How to use Max Home Loan Tax Benefit in 2022? The maximum benefit of a home loan

which can be claimed as a deduction as follows:-

Section Exclusion allowed for

1. Section 24 Rs. 2,000,000

of interest

2. Section 80C Rs. 1,50,000

Special payment

3. Section 80EEA Rs.

1,50,000 Payment of Interest

For

example, as can be seen in the table above, various sections of the Income TaxAct can be said to be exempt from interest and principal. These categories,

along with allowable deductions, are discussed in more detail in this article.

Section 80C: Tax Benefit on Home Loan (Key Amount).

The

amount paid on repayment of principal of an individual/HUF home loan is allowed

as a tax deduction under Section 80C of the Income Tax Act. The maximum tax

deduction u/s 80C is Rs. 1 50 000.

Property cannot be sold within 5 years

Section

80C(5) also states that in case the valuer transfers the property on which tax

deduction is claimed under Section 80C before the expiry of 5 years from the

end of the financial year in which he acquired the property, then only section

80C does not allow deductions and tax benefits on housing loans. The total

amount of tax deduction already claimed in respect of previous years is treated

as income of the Shareholder for the year in which the property is sold and the

Shareholder is liable to pay tax on that income.

Tax benefits Home loan (interest rate).

Tax

credit on a home loan for payment of home loan interest can be claimed as a

deduction under section 24 and under the newly introduced section 80EEA

(amended in the 2020 Budget).

Section 24: Benefit of income tax on interest on the loan for purchase/construction of the real estate.

A

tax benefit on a mortgage loan for payment of interest is allowed as a

deduction under Section 24 of the Income Tax Act. Under Section 24, income from

the acquisition of property is reduced by the amount of interest paid on the

credit under which the loan is availed for the purpose of

purchase/construction/renovation/renovation/reconstruction of buildings.

The

maximum tax deduction allowed u/s 24 of a private dwelling is capped at a

maximum of Rs. 2 Lakhs.

Note:

if the immovable property is not occupied by the owner himself by reason of the

fact that he has carried on his profession, trade or occupation in another

place, he must occupy that other place which is not his he, with then the

amount of tax deduction allowed under Section 24 is Rs. 2 Lakhs itself.

It

is also important to note that this tax exemption of interest on loans under

section 24 is deductible on an accrual basis, i.e. Thus, deductions under

Section 24 can be claimed every year even if no payments have been made during

the year as compared to Section 80C, which allows a deduction only on payment

basis. Also. (The limit has increased from 3 years to 5 years from FY 2016-17).

Section 80EEA:

Income

Tax Benefit on Home Loan Interest (First Time Buyers).

Interest

deduction can also be claimed u/s 80EEA which is in addition to the deduction

claimable u/s 24 of Rs. 2 Lakhs and also aforesaid the deduction of Rs. 1.5

Lakhs is allowed u/s 80C

This deduction under section 80EEA is applicable only in the following cases:-.

1.

80EEA deduction would be availed only if the stamp duty value of the property

purchased is below Rs. 45 lakhs of cash.

2. The loan must be approved

between April 1, 2019, and March 31, 2022.

Keep in mind that:-

1.

The above tax deduction applies to an individual and not to a Building. So if

you bought a home together and took out a joint home loan, each repayment would

be entitled to the full deduction separately.

2.

If you live in a rented flat and have tax benefits through HRA deduction, then

you can also claim tax benefits on home loans according to Article 24, Article

80EEA and Article 80C.

3.

If an individual chooses the new tax regime announced in Budget 2020, they will

not be able to claim the benefit of any of these deductions.

To

claim the above tax deduction, you must submit a letter provided by the lender

that clearly shows the amount owed, interest and principal. After claiming the

above amount for home loan tax purposes, the rest of one’s income would be

taxed according to income tax rates. (Recommended

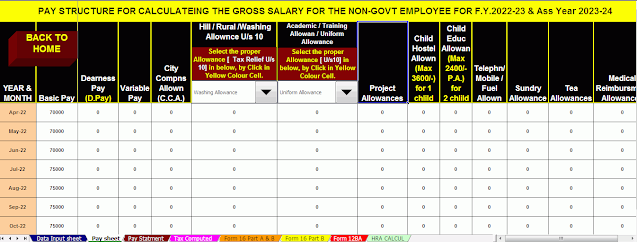

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

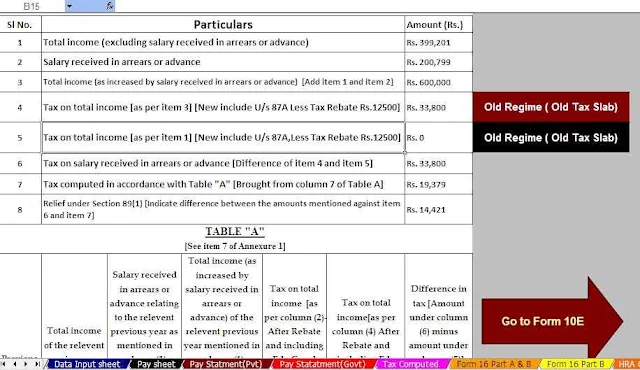

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23