Provident Fund –Vs- Fixed Deposit, which investment strategy is right for you? If you want a relaxed

lifestyle without the hassle of earning money in retirement, public provident funds and fixed deposits

maybe the right option for you.

Financial planning for the future

is very important. Especially when we start earning money at a young age. If

you don't earn from a young age, the responsibilities and expenses will

increase with age. Naturally, one would have to work harder and not be able to

retire early. The good news is that there are multiple ways to save for people

of all ages.

If you want a relaxed lifestyle

without the hassle of earning money in retirement, public provident funds and

fixed deposits may be the right options for you. Investing in these two ways

can easily save money for the future. Both plans have advantages and

disadvantages. That is why one must know all the details before investing in

any system. The report analyzes in detail the investments of PPF and FD.

What is PPF?

The Public Provident Fund is a

long-term permanent savings plan of the government. Investments under this

scheme offer tax-exempt benefits as well as guaranteed returns. The investor

can claim tax exemption under Section 80C of the Income Tax Act of India. The tenure

of the PPF account is 15 years and no withdrawal can be made before expiration

unless there are special conditions. If the account lasts 5 years, the investor

can withdraw part of the money.

PPF is a long-term savings scheme

recognized by the government.

Investors can invest up to Rs

1,50,000/- per annum and take advantage of tax exemption under Section 80C of

the Income Tax Act.

The PPF period is 15 years and

partial retirement is possible under various conditions.

Investments, dividends, and

post-refund gains are tax-free.

Post offices, banks and financial

institutions provide PPF services.

What is a fixed deposit?

A fixed Deposit or FD is the safest

option. In this case, the interest rates are much higher than in risk-free

savings accounts. When investing in time deposits, the investor has to adjust

the tenure and the interest is paid accordingly. For the elderly, savings pay

comparatively high-interest rates.

About fixed deposits

The fixed deposit is a safe

investment option that offers guaranteed interest rates.

In this case, the investor has zero

probability of loss.

Fixed income returns are superior

to other risk-free investment options.

A tax was collected on interest

over Rs 40,000. However, the investor can claim tax exemption.

Complementary loans are granted based on fixed amounts.

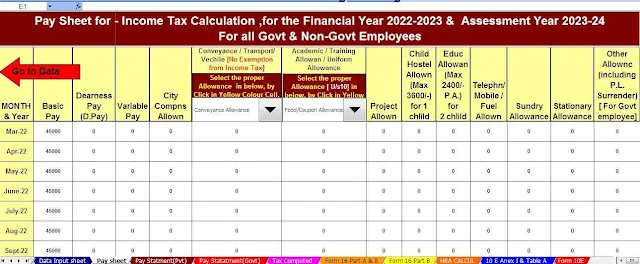

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2022

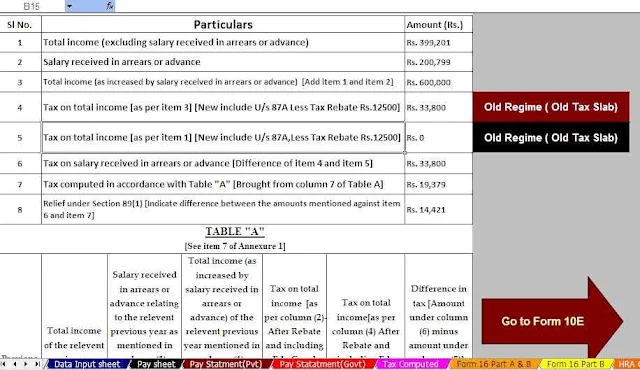

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern's Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10)

Automatic Convert the amount into the in-words without any Excel Formula