What are the tax benefits of a home loan? Did you know that the most common form of tax benefit is a

tax deduction? Tax laws that allow you to deduct taxes to meet certain eligibility requirements are tax

benefits. As a professional, you need to do tax planning every year. You should make wise investments

as your income increases to reduce your tax burden. There are many tax-saving investments, and

among them, home loans are long-term purchases, which attract a tax deduction for the interest earned

on them.

Get a home loan to fulfil your

dream of buying a home, and also to save on taxes, which you pay at the end of

the year. The Indian government encourages its citizens to buy houses by

offering tax advantages on their home loans. You are eligible if you take out a

home loan for the purchase or construction of a home and, in the case of

construction, it must be completed within 5 years.

Tax breaks for home loans in 2022

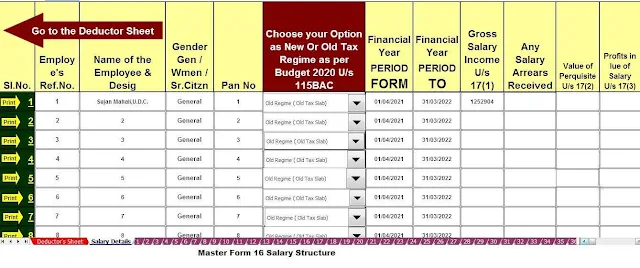

Download One by One Preparation Excel Based Software Form 16 Part B for the F.Y.2021-22

With the additional tax deductions

on home loans announced by the finance ministers union in the previous

financial statements, applicable for the 2021-22 financial year, you can enjoy

tax breaks from the old tax regime through exemptions and deductions. The tax

benefits of a home loan are detailed below.

Reduction of repayment of principal

There are two components of the EMI

that you pay out and those are the principal amount and the interest amount.

For independent property, you can claim the principal amount paid back at EMI

as a deduction under section 80 C of the 1961 Income Tax Act. If you have a

second home, where your parents live or it is vacant, it will also be your

home. private property.

You are entitled to a tax deduction

of up to 1.5 lakhs on the principal amount you paid at EMI for both homes,

purchased using a home loan. If a second home is rented, it is considered a

rental property and you are still eligible for the home loan tax benefits. You

can also claim registration and stamp duty issued on your home purchase.

Interest payment reduction

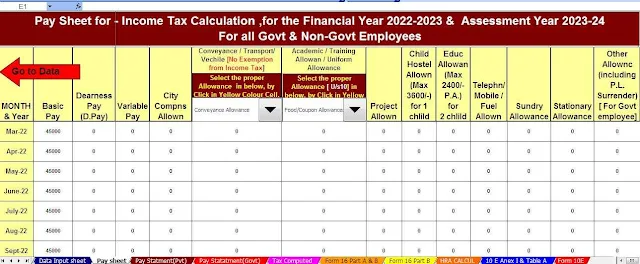

Download One by One Preparation Excel Based Software Form 16

Part A&B and Part B for the F.Y.2021-22

The tax deduction on a home loan

also includes interest paid on the mortgage. Under Section 24(b) of the Income Tax

Act, you are entitled to a home loan tax benefit of up to 2 lakhs for a

detached home. If you own a second home, the total tax deduction on a home loan

for two homes cannot exceed 2 lakhs in one financial year.

If it's a rental property, you have

no upper limit on claiming interest. However, the loss you can claim based on

Home Ownership Income has limited to Rs 2 lakh only. The remaining losses can

be carried forward for 8 years for homeownership income adjustments.

Additional deduction based on 80EE

bagian section

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

You can take advantage of these

home loan tax advantages if you take out a loan in the 2022-23 financial year.

Under section 80EE, you are entitled to an additional deduction of Rs. 50,000

plus a discount of 2 lakhs on interest paid, provided the following conditions

are met.

• The loan amount should not exceed

Rs 35 lakh and the value of the property you are borrowing should be Rs 50

lakh.

• You should have received

sanctions between April 1, 2016, and March 31, 2017.

• This discount applies to

homeowners and first-time homeowners only.

Extra cut under the 80EEA section

for an affordable home

You can request an additional

deduction of up to Rs 1.5 lakh on the interest paid on the home loan. To get

home loan tax benefits under Section 80EEA, you must meet the following:

• The stamp duty on residential

properties must be a maximum of 45 lakhs.

• You must have used the loan

between April 1, 2022, to March 31, 2023.

• You must be the first home buyer

by the date the loan is approved.

• To apply for a deduction under

this section, you must not be eligible to apply for a deduction under section

80EE.

Download and Prepare at a time 50 Employees Form 16 Part A&B

for the F.Y.2021-22

Deductions on joint home loan

If you have a joint home loan

account with IDFC First Bank, any borrower can apply for a home loan tax

benefit on taxable income. Borrowers are expected to be co-owners of the

property and can claim a deduction of up to 2 lakhs each on interest and 1.5

lakhs each on the principal amount paid for the home loan.

How do I apply for tax benefits for a

home loan?

To apply for a home loan income tax

benefit, you need to make sure that:

1. The residential property is in

your name and, in the case of a co-mortgage, you must be one of the co-owners.

2. Property construction is

complete.

3. You get a certificate from the

bank detailing the interest and principal amount paid.

4. Your employer knows the tax

benefits of your home loan application and adjusts the TDS accordingly.

5. You have calculated the amount

that will be required as a tax deduction.