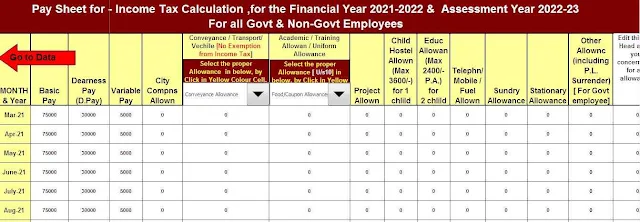

Download Auto-Fill Income Tax Preparation Software All in One in Excel for F.Y.2022-23 as per

Budget 2022| This software is simple and easy-to-use income tax software for salaried employees. This

software for old and new tax systems was released in 2020. You can calculate your tax liability and

identify taxable investment options and appropriate tax regimes for F.Y 2022-23.

The software is developed using Microsoft Excel. Simple code of Visual Basic & Excel formulas and functions are used to run this software. This Excel-based income tax software All in one, let us know the new income tax bracket for this financial year 2022-23 and the income tax changes in the 2022 budget

You may also, like- Auto-Fill Income Tax Software All in One for the Non-Government Employees for the F.Y.2022-23 [This

Excel Utility can prepare at a time Tax Computed Sheet as per new and old tax

slab + Automated Income Tax Form 12 BA + Automated Calculate Income Tax

House Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B

and Form 16 Part B as per Budget 2022]

Income tax and income tax rates will remain unchanged for F.Y 2022-23 (A.Y 2023-24). The budget change is that only citizens over the age of 75 are exempt from income tax returns if they have retirement income and interest. There have been no major changes in income tax laws.

If you opt for a new tax system, you cannot avail of the exemption under Section 80C as well as the

exemption under Chapter VI A Except NPS and 80CCD (2).

However, there are some discounts that you can still claim through the new tax system and they are as below.

Making Income In Retirement

Trim Allowance

The location of the VRS

• EPFO: employer fund

• NPS elevator facility

• Educational assistance

Assesses can elect any new or old tax bracket. They can switch between the old tax system and the new tax system. If an individual or HUF owns business capital, the ability to switch between tax categories is not allowed.

This income tax software in Excel F.Y 2022-23 (A.Y 2023-24) from the link below easily calculates the income tax payable. This calculator consists of two parts. Both are given on separate pages.

Episode 1 - Calculate taxes based on top tax rates

The first page contains the top tax rate calculator, where deductions and reductions are allowed.

You

may also, like- Auto-Fill Income Tax Software All in One for the West Bengal State Government Employees for the F.Y.2022-23 [This

Excel Utility can prepare at a time Tax Computed Sheet as per new and old tax

slab + Automated Calculate Income Tax House Rent Exemption Calculation

U/s 10(13A) + Automated Form 16 Part A&B and Form 16 Part B as per Budget

2022]

To calculate your income tax due based on the top tax rate, you need to enter information such as total income and the amount of the deduction. In addition, you must provide information about the investments you have made under various headings. The blade has inputs for different sections such as 80C, 80D, 80CCD, etc.

After completing this step, you will need to proceed to the bottom section where you need to select the applicable tax bracket by choosing options for men/women, adults, and very old.

You will immediately see your tax liability in taxes including the supply portion.

Part 2 - Calculate the tax according to the lowest tax rate

The second page contains a new calculator to reduce the tax rate under the new tax system, where no deductions are allowed.

To calculate your income tax due according to the new rate plate, you only need to state once in your total income.

The Excel-based software automatically calculates the tax liability and displays it in the tax liability including the cess field.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23