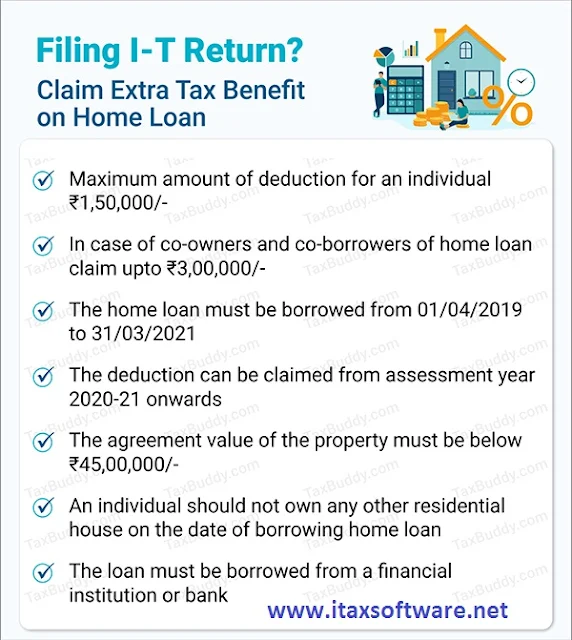

Buying a home with a mortgage has some tax advantages in the form of a deduction of interest paid on the mortgage and repayment of the principal on the mortgage. In addition to this, starting from the fiscal year 2021-22, or from the assessment year 2022-23, you can also save on taxes through an additional deduction of Rs 1.50.000 / -.

This deduction runs from this evaluation year (I-T return must be filed this year). It can be claimed for the term of the mortgage loan, provided the full deduction under this provision does not exceed Rs 1.50,000 / -.

You may also like- Automatic Income Tax Master of Form 16 Part B for the F.Y.2021-22[This Excel Utility prepare at a time 50 Employees Form 16]

This deduction is not available to all homebuyers, only to those who purchase affordable housing. This is an additional deduction in addition to the existing home-ownership income deduction. This deduction should not be claimed on home-ownership- income, but on gross gross income itself.

What is u / s 80EEA deduction?

• This additional deduction is available in connection with the repayment of interest on a home loan borrowed from a financial institution and banks.

• The home-ownership interest deduction is available for loans borrowed from friends and family, but not for this deduction. In this case, the loan must be borrowed from a financial institution or bank.

• A similar deduction is also available at Rs 50,000 / -80EE under the Income Tax Act but is only available if you took out a mortgage in the 2016-17 financial year. If you have taken advantage of u / s 80EE deduction, or if you are eligible to take advantage of this deduction, you are not eligible to request the deduction of Rs 1.50.000 / - u / s80EEA.

You may also like- Automatic

Income Tax Master of Form 16 Part A&B for the F.Y.2021-22[This Excel Utility prepare at a time 50 Employees Form 16

Part A&B]

Conditions for obtaining a

deduction u / s 80EEA

• This deduction is only available

for individuals and NOT for HUF or companies.

• The price of the house purchased

under the contract must not exceed 45.00.000 rupees / -

• The house must be financed with a

mortgage

• This mortgage loan must be

borrowed in the 2019-20 or 2020-21 financial year (the date of the sales

contract does not matter)

• As of the date this mortgage is

approved, you must not own any other residential buildings.

• This deduction can be requested

in the fiscal year 2020-2021 and in the following fiscal years.

• The amount for which this deduction is requested cannot be claimed as a deduction from any other section, eg. on a mortgage loan if you have a total interest payment of Rs 200,000 / - and have claimed the same amount as a home-ownership income deduction under clause 24 of the Income Tax Act, again, not you can request the same amount as u / s 80EEA deduction. However, if you have an interest payment of Rs. claimed as a deduction u / s 80EEA.

Income from home-ownership and

deduction U / s 80EEA

• This deduction should be deducted

from total gross income, not home-ownership income.

• The u / s 24 interest deduction

must be deducted from home-ownership income.

• If the full amount of interest

paid is not used when requesting a deduction under section 24 of the law, you

can claim the unused portion under section 80EEA.

• If you own a house in co-ownership and both co-owners have taken out a mortgage, both co-owners can independently request a deduction up to a limit of Rs 1.50.000 / -

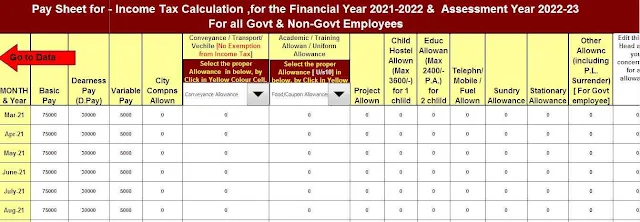

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

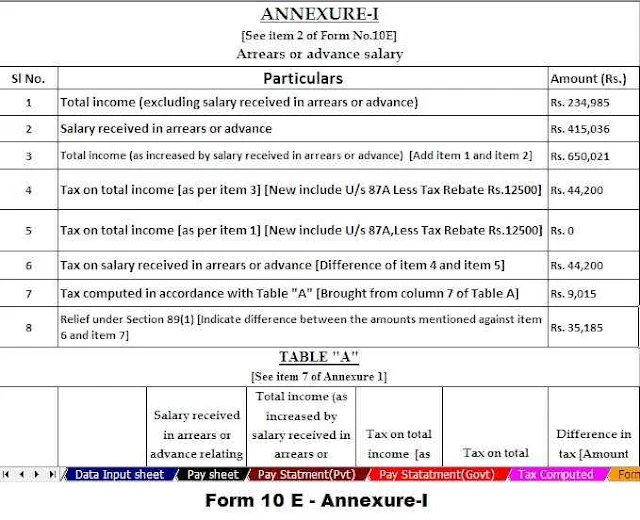

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

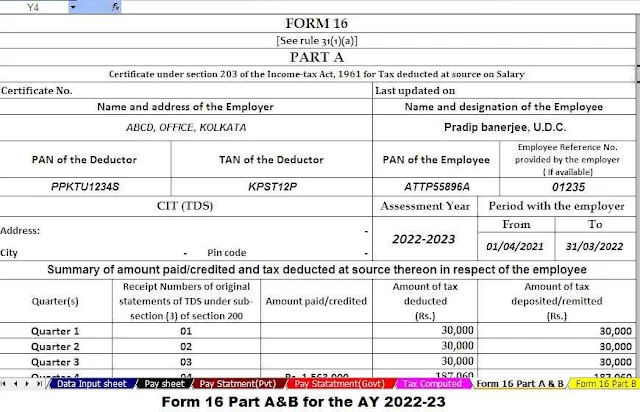

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

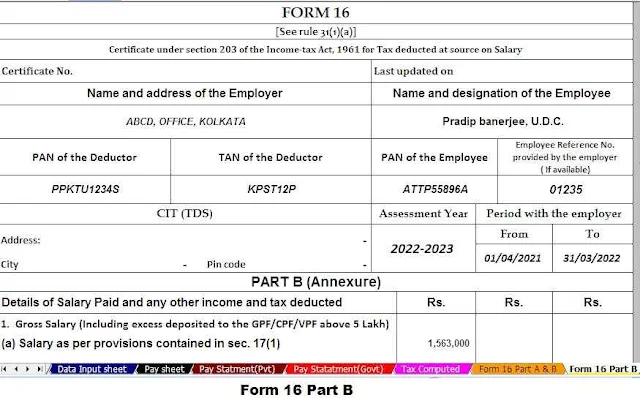

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23