Introduce a new section 115 BAC in the 2020 budget for the fiscal year 2022-23. This section 115BAC

contains an option that allows you to continue with the old tax regime with all tax deductions from the

financial year 2021-22 and opt for the new tax regime excluding all tax deductions on income for the

financial year previous.

As per the budget 2020, a new U/s tax label has been specified under 115BAC, which was introduced in

the 2020 budget

According to the new article 115BAC (New Tax Regime), there is no exemption for the elderly in the new tax plan.

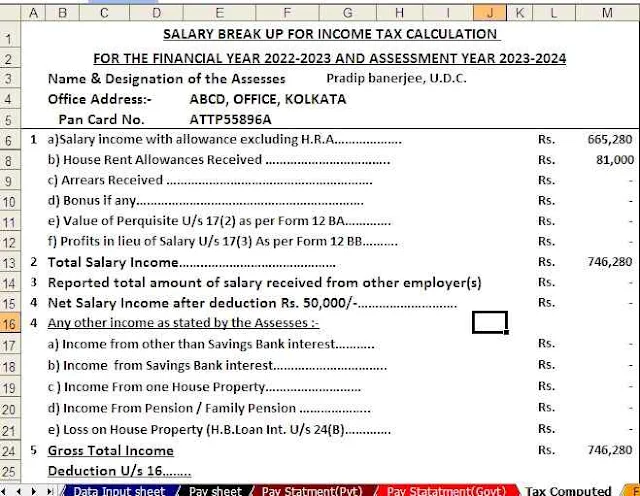

Download Excel All in One Automated Income Tax Preparation Software for Government and Non-Government (Private) Employees for Financial Year 2022-23 and Assessment Year 2023-24 U/s 115BAC

Feature of this excel utility:-

1) This excel utility perfectly prepares your income tax according to your U/s 115BAC option.

2) This Excel utility has a completely revamped Income Tax section as per Budget 2021

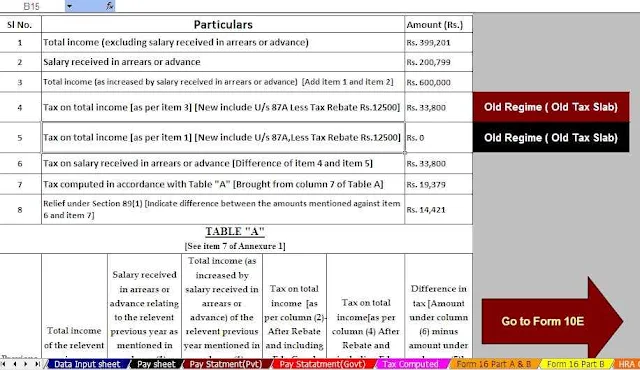

3) Computerized Income Tax Calculator U/s 89(1) in Form 10E from F.Y.2000-01 to F.Y.2022-23 (updated version)

4) Automatic computation Income Tax Exemption rented house U/s 10(13A).

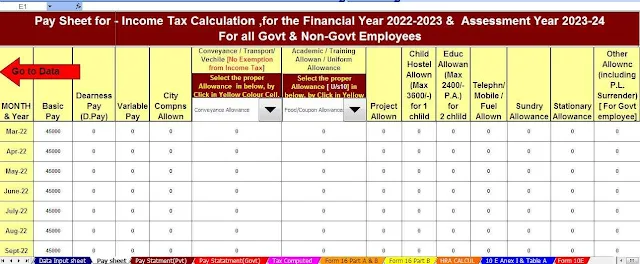

5) Individual salary structure according to government and private group salary model

6) Individual Pay Sheet

7) Individual tax datasheet

8) Automatic Income Tax Form 16 Part A&B revised for the financial year 2022-23

9) Automatic Income Tax Form 16 Part B revised for the financial year 2022-23

10) Automatically convert quantity to in words without an excel formula