Income Tax Section 80 D| The global health crisis has affected people’s financial health, especially

those without medical insurance. Aside from a lack of knowledge about insurance policies, high

premiums are another major reason people skip buying them.

However, with Section 80D deductions, taxpayers can save a lot on extra hospital bills.

To make the most of these benefits and benefits, you need to understand the intricacies of Section 80D medical insurance deductions. Here’s everything you need to know!

Eligibility criteria for claiming tax deductions under section 80D

While you don’t have to submit documentary evidence for the application process, you do need to know who is eligible:

• Alone

• Foster parents

• Male

• Children in care

You must remember that Section 80D of the Income Tax Act does not apply if you pay the premium in cash. A check must be provided for this so that you can take full advantage.

What payments qualify for Section 80D waivers?

You may elect any form of payment to pay your health insurance premiums except payments to claim tax benefits under this section. The perks will be money paid for treating the elderly (age 60 and older), along with medical expenses for a preventive health check.

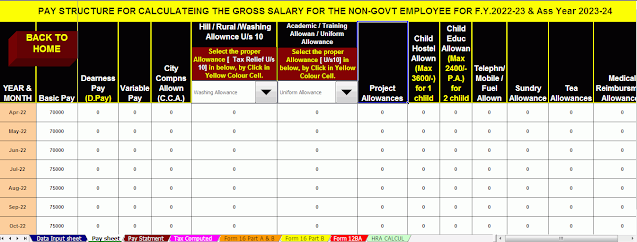

You may also like:- Automated Income Tax Preparation Software All in One in Excel for the Non-Govt Employees for theF.Y.2022-23

See a side note to explain what preventative health checks are all about. It is nothing more than an annual health check conducted by health professionals to contain the health risk factors of a person.

Section 80D of the ITA allows you to claim a tax deduction of Rs 5,000 for you and your family members, and you can also pay the amount in cash.

See the following 80D calculation for better understanding -

Let’s assume you have to pay Rs 17,000 for your health insurance every financial year. Additionally, you choose to have a preventive health check for yourself or for your spouse and their associated children. You can then enjoy an additional amount of up to NLG 5,000 under Article 80D, depending on your expenses.

In addition, if you made certain contributions to a particular type of government-sponsored plan, you may also receive tax benefits under this section.

Maximum deduction limit available under Section 80D

Now comes the part where you will find out the maximum limit of 80D and how much you can actually save with this choice. Remember, though, that it varies from situation to situation.

Here are the different deduction limits based on ability –.

• The maximum deduction for the amount you pay for your insurance premium (for your spouse, children and yourself is 25,000.

• Individuals can avail of 80D deductions up to Rs 50,000 for dependent parents below 60. If the age of your parents is above 60, the limit increases to Rs 75,000.

• If a taxpayer with health insurance coverage is over 60 years of age, he can claim a deduction of up to Rs. 1, 00,000 deductions.

As you can see, the tax benefits under Section 80D for senior citizens are quite substantial. So you can avoid financial obligations that year.

The person is suffering from financial problems after spending a lot of money on medicines. The Section 80D deduction scheme is probably the most popular tax-saving tool right now. If you are planning to apply for ITR under this section, make sure you check the above first to avoid confusion.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This Excel

Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23