Income Tax Section 80CCD | The government imposes mandatory fiscal taxes or fees on the income of

taxpayers, which is the source of government income for financing various government expenditures.

This fee or financial charge is known as a tax. There are two types of taxes. The tax levied on corporate

or individual income is a direct tax, while the tax levied on prices of goods and services is an indirect

tax. Punishable for non-payment or tax evasion. Every citizen has a moral responsibility to pay taxes

on time.

The Government of India has enacted several provisions

under the Income Tax Act 1961 which allow deduction of investments in some

schemes. One such provision is Section 80CCD.

Section 80C is a provision of the Income Tax Act 1961

that allows a maximum deduction of 1.50 lakh for investments made in certain

schemes. Section 80CCD allows you to deduct investments in the NPS (National

Retirement Scheme).

What is 80CCD?

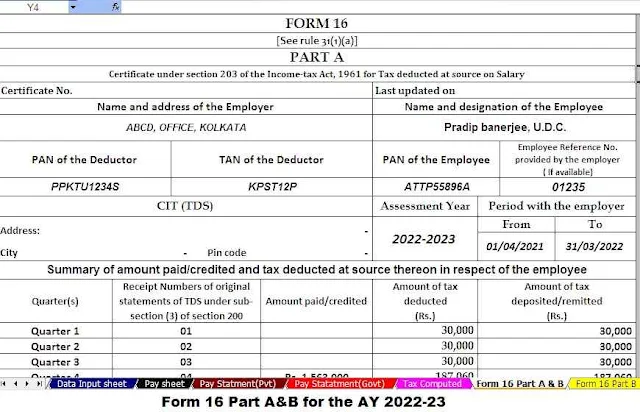

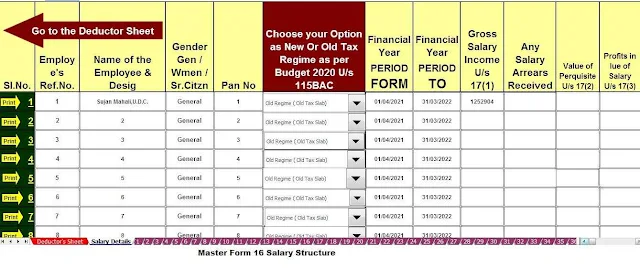

You may

also like:- Autofill Income Tax Form

16 Part A&B for the F.Y.2021-22 [This

Excel Utility can prepare One by One Form 16 Part A&B]

Section 80CCD of the Income Tax Code is a provision

that allows you to deduct contributions made to the NPS. NPS is a notified

pension scheme provided by the Central Government exclusively to the employees

of the Central Government (excluding the Armed Forces) and effective from 1st

January 2004. This scheme was subsequently made available to all citizens of

A contribution made to the N.P.S. by the employee and

employer qualifies for a deduction under Section 80CCD of the Income Tax Act.

The maximum deduction allowed under section is 1.50 lakh including the

deductions allowed under section 80C.

What is NPS?

The National Pension Scheme (NPS), is a new pension

scheme introduced by the Central Government to all citizens of

This system has become a boon in disguise for workers

in the private sector, as they are not entitled to any pension after

retirement. Any Indian national between the ages of 18 and 60 is eligible to

invest in a pension scheme.

There are two types of NPS accounts: a Tier I account

and a Tier II account.

Level 1 Account: Since this account is designed to

create a pool that can be used after retirement, the full amount cannot be

withdrawn at the end of the term. Only 60% of the amount can be withdrawn, and

40% must be invested in an annuity plan without fail in order to receive a

monthly pension.

You may

also like:- Autofill Income Tax Form16 Part B for the F.Y.2021-22 [This Excel Utility can

prepare One by One Form 16 Part B]

Tier II Account: A Tier II account can only be opened

if you have a Tier I account with voluntary Tier-II investments. These

investments are provided to meet short and medium-term needs. There are no

limits for withdrawals from this account.

NPS Highlights

The central government introduced the National Pension

System (NPS) with the aim of facilitating the establishment of a lifelong body

after retirement. The features of this scheme are:

• All Indian nationals between the ages of 18 and 60

are eligible to invest in this scheme.

• An employee in the central government is required to

invest in this system

• For others who are not central government employees,

investment in this system is voluntary.

• The minimum deposit must be 500 each month

• Investment in this system must continue until the

person reaches the age of sixty.

• You have the option to choose from different types

of investments such as fixed income instruments, equity funds and government

securities, but equity fund investments are limited to 50%.

• The investments are linked to the market and the

cost of managing the fund is nominal.

• Upon reaching the age of 60, it is allowed to seize

up to 60% of the hull. 40% of housing must be transferred to a pension plan

without fail.

• There is also a deferment option, but 80% of housing

must be converted to an annuity plan.

• 25% of the total amount is allowed to be used to

fund certain expenses such as medical expenses for you and your family,

education or child marriage expenses, home purchase, etc.

