Automatic Income Tax Preparation Excel-based All-in-one software for F.Y.2022-23 as per U/s 115

The financial project is finally

here, we have been waiting for this for a long time. On the one hand, we

expected some big steps to love the economy and at the same time, we expect a

big reduction in the tax rate for individuals.

If yes, as soon as the finance

minister started reading his budget speech in Parliament we all started ringing

and in no time the news of personal income tax was all Rs 78000. Reduction

announcement, on seeing this news how can we do such a big change, then we

immediately took over and read the financial statements, and found that there

was no change in the person.

Yes, what exactly was financial and what it was? The income tax rate is up to 2.5 lakh to 5 lakh and more than 5 to 10 lakh then why is there so much noise that the Income Tax Act has been implemented and what will happen if your total income will be up to 2.5 lakh to be?

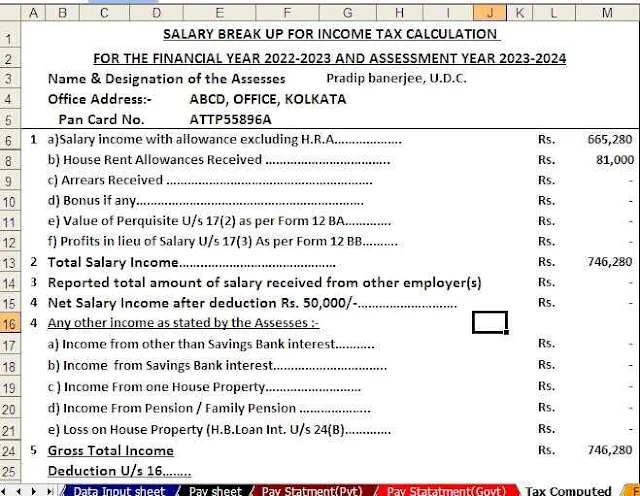

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2022

3)

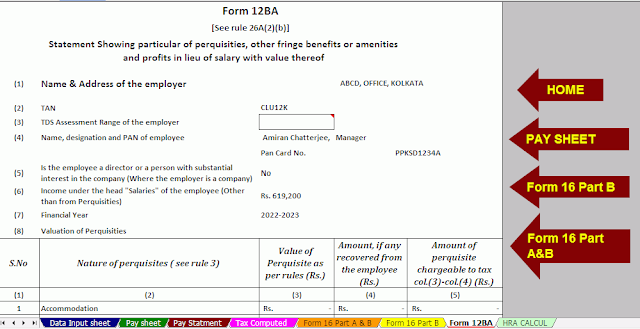

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

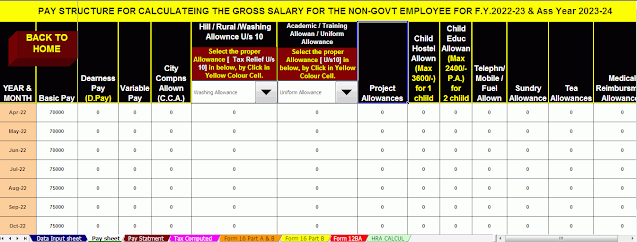

Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

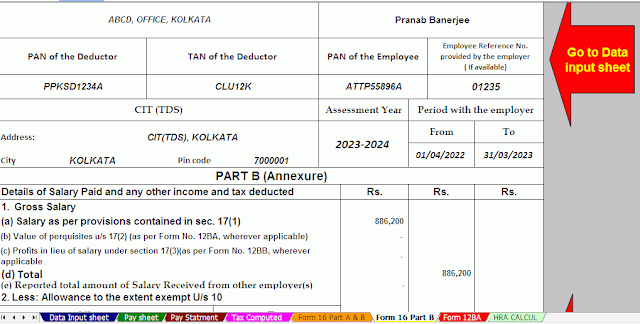

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10)

Automatic Convert the amount into the in-words without any Excel Formula

There is no change so far, but it

is quite different from this with the usual tax rate from 500000 to 1000000 and

here from 5 Lakh to 7:5 Lakh. If income tax exceeds 7:5 Lakh to 10:00 Lakhs.

Then it is true that an individual can get help up to Rs. 78000/-, but friends are not such simple side effects. There are also some conditions in 15 Given and you will all have to agree to them when doing this, so what is the condition?

Let’s see, if you do, you have to give up all the more important things. Even if you live in a rented apartment, you should leave immediately. If you do then you have to let the government can take it, if nobody needs to provide a unit in the next 5 years, plus you will get all the Rs. 50000 if you also have to give up the action. Except for self-owned household property or household property, which a person could not use for self-employment for his profession, the deduction does not extend up to Rs. 2 Lakh received under Section 24B from interest on loan incurred for construction or purchase of said house and deduction of family pension upto Rs. 15000 and will not be levied and here a point is crucial apart from all the deductions available under Chapter VI-A except section 80 of the CCD exemption. You won’t find any deductions here ie. section 80 TTB and all the rest you will not forget unless it is other employees will not be available and you will not receive any more allowances and earnings.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

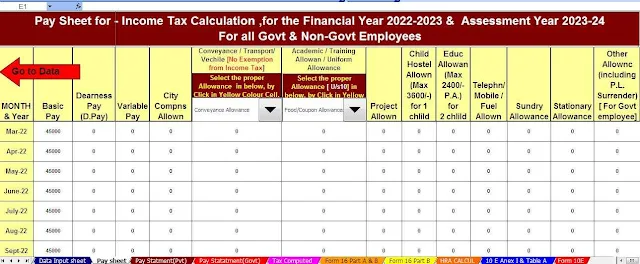

Excel Utility has a unique Salary Structure for Govt & Non-Govt Employee

Salary Structure.

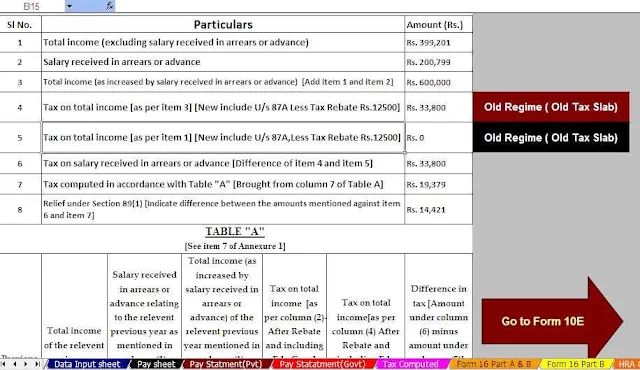

4) Automated

Salary Arrears Relief Calculation U/s 89(1) with Form 10E for the F.Y.2022-23

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23

7) Individual Salary Sheet