Download All in One Automated Income Tax Calculator for Government and Non-Government

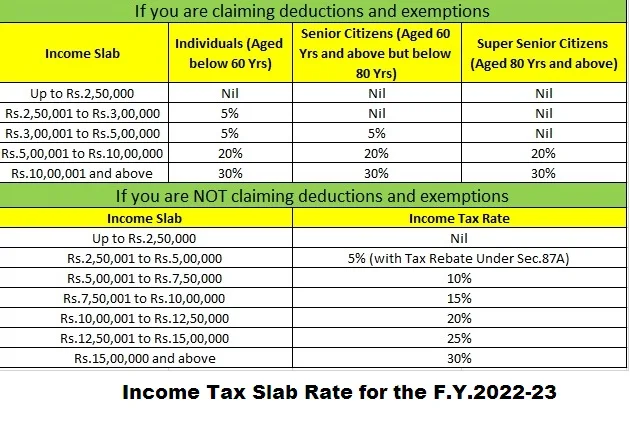

Employees | Include a new section 115 BAC in the 2020 budget for the fiscal year 2022-23. This

section 115BAC contains an option that allows you to continue the old tax regime with any income tax

exemption as of the financial year 2021-22 and opt for the new tax regime apart from any income tax

exemption as of the last fiscal year. Current. 2019-20 as clearly indicated in Budget 2020 U/s 115BAC.

According to the budget, a new U/s

tax label has been specified under 115BAC which was introduced in the 2020

Budget.

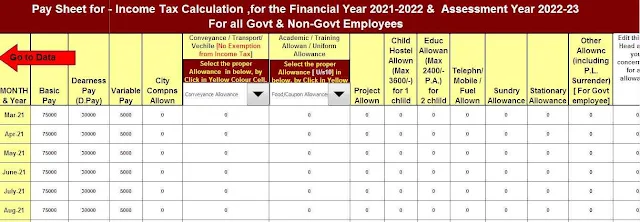

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2021

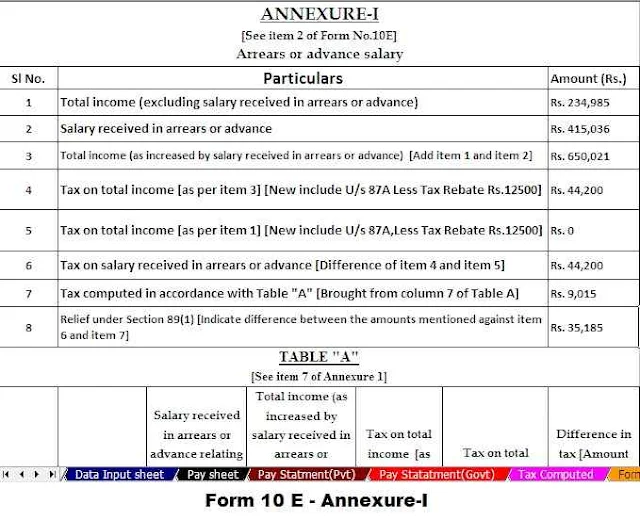

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

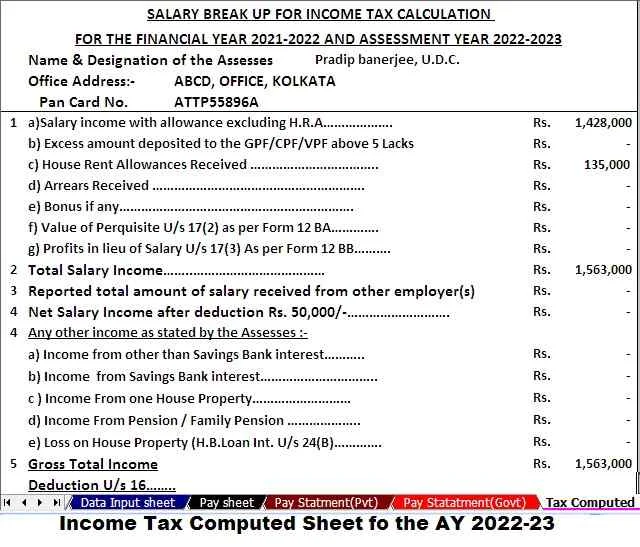

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount into the in-words without any Excel Formula