Standard Deduction U/s 16(ia) | Section 16 of the Income Tax Act 1961 provides for a

deduction from income charged to tax under the heading “salaries”. Provides deductions for

the standard deduction, leisure allowance, and occupational tax. Through this deduction, a

salaried taxpayer can reduce his or her taxable salary income.

Moreover,

with recent modifications to the standard deduction, the interest of this

section has been extended to a higher amount. Moreover, there is no hassle in

submitting bills for travel and medical treatment which makes it easy to claim

them.

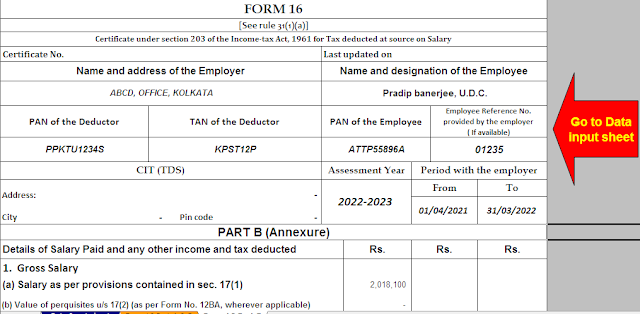

Download and Preparation One by One Form 16 Part A&B

and Part B for the Financial Year 2021-22

In

this article, we'll cover each of the deductions in Section 16 along with

account-specific illustrations.

U/s 16 (IA) Salary Deduction of Rs. 50,000/-

The

standard deduction is allowed under Section 16(ia) of the Income Tax Act. Replace

the standard deduction for transportation allowance of Rs 19,200 and medical reimbursement for Rs 15,000. In Budget - Presented by Finance Minister Jaitley

for 2018.

Budget

- 2018 provided for a standard deduction of Rs 40,000 in lieu of transport

allowance and medical reimbursement. This deduction of Rs 40,000 does not

require the taxpayer to provide any invoice or proof of expenses. It provides for

a fixed discount of Rs 40,000.

Download and Preparation One by One Form 16 Part B for the Financial Year 2021-22

Later

in the 2019 Provisional Budget, the discount amount of Rs 40,000 was increased

to Rs 50,000. Hence, the discount for F.Y 2018-2019 was Rs 40,000 and from FY

2019-20 the discount would be Rs 50,000.

The

standard discount is also available for retirees. A clarification has been

issued by the Central Bank of

The

deduction amount available under Section 16 for the standard deduction is:

Salary

received

Or

50,000

rupees

Whichever

is less?

Download and Preparation at a time 50 Employees Form 16 Part B for the Financial Year 2021-22

Details

F.Y2018-19 F.Y2019-20

(Rs.)

From F.Y2019-20 From F.Y2020-21 (Rs.)

Base

salary + design allowance 800,000 800,000

Other

taxable benefits 100,000 100,000

Gross

wages 900,000

Standard

deduction 40000

Total

income 860,000

Other

deductions 200000

Taxable

income 660000

Income

tax 44500

Income

Tax Savings - 2000

Remember

that the standard deduction is not related to the u/s 80C deduction or any

other part of the VIA chapter.

Interpretation

of the Standard Deduction Calculation

Section

16(ii) Entertainment allowance

Entertainment

allowance is first included in wage income and then deducted based on several

criteria. The allowance must be an allowance specifically provided by the

employer to the taxpayer as an entertainment allowance.

Entertainment

allowance for government employees

The

minimum deduction for central government and state employees is:

20%

of the basic salary

5000

rupees

Amount

Provided as Entertainment Allowance in Fiscal Year

Download and Preparation at a time 50 Employees Form 16 Part

A&B for the Financial Year 2021-22

To qualify for relief, the taxpayer must ensure that the following details are

met:

Salary

must not include any allowances, employer benefits, or other benefits received.

Essentially, wages should be the gross amount received, excluding any other

benefits.

Ignore

the actual amount spent on entertainment benefits received from the employer.

Entertainment

allowance for a non-government employee

The

hospitality deduction is not available to non-government employees. Only

employees of the central or state government are eligible for the deduction. In

addition, employees of local governments and public corporations are not

entitled to the deduction.

Demonstration

of calculating the entertainment allowance deduction

Size

Details

Salary

(excluding other allowances, benefits and privileges) 120000

Entertainment

allowance received per month 1000

Entertainment

allowance for the full fiscal year 12,000

Available

withdrawal amount:

20%

of salary (а) 24000

5000

rupees (b) 5000

The

actual amount received (c) 12000

The

amount allowed as a deduction (minimum a, b and c) is 5000

Download and Preparation at a time 100 Employees Form 16 Part B for the Financial Year 2021-22

Occupational or employment tax under Section 16(iii)

A

deduction is allowed for payroll tax under section 16iii of the Income Tax Act.

The amount paid by the taxpayer in respect of work tax or occupational tax is

allowed as a deduction in accordance with section 16. Here, work tax is

provided for in (2) of section 276 of the Constitution.

When

calculating professional tax deductions, the following points should be

considered:

The

taxpayer must claim the deduction only in the fiscal year in which the

professional tax is paid to the government.

Tax

paid by an employer on behalf of an employee is also eligible for a deduction.

Here, the amount paid by the employer as an occupational tax will be included

in the first place as a mandatory condition in the total salary. Later, an

equal amount will be allowed as a deduction under section 16.

Under section 16 of the Income Tax Law, there

is no upper or lower deduction limit.

However, no state government may charge more than 2500 rupees per year

as professional tax. Only tax paid is deductible, not interest on late payment

or fees for late or non-payment of professional tax.

Download and Preparation at a time 100 Employees Form 16 Part

A&B for the Financial Year 2021-22