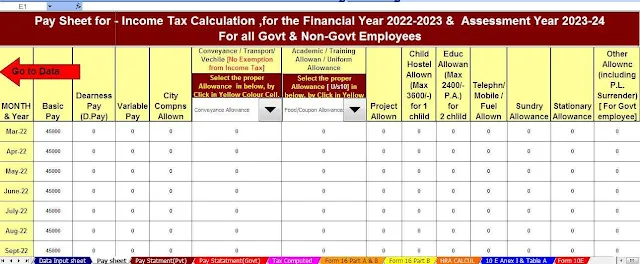

Download all-in-one income tax preparation software in Excel for government employees and private-

sector employees for the tax year 2022-23 with Form 10 E

The article contains an automatic income tax calculator in Excel format for the tax year 2022-23, that

is the determination of income tax for the year 2023-24. The income tax calculator is useful for

salaried government and private sector employees.

I wish you a life free of financial

stress and wise tax planning! Good luck and God bless you. A common question

salaried employees ask is: What are the factors to consider when preparing a

tax and financial plan?

Tax-related financial planning is

important for salaried employees as they invest their limited hard-earned

resources to save on taxes and increase their wealth. When preparing a detailed

tax plan, you should keep a few points simple.

How much to invest in tax-saving

tools?

Review your current obligations,

such as contribution to an Employee Provident Fund, school fee payments,

premiums paid on life insurance policies, home loan repayments, etc. who

qualify for Sec 80C tax investments. There is no need to invest in eligible

tax-saving instruments if the total payments under the list above are greater

than 1.5 lacs per year, or if you need to invest in tax-saving options only to

the extent remaining after accounting for all payments aforementioned. So, to

keep it very simple and straightforward, don't spend too much to save on taxes.

The balance of your available money can be invested in a growth/wealth

accumulation fund, other than a tax savings fund, give the following ideas.

Emergency fund to cover unexpected

expenses.

Create a disciplined investment behaviour.

Starting early from the time you start your career will help you get a very good

accumulation of money until your retirement age. for instance. Rs 5,000/- per

month, starting at age 30, 18 lakh investment for 30 years, at age 60, fund

value of Rs 1.25 Lakh or more depending on the current market situation.

Never dig too deep into long-term

investing for simple expenses.

Keep a small but diversified

portfolio, with a few tools that will give you higher returns than your past.

Please refer to the National

Pension Plan (NPS) investment options in Section 80CCD, investments up to Rs

50,000 are eligible for tax benefits. A contribution to the NPS made through

your employers is completely tax-free, up to 10% of your annual base salary.

Make sure you have a health

insurance policy, although employers offer some health insurance support, this

may not be enough to cover all the costs of your treatment, should an

undesirable event occur. Health insurance premium qualifies for tax savings

under Section 80D

Salient Features of Income Tax Calculator for Salaried

Employees- F.Y. 2022-2023.

Useful for salaried employees in government and the private sector.

Calculate the tax and allowance/deduction for all types of income,

including farm income, to arrive at the annual tax liability.

Marginal relief on the surcharge, when income exceeds the established

limits.

Automated HRA exemption/80GG deduction calculation based on wages and

rent payments. Chapter VIA Validation Limits Discount, Compensation of home

loan interest

Built-in salary structure for government and private sector

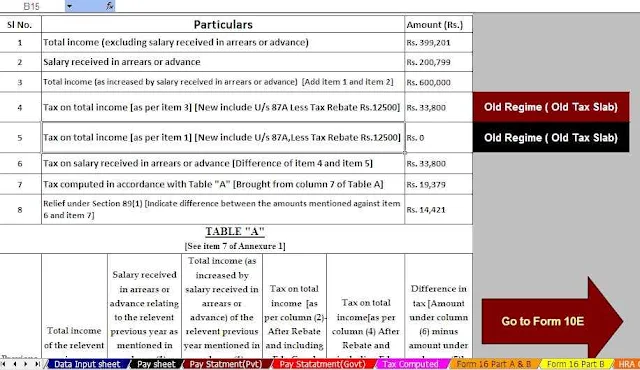

Automatic U/s 89 (1) Income Tax Deduction Calculator with Form 10 E for

Tax Year 2022-23

Automated Income Tax Form 16 Part A and Part AB for fiscal year 23-2022