The government has not changed the basic exemption limit of 2.50 lakhs for a while as the government

does not want people to step out of the tax net and be exempt from filing the ITR. However, at the

same time, successive governments have proposed tax exemptions for taxpayers up to certain income

limits. Tax exemption is currently available for those whose income does not exceed Rs. 5 lakh. This

exemption is available in section 87A.

Section 87A was introduced into the

Finance Act 2003 which was amended from time to time. Currently, an individual

taxpayer, resident in

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

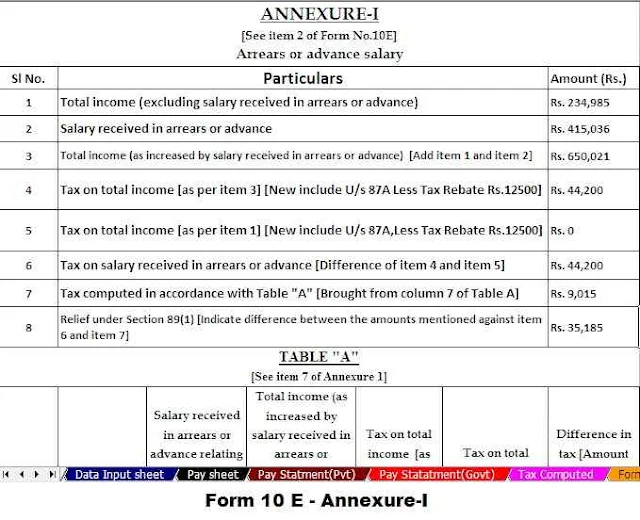

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

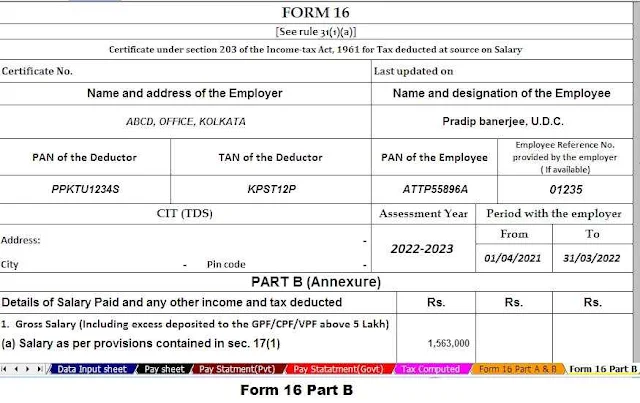

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

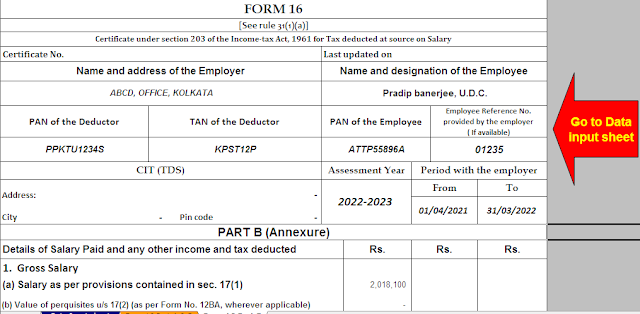

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22

No one and everyone can take advantage of this exemption. Although the basic exemption limit of Rs. 2.50 lakh is applicable to all natural persons and HUF, resident or non-resident, but the exemption under section 87A is only available to a natural person and also only if a resident is for income tax purposes. Therefore not all HUF and non-resident persons are entitled to this exemption.

What income must be considered for the eligibility criteria

There is always this confusion in the minds of taxpayers as to what income should be considered in order to qualify for this exemption. In the first place, the income to be considered for this purpose is the income that is received after deducting all the old anticipated losses with the current year's income. Likewise, from the net profit after such loss adjustment, you must deduct all available deductions under the various sections of chapter VI A. Chapter VI A includes the deduction for various items such as Section 80C (for LIP, EPF, PPF, ELSS, tuition, home loan repayment etc.), Section 80 CCD (NPS), Section 80D (Health Insurance), 80 G (donations) and 80 TTA and 80 TTB (bank interest).

YOU MAY REQUIRE THE BELOW GIVEN FORM 16 FOR THE FINANCIAL YEAR 2021-22

Or

Or

Or