apply for Exemption Under Section 80U

Form 10-IA does not require any documents other than a certificate of disability attested by a recognized medical authority. There is no need to invoice for subsequent treatment or other similar expenses.

To submit an application under this section, you must submit a medical certificate certifying your disability along with your section 139 income tax return for the relevant A.Y.

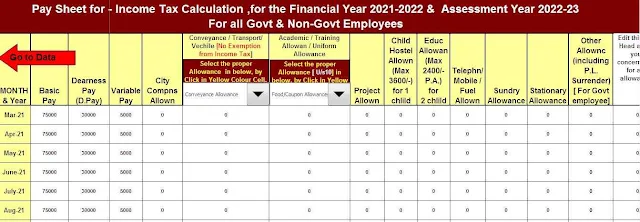

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

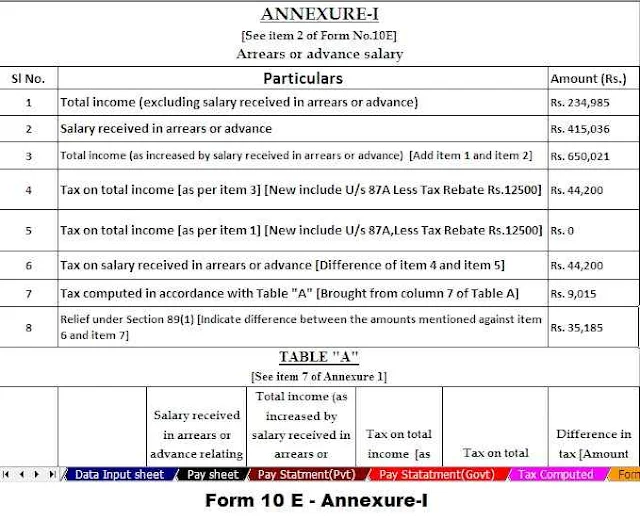

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

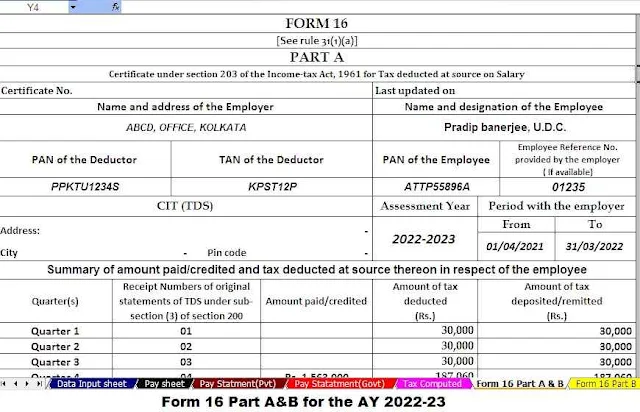

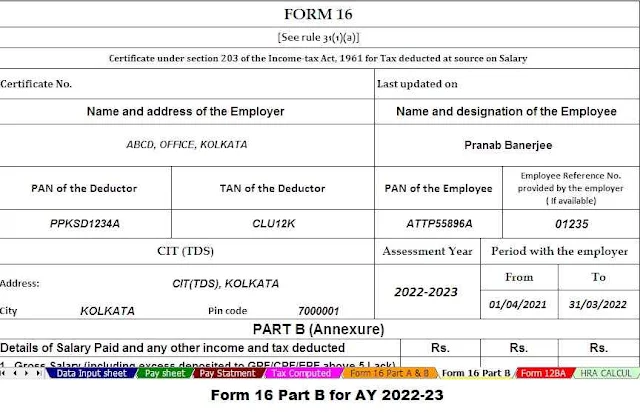

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22

Once the Invalidity Assessment Certificate has expired, this deduction can be requested in the year the certificate expires. However, to apply for the benefit under 80U, a new certificate will be required from next year onwards.

The certificate can be obtained from medical authorities, either a neurologist with a Doctor of Medicine (MD) in neurology (in children, equivalent to a pediatric neurologist) or a civil surgeon

Note: If the invalidity is temporary and requires re-evaluation after a certain period, the validity of the certificate starts from the year of assessment with the year in which it was issued and the related year of assessment ends with the year of expiry. of the Certificate.

Difference between section 80U and section 80DD

Section 80DD provides for the tax deduction for disabled people and the relatives of taxpayers, while section 80U provides for the tax deduction for the disabled person himself.

Section 80DD is applicable if a taxpayer pays a certain amount as an insurance premium for the assistance of his or her dependent disabled person. In section 80DD, the deduction limit is the same as in section 80U. Here, dependent refers to siblings, parents, spouses, children, or members of a Hindu family.

Frequent questions

What certificate do I need to provide to apply for a deduction under section 80U?

The person must provide a copy of a medical certificate under section 80U along with the tax return.

What is the amount of the deduction under section 80U?

The amount of the exemption available for a disabled person is Rs 75,000. In case of 80% disability, the exemption is Rs 1.25.000.

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2021

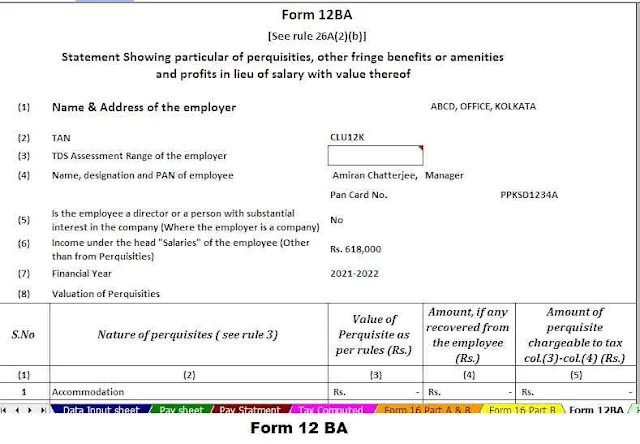

3)

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount in to the in-words without any Excel Formula