• The Central Government Pension Scheme and the State

Government Pension Scheme are the two main schemes for NIPs. However, since

2009, employees of other organizations can also make voluntary contributions to

the pension system.

You may

also like:- Autofill Income Tax Form

16 Part A&B for the F.Y.2021-22 [This

Excel Utility can prepare at a time 50 Form 16 Part A&B]

Categories within 80CCD: 80CCD(1), 80CCD(1B), 80CCD(2)

Prior to the 2015 Union Budget, the maximum discount

allowed for investment in NPS was Rs 1 lakh. In an effort to encourage citizens

to invest in the pension system, the 2015 budget raised the contribution rate

to 1.50 lakh. In addition, subsection 80CCD (1B) was added to allow an

additional deduction of 50,000 for investments made by each individual taxpayer

in the pension system.

This deduction is in addition to the 1.50 lakh

deduction allowed under Section 80C of the Income Tax Act 1961.

There are other subsections of Section 80CCD that

allow taxpayers to invest in NPS. Details of a contribution that is a

contribution from an employer or business owner must be included in the IT

reports. The transaction report must be submitted as evidence in order to

obtain a tax credit.

You may

also like:- Autofill Income Tax Form16 Part B for the F.Y.2021-22 [This Excel Utility can

prepare At a time 50 Employees Form 16 Part B]

Section 80CCD (1)

Salaried individuals (a government employee or

employee of a non-governmental department organization) and non-paid

individuals who invest in NPS are eligible for a tax deduction under Section

80CCD (1). Details of benefits available under Section 80CCD (1) are provided

below:

• The maximum tax deduction under this section is Rs

1.50 lakh, including deductions permitted under section 80C.

• The maximum deduction that employees may claim under

this section is 10% of their annual salary (base + DA).

• Non-working, ie self-employed workers may qualify

for a 10% deduction from gross income for a given year. However, this limit has

been raised to 20% from the 2017-2018 fiscal year.

An employer may contribute to the NPS in addition to

contributions to the EPF and PPF. This deposit can be made in three ways:

• The employer's contribution can be equal to the

employee's contribution

• The employer's contribution may be higher or lower

than the employee's.

• The employer can make a contribution to the fund on

behalf of the employee

Both the employee and the employer are entitled to

benefits under Section 80CCD (2).

The business owner may record this contribution as a

business expense on the income statement and claim a tax deduction. For these

employer contributions to the NPS, the employee may qualify for a tax credit

under Section 80CCD (2) of the Income Tax Act 1961.

Section 80CCD (1B) of the Income Tax Act 1961 was

introduced primarily to encourage investment under the National Pension Scheme.

Under this section, an additional Rs.50,000 tax credit is available for

investments made by both employees and non-employees. The tax incentives available

under the scheme are listed below:

• This section was introduced as part of the

amendments to the Federation budget for the year 2015.

• Additional Tax Credit of Rs 50,000 for investments

in the pension plans is available in this section.

• Both self-employed and employed persons are eligible

for a tax credit under this section.

• The additional discount allowed is in addition to

the discount allowed under Section 80CCD (1).

You may also like:- Autofill

Income Tax Form 16 Part A&B for the F.Y.2021-22 [This Excel Utility can prepare At a time 100 Employees Form

16 Part A&B

This benefits taxpayers who fall under a higher tax

slab. There is a tax savings advantage of Rs 15,000 for taxpayers under the 30

per cent slab and Rs 10,000 for those under the 20 per cent slab on an

investment of Rs 50,000 in NPS.

Suppose an individual has invested up to Rs 1,50,000

in other specified schemes included in Section 80c other than a contribution of

Rs 50,000 to NPS, then an additional deduction of Rs 50,000 may be claimed

under Section 80CCD (1B), which in addition to a deduction of 1.50 lakh claimed

under section 80C.

Eligibility for an 80CCD tax credit

Eligibility for tax deductions under 80CCD as set out

below:

• An employee may qualify for a deduction under 80CCD

up to 10% of wages (Basic + DA) and a self-employed person may qualify for a

deduction of up to 10% of gross annual income. The maximum claim amount for

80CCD(1) and 80CCD(2) is 1.50 lakh.

• Under section 80CCD of the Income Tax Act, a 1961

contribution made by an employee as well as a self-employed person to the NPS

qualifies for a tax deduction. The employer's contribution to the NPS on behalf

of the employee is also deductible under oath.

• Section 80CCD (1B) allows an additional deduction of

up to $50,000 for any taxpayer's own contribution to the NPS. That being said,

the total deduction allowed under section 80CCD is up to 2 lakhs.

• You can claim these deductions when you file your

income tax return

• Hindu Undivided Families (HUF) are not eligible for

the deduction under Section 80CCD.

• Residents and non-residents of

• If tax deductions are claimed under 80CCD, the same

cannot be claimed under 80C.

Download and prepare at a time 100 Employees Form 16 Part B for the Financial Year 2021-22