New and old tax regime U/s 115BAC|In this New Tax System, A lot of doubt about the new tax regime.

People can't decide what to choose. Let's discuss the new tax regime.

The new tax regime has available for individuals, both for HUF, if you are a resident or a non-resident, and is optional. The new tax regime has preferential rates up to a taxable income of Rs. 15 lakh with tax slabs of 5%, 10%, 15%, 20% and 25% on income, upfront of 2.50 lakh of Rs base exemption. 2.50 Lakh If you wish to take advantage of the reduced tax slab rates under the new tax regime in lieu of the existing tax slabs, you must waive the tax deductions & exemptions available under the old tax regime.

As for employees, they are not eligible for important benefits such as standard deductions, housing allowance, vacation assistance, etc. if they choose the new tax regime. The senior citizen will not be able to claim the standard ex-employer's pension deduction, nor the section 80TB postal and bank interest deduction if they choose the new tax regime.

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

In addition, various deductions under Chapter VIA such as Section 80 C (consisting of various items such as EPF, LIP, tuition, PPF, NSC, ELSS, home loan repayment, etc.), 80 CCD (1) and 80 CCD (1B) (for NPS) 80D (for health insurance premiums) 80D for health insurance, 80G for donations, 80 TTA for bank savings interest, etc. but not available in the new tax regime.

If you have borrowed money to buy a home or renovate a home claiming autonomy, you are not eligible for the interest deduction, which is available up to Rs. 2 million a year. You will also not be able to offset the current loss, as well as the expected loss of ownership of the main home against current income if you choose the new scheme. Not only that, you are not allowed to carry any homeownership losses onto the rental property.

The total benefit from the transition to the new tax regime is about Rs. 75,000/- plus 4% deductible if your total income is Rs. 15 thousand. Since many exemptions and deductions can be claimed, and the composition of these tax credits varies from person to person, there is no ready answer to the question of which scheme works for you. However, looking at the tax credits that most taxpayers have to forgo, the benefits available under the existing scheme outweigh the lower rate benefits available under the new scheme, especially for employees and homeowners.

How to activate consent to the new scheme and switch between the old and new scheme

Those with no business or income must use this option each year by filing Form 10IE with the ITR, no later than the ITR filing deadline. those. July 31st and an option once exercised for a given year cannot be changed if you wish to file a revised report. Therefore, take into account all income, benefits and deductions when choosing a scheme for a given year.

Download and Prepare at

a time 50 Employees Form 16 Part A&B for the F.Y.2021-22

Please note that under income tax law, using the new tax regime with your employer does not count as exercising the option. The use of the employer option has a limited purpose and you may choose an alternative scheme when filing an ITR. Be sure to file your ITR before the expiration date if you wish to opt for a new tax regime as this option is not available after the expiration date. However, you can stay on the old scheme for one year and on the new scheme the following year.

Those with business and income must exercise the option once and for all first by completing Form 10IE before the ITR filing deadline through the ITR, which can be filed later. This person can opt-out of the new tax regime only once, and then cannot return to the new tax regime if there is no business income that year. Therefore, you need to be very careful when choosing a new tax regime when you have business income, and you must take into account the composition of income not only of the relevant years but in all future years.

How does the scheme work?

Let's see how the circuit works with examples. Almost all employees receive HRA benefits for paying rent or buying a home with a mortgage. Assuming you bought a house with a mortgage, you will not be able to claim the benefits of a home loan with interest and principal repayment of Rs. 3.50 thousand together.

Bearing in mind the fact that you will also have to waive the standard deduction requirement. 50,000/- if you choose the new mode, losing all the benefits of Rs. 4,00,000/- leading to tax implications of Rs. 80,000 if you are on the 20% tax rate with an income between 5 and 10 lakhs.

Download and Prepare at a time 100 Employees Form 16 Part B for the F.Y.2021-22

The forgone net tax benefit is greater than the benefit of Rs. 62 500/- is accumulated for you under the new scheme. For those on the 30% tax slab, the tax effect of waiving the 30 % exemption will be 1.20 lakh compared to the Rs benefit. 75,000/- accumulated under the new regime.

