Section 80GG of the Income Tax Act provides a deduction for renting a home under certain conditions

. Some of these involve being a Hindu individual or undivided family (HUF), being self-employed or

salaried, etc.

One of the most important tax deductions available to us is house rent. This is covered by section 80GG of the Income Tax Act. This is especially useful for employees who do not receive a Home Rent Allowance (HRA) from their employer. The tax exemption under Section 80GG depends on your salary, city in which you live (Level I, Level II, Level III, etc.), amount of rent and HRA received.

Deduction by Section 80GG

To be eligible for a rental deduction under Section 80GG, the following conditions must be met:

• You must be an individual or a Hindu United Family (HUF). The company cannot claim a deduction for house rent.

• You must be self-employed or a salaried person.

• You should not receive HRA benefits in your salary.

• You must complete and submit a

10BA form to certify that you are not claiming the benefits of owning a home in

another location or the same place where you work.

• However If the rent paid is excess amount than Rs. 1 lakh per year, you have to show the PAN Card of the owner of the house you live in for rent.

• You can ask for rent even if the house you are renting is semi-furnished or fully furnished.

In this section, you can request the minimum amount that applies below:

• Rs. 60,000 per year (Rs. 5,000 per month)

• The amount same as the total rent paid minus 10% of the total income

• 25% of annual salary

To understand this, let us consider an example. Riten earns Rs. 7 lakhs per year and does not receive HRA. He paid the rent of Rp. 18,000 per month, or Rp. 2.16 million. We now apply the 3 quantities above to determine the appropriate amount. At point 1, the amount of the exemption is Rs. 60,000. According to point 2, the amount is - 2,16,000 - 70,000 (10% of revenue) - Rs. 1,46,000. As in point 3, the amount is Rs. 1.75 Lakh. As this minimum amount applies as a tax deduction under Section 80GG, Riten can only claim Rs. 60,000 as a tax deduction.

Exceptions under Section 80GG

• You cannot apply for a reduced rent if you own the home where you work or run a business.

• You cannot apply for a reduced rent if you apply for benefits for a house held in another location as a stand-alone property. If you live in one city and own a house in another, it will be considered a rental.

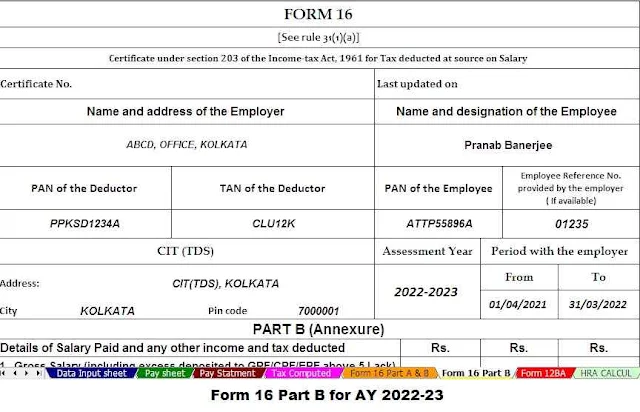

Download and Prepare One by One Form 16 Part B for the Financial Year 2021-22

If you live with your parents, there are interesting ways to take advantage of the benefits of Section 80GG. You can make a rental agreement with your parents and pay a certain amount - at least Rs. 60,000 - as rent to your parents. However, your parents must show this amount as income on their tax returns.

With today's real estate rates, it is absolutely impossible for the minimum amount to be anything other than the Rs. 60,000 received in accordance with Section 80GG. And if you pay rent under Rs. 5,000 a month, you are most likely in a smaller city and your income is proportionately low and therefore exempt from paying income tax altogether. In addition, most businesses today offer rental benefits as part of their salary, which will automatically exclude you from claiming benefits under Section 80GG.

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2021

3)

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount into the in-words without any Excel Formula