U/s 89(1) Income Tax Arrears Relief Calculator with Form 10E| How can income tax arrears be exempted from back wages from the previous tax year? Assuming you really care about the tax consequences of the equivalent. Can I pay taxes on the total tax base? For taxpayers with such demands in mind, here's everything you need to know.

At the moment, I recently found out that income tax is determined by the taxpayer's total income for a given year. Income can be a salary, an annual family stipend, or multiple sources of income.

You may also like- Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2022-23

However, there may be circumstances where you received back family benefits or your paycheck is closer to the current cash year. It may happen that a taxpayer receives a tip from their preferred status or preferred wage before or after any money-related year, causing their total income to accumulate similarly as the taxes payable increase. In such a case, an application can be filed and the inspection department can allow the taxpayer to be exempt.

In short, the income tax law ensures that there is value in irregular income tax rates, and in this way, when there is no indication of income associated with the current year, the exemption is waived with a view to the achievement of taxable income. . Do not add.

You may also like- Prepare at a time 100 Employees Form 16 Part A&B for the F.Y.2022-23

To make sure it doesn't interfere with making additional taxes, the Income Tax Office grants you the U/s 89(1) exemption. If you received any annuities or portions of the prior year, you will not pay taxes on the entire amount for the current year. Basically, it prevented you from paying additional taxes by thinking about the route in which the partial delays occurred.

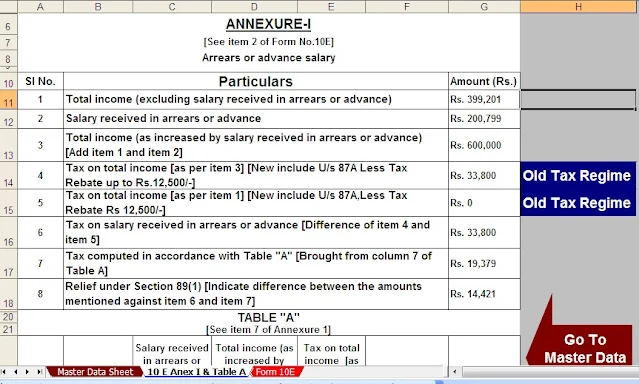

To take advantage of the provisions of Section 89(1), you must file Form 10E. The Form 10E would be the most obvious request. The exact details of Form 10E, how to file the amount, and why are listed below.

What is relief under Section 89(1)?

Specifically when a taxpayer gets:

1. The return of wages or

2. An advance salary or

3. Arrears in family pensions

You may also like- Prepare at a time 50 Employees Form 16 Part B for the F.Y.2022-23

At this point, said amount is taxed in the monetary year in which it was obtained.

In any case, relief is granted in accordance with article 89(1) to minimize the additional tax inconvenience derived from the deferral in obtaining such income.

How is the exemption calculated under Section 89(1)?

The following is the best approach for calculating the exemption under Section 89(1) of the Income Tax Act 1961:

1. Calculate the tax to be paid on the total income, reviewing the delinquency of the year in which it was due.

2. Calculate the total income tax payable regardless of the delay in the year in which it is due.

3. Calculate the separation between some points on scales (1) and (2).

4. The tax to be paid on the entire taxable income for the year to which the arrears refer, including arrears.

5. Calculate the distance between some points in the range (4) and (5).

6. The amount of the exemption is abundance (3) over (6). No exemption will be allowed if the amount in (6) is greater than the amount in (3).

You may also like- Prepare at a time 100 Employees Form 16 Part B for the F.Y.2022-23

What is Form 10E?

To secure exemption under Section 89(1) for back-earned wages, Form 10E is expected to be filed with the Income Tax Department. If Form 10E is not filed and the exemption is granted, the taxpayer is on track to receive a warning from the Income Tax Office for failing to file Form 10E.