We can also include exclusive benefits available for NPS Rs. $50,000 pursuant to Article 80 CCD (1B). So, apparently, the new scheme does not look attractive to the employee. Employees must determine their final tax liability when completing the ITR and select a regimen that will help them optimize their tax revenue.

From the example above, it becomes obvious that if someone is on a 20% or 30% tax rate, the current scheme is better for those who enjoy all the major deductions that people usually enjoy.

Let's move on to an example where a person has an income of up to Rs. 7 lakh and who will have to pay a tax of Rs. 32 500 / - if you choose the new model. However, if he can claim a deduction under section 80 C for Rs. 1.50 lakh and deduction of Rs. 50,000/- under Section 80 CCD (1B) for NPS and reduce his total income below 5 lakhs, he will not have to pay any taxes, taking advantage of the u/s 87A discount to Rs. 12,500/- Thus, by investing two lakh rupees, it will be possible to save rupees in taxes. 32 500 / - remained in the old regime. However, this scheme will work for self-employed people who don't want to save money to make investments that qualify for multiple deductions.

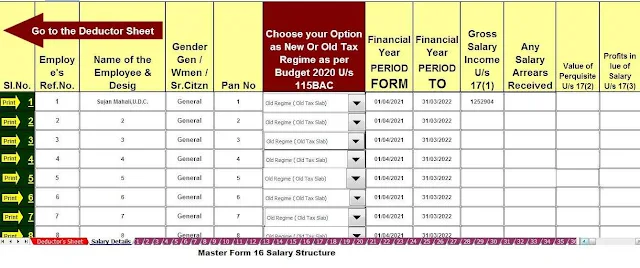

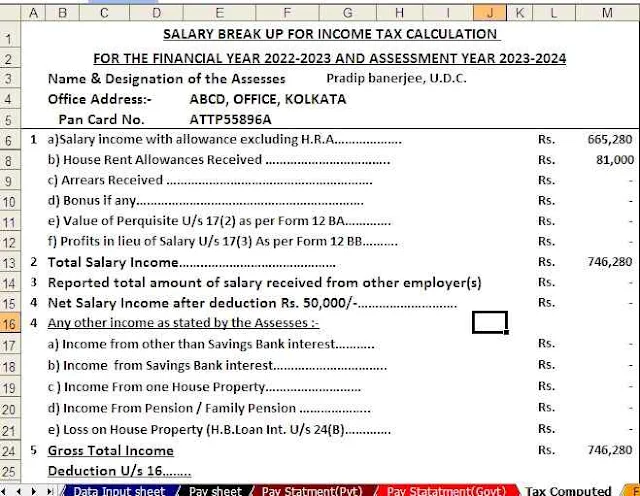

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

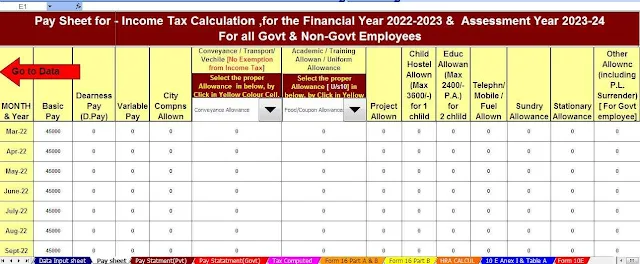

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

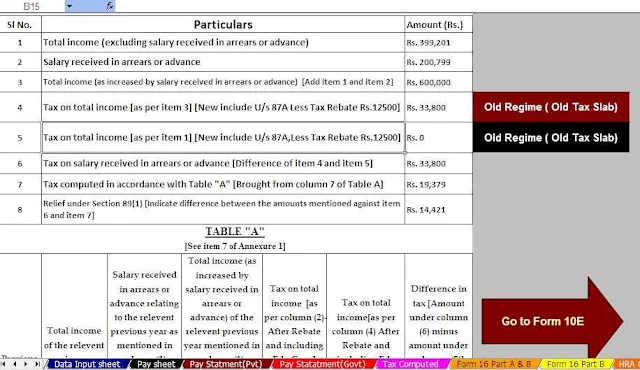

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23