Disability Tax Exemption U/s 80U| There

are certain sections in the income tax laws of

provide tax benefits to people if they or any of their family members suffer from a certain disability.

Section 80U offers tax credits if

an individual has a disability and Section 80DD offers tax credits if the

taxpayer's dependent family member has a disability. This article is about a

discussion of the tax credits available in section 80U.

Who Can Apply for a Section 80U

Deduction

A resident who has been certified

as disabled by a medical authority is eligible for a tax credit under section

80U. For the purposes of this section, a person with a disability of at least

40% as established by the health authorities is considered disabled.

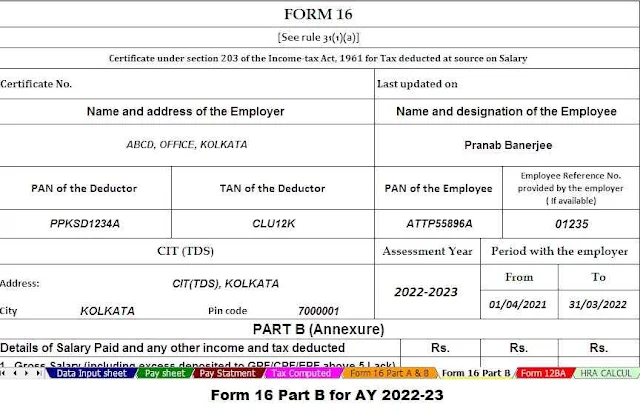

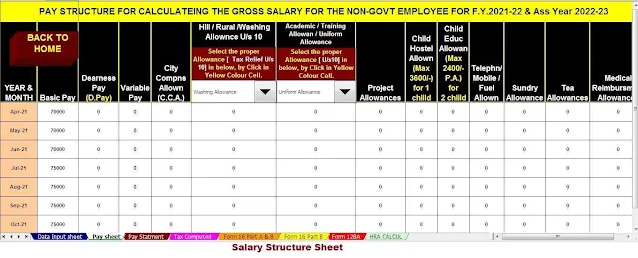

Download and prepare at a time 50 Employees Form16 Part B for the Financial Year 2021-22

For the purposes of this section,

disability is defined as one of the following:

• Blindness

• Poor eyesight

• Healing from leprosy

• Hearing problem

• Motor disability

• Mental delay

• Mental disease

The section also defines a major

disability, which refers to a condition where the disability is 80% or more.

Severe disability also includes multiple disabilities, autism and cerebral

palsy.

Quantum deduction up to 80U

Deduct Rs. 75,000 is allowed for

people with disabilities, Rs. 1.25.000 deductions for people with severe disabilities.

Section 80U Requirements for

Requesting Deduction

No documentation other than a

certificate of disability issued by a recognized medical institution on Form10-IA is required. There is no need to submit invoices for expenses incurred in

connection with treatment or other similar expenses.

To apply under this section, you

must submit a medical certificate certifying your disability along with your

Section 139 tax return for the applicable. In the event that the certificate of

invalidity has expired, you can still request these deductions in the year the

certificate expires.

Download and prepare at a time 50 Employees

Form 16 Part A&B for the Financial Year 2021-22

However, a new certificate will be

required next year to receive the benefits. Certifications can be obtained from

medical authorities, which can be a neurologist with a doctorate of medicine

(MD) in neurology (in the case of children, a pediatric neurologist with an

equivalent degree) or a civil surgeon or medical director of a hospital public.

Note. If the invalidity is

temporary and requires re-evaluation after a certain period, the certificate

will start in the assessment year corresponding to the fiscal year in which it

was issued and will end in the assessment year corresponding to the fiscal year

in which the certificate expires.

Difference between 80U partition

and 80DD partition

Section 80DD provides tax credits

to family members and relatives of a taxpayer with a disability, while Section

80U provides tax credits to the taxpayer with a disability.

Section 80DD applies if a taxpayer pays a certain amount as an insurance premium for the care of a dependent person with a disability. Under section 80DD, the deduction limits are the same as in section 80U. Here dependent refers to siblings, parents, spouse, children, or a member of the same Hindu family as the taxpayer.