Download Excel-Based All-in-One Automatic Income Tax Preparation Software in Excel for Non-Government (Private) Employees for Tax Year 2021-22 New and Old Tax System

Finance Minister Nirmala Sitharaman has announced the inclusion of a new provision in the 2020 Union Budget, known as 115BAC, in the Income Tax Act. The second BAC Law 115, after the 2020-21 tax year, defines a new discretionary income tax structure for Hindu individuals and Undivided Families (HUF).

Let's understand the new panel fee, the eligibility measures for the new system, and the allowances allowed or denied under Section 115 BAC. In addition, we will help you compare the two tires so that you can choose the most suitable one.

What is Section 115 BAC?

Section 115 BAC is a provision recently introduced in the Income Tax Law of 1961, which guarantees a new income tax system. This alternative fiscal provision and discipline has been introduced in the 2020 Union Budget and relates to Hindu Individuals and Undivided Families (HUF). An important component of this new system is that the income tax rate has been significantly reduced. However, the new rates come at the cost of various basic income tax exclusions and exemptions, which are now accessible under the old (current) income tax framework. The attached table shows the rate for the new panels referred to in article 115BAC.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2022

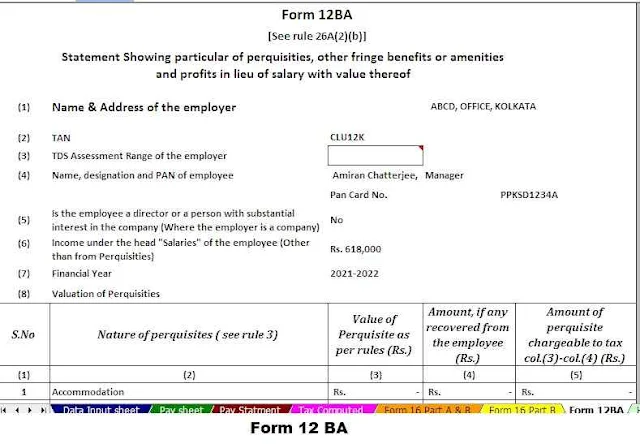

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

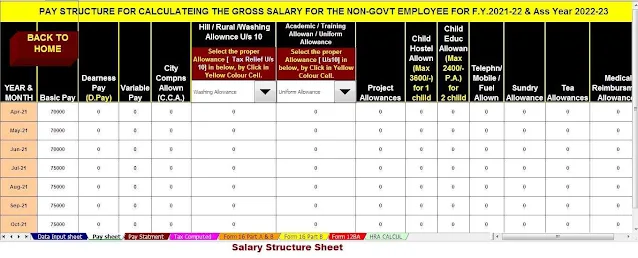

5) Individual Salary Structure as per the Non-Govt (Private) Concern’s Salary Pattern

6) Individual Salary Sheet

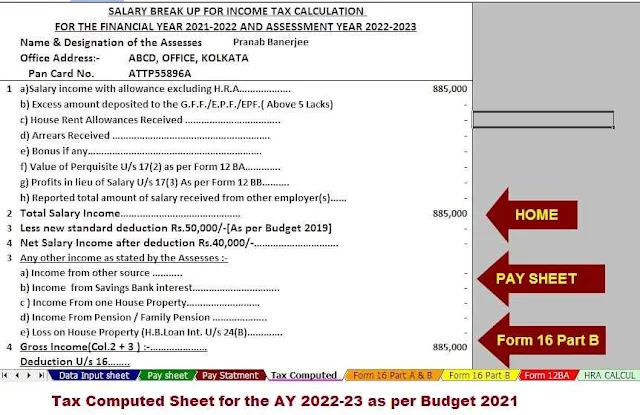

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10) Automatic Convert the amount in to the in-words without any Excel Formula