Income Tax Section 16 of the Income Tax Act 1961 provides for a deduction from taxable income

under the wage line. Provides deductions for the standard deduction, entertainment allowance, and

labour tax. With this deduction, the taxpayer can reduce the taxable wage income that is subject to tax.

Also, with the recent changes to

the flat-rate deduction, the benefit under this section extends to a larger

amount. Plus, there's no problem providing travel and medical expenses, which

makes it pretty straightforward.

In this article, we will look at

each of the deductions in Section 16 along with the illustrations of the

calculation.

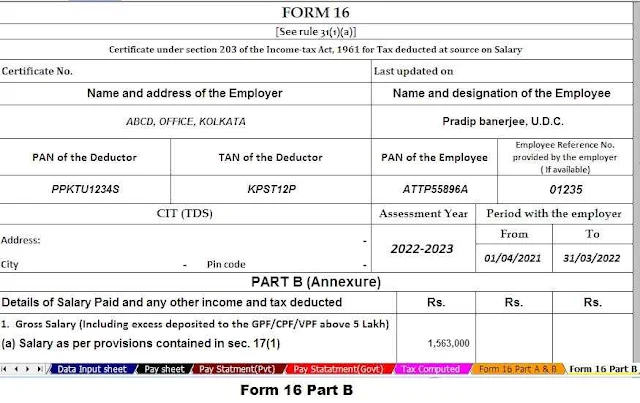

You may also like- Automated Income Tax Form 16 Part B for the Financial Year 2021-22[This Excel Utility can prepare at a time 50 Employees Form

16 Part B]

Standard pay deduction under

section 16 (ia)

A standard deduction is allowed

under section 16ia of the Income Tax Act. The standard deduction replaced the

transportation allowance of Rs 19,200 and the medical reimbursement of Rs

15,000. The 2018 budget, it was introduced by our finance minister, Jaitley.

The 2018 budget includes a standard

deduction of Rs 40,000 in lieu of travel and medical expenses. This deduction

of Rs 40,000 does not require the taxpayer to submit invoices or proof of

expense. It provides for a fixed deduction of Rs 40,000.

Subsequently, in the provisional

budget for 2019, the deduction was increased from Rs 40,000 to Rs 50,000.

Therefore, the deduction for the 2018-2019 financial year was Rs 40,000 and

from the 2019-20 financial year, the deduction will be Rs 50,000.

The ordinary deduction is also

available for retirees. The CDTC has issued a clarification clarifying the

applicability of the standard deduction to retirees. The pension received by

the taxpayer from his former employer will be taxed under "salary".

Since the pension received is taxed in the payroll section, the deduction will

also be available to retirees under section 16.

You may also like- Automated

Income Tax Form 16 Part A&B for the Financial Year 2021-22[This Excel Utility can prepare at a time 50 Employees Form

16 Part A&B]

The maximum deduction will be available

U/s 16 for the standard deduction is:

Salary received

OR

50000 rupees

Whatever it is below

Remember that the standard

deduction has nothing to do with u / s 80C deduction or any other section of

the EIA chapter.

Illustration for the calculation of

the standard deduction

Entertainment allowance under

Section 16 (ii)

Entertainment allowance is first

included in wage income and then deducted according to various criteria. The

allowance must be an allowance specifically granted by the employer to the

taxpayer as an entertainment allowance.

Entertainment allowance for

government employees

For central and state government

employees, the available deduction is the lower of the following:

20% of the basic salary

5000 rupees

Amount provided as an entertainment allowance in the fiscal year

You may also like- Automated Income Tax Form 16 Part B for the Financial Year 2021-22[This Excel Utility can prepare at a time 100 Employees Form

16 Part B]

To determine the amount of the

allowance, the taxpayer must ensure that the following conditions are met:

The salary must not include any

other allowances, employer benefits, or privileges received. Basically, the

salary should be the gross amount received with no other benefits.

Never include the actual amount

spent in the entertainment allowance received by the employer.

Entertainment allowance for a

non-state employee

The entertainment allowance

deduction is not available for non-state employees. Only central or state

government employees are eligible for the deduction. Furthermore, employees of

local and public bodies are not entitled to the deduction.

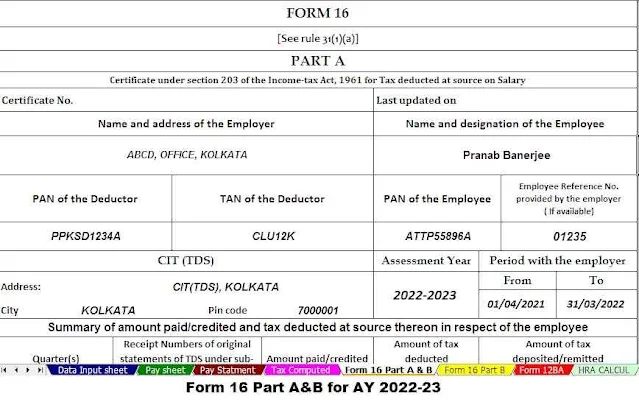

You may also like- Automated

Income Tax Form 16 Part A&B for the Financial Year 2021-22[This Excel Utility can prepare at a time 100 Employees Form

16 Part A&B]

Employee tax under Section 16 (iii)

An employee's tax deduction is

allowed under section 16iii of the Income Tax Act. The amount paid by the

taxpayer for the labour tax or the professional tax is allowed as a deduction

pursuant to article 16. Here, the labour tax is provided for by section 276,

paragraph 2, of the Constitution.

When calculating professional tax

deductions, the following points should be taken into account:

The taxpayer must request the

deduction only in the fiscal year in which the professional tax is actually

paid to the State.

Tax paid by the employer on behalf

of an employee is also deductible. In this case, the amount paid by the

employer as labour tax will first be included as a mandatory condition in the

total salary. Thereafter, an equal amount will be allowed as a deduction under

section 16.

Under Section 16 of the Income Tax Act, there is no upper or lower deduction limit. The deduction depends exclusively on the actual amount of the business tax. However, the government of any state cannot charge more than 2,500 rupees per year as a business tax. Only tax paid is deductible, not interest or penalties for late or non-payment of labour tax.

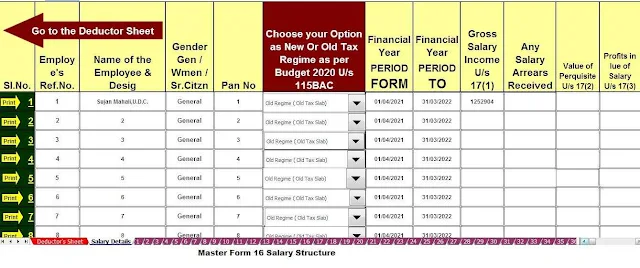

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2022

3)

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10)

Automatic Convert the amount into the in-words without any Excel Formula