Exemption U/s 80C | Investment under Section 80C has two purposes: first, to make investments, and

second, to save tax. Thus, the tax thus saved and the investments thus made can be used in the future.

Miscellaneous

funds under section 80C

There are several investments under section 80C which allows

the assessee to reduce his tax liability to Rs. 1.5 lac. These investments are

as follows:

Public Provident Fund or PPF Scheme is a long-term investment

scheme backed by the Government of India. Also, one can invest in PPF by

opening an account and making a minimum deposit of Rs. 500 up to a sum of Rs.

1.5 lac. In addition, the PPF scheme has a lock-in period of 15 years and the

current interest rate is 7.1%. In addition, the premium, as well as the

interest amount on the PPF, is tax-free.

Sukanya

Samridhi Yojana

Sukanya Samridhi Yojana or SSY is one of the best performing

investments under section 80C. This is because it is a government initiative

aimed at uplifting the girl child. It was launched in 2015. Thus, a person with

a daughter can open an SSY account with some post offices and banks in

Life

insurance premiums

Life insurance premiums, commonly known as LIC premiums, are

common investments under Section 80C. The reason is that the life insurance

premium not only provides life cover to the individual but also protects his

family and gives them financial independence accordingly. Maximum limit Rs.1.5

Lakh.

Provident fund scheme for employees

The Employees Provident Fund or EPF Scheme is a long-term

retirement scheme available to salaried employees. Under this scheme, the

employer and the employee pay the same premium of 12% of the basic salary plus

severance pay. When an employee retires, the amount so earned, plus interest is

paid directly to the employee. Additionally, the gift is exempt from tax under

section 80C.

5 Years

Tax Savings Fixed Deposits

Tax-saving 5-year fixed deposits are similar to fixed

deposits. Maximum deduction of up to Rs. 1.5 lacs under section 80C in these charge-saving

FDs.

National

Savings Certificate (NSC).

National Savings Certificate or NSC is yet another investment

option under Section 80C backed by the Government of India. Therefore, the

guarantee includes returns. The current interest rate for NSC is 6.80% and it

has a 5-year lock-in period.

Shared

savings plan and link

Equity Linked Savings Scheme or ELSS is an investment fund

that invests at least 80% of its assets in the stock market. These are also

known as tax-saving mutual funds as they can avail deductions under Section

80C. In addition, they have a lock-in period of only 3 years and the return is

dependent on market norms.

You may also like – Automated Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10E for the Financial Year 2022-23

National

pension system

The National Pension Scheme or NPS is a scheme that allows

working professionals and earners in other sectors to benefit from pension

benefits. For example, any Indian between the ages of 18 and 60 can open an NPS

account. Investments up to Rs. 1.5 lakh in this scheme are eligible for tax

deduction under Section 80C of the Income Tax Act. Apart from this, one can

also get some tax rebates on investments of Rs. 50,000 under Section 80CCD

(1B). The lock-in period is also up to retirement age and the current interest

rate is 7.10%.

Unit Lien

Insurance Plans

Unit Linked Insurance Plans or ULIPs are effective

investments under Section 80C that provide investors with investment and

insurance in one package. According to ULIPs, part of the investment is in life

insurance, and the rest is in equity, debt, or a combination of both.

Thus, under Section 80C, the premium amount of ULIP is tax

deductible up to Rs. 1.5 million per annum. In addition, policy returns at

maturity are exempt from income tax under Section 10(10D).

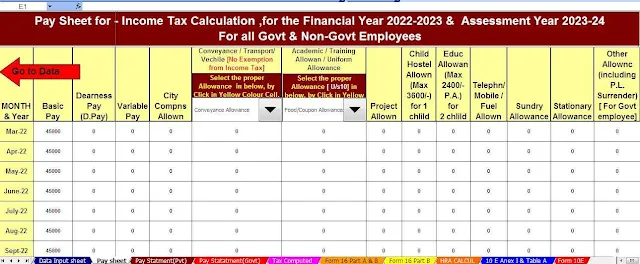

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23