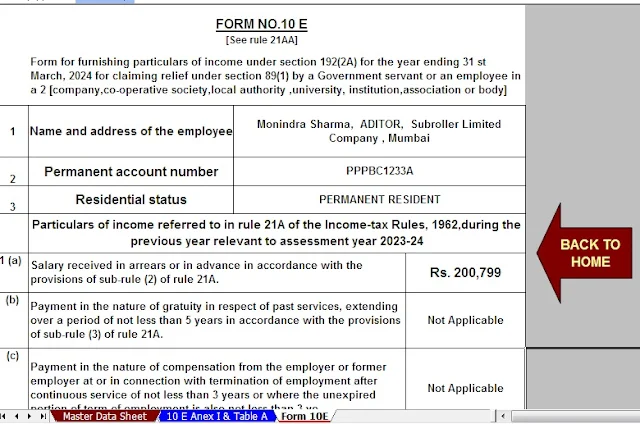

Download Automated Arrears Relief Exemption Calculator U/s 89(1) Income Tax With Form

10 E | Article 89 comes into force when the salary/annuity or other parts are paid sooner or

later. As explained in Section 89, if you simply receive your salary in cash or in advance

during the budget year because your total income for that year expands, increasing your

taxable income, it will lock you in. Relief under Section 89. You must complete Framework

10E with these exact details and then submit it to your current principal to secure relief. The

10E structure must be filed online and you do not need to attach a duplicate to the tax return.

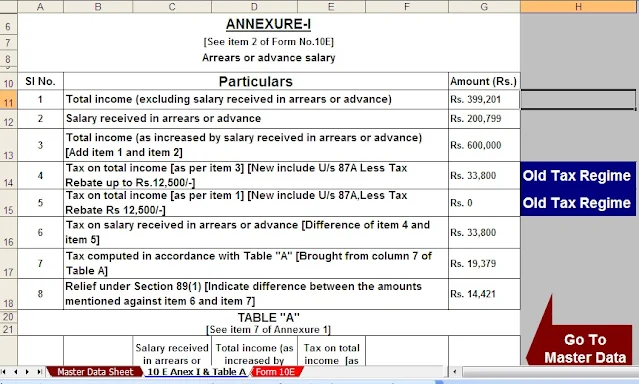

This is how the relief u/s 89 is determined

Step 1: Confirm the current year tax (calculation of completion and termination of education)

on income by remembering back wages/advances/payments.

Step 2: Determine the tax for the current year (taking into account the suspension and

suspension of education) on income, unless wages are

less than monetary wages.

Step 3 – Step 1 is short for Step 2

Step 4: Confirm the fiscal year in which the salary will be received (cees and cessation of

education account) on the income, remembering

salary for arrears.

Step 5: Calculate the tax for the year during which wages/salary (counting educational

interruption and educational interruption) must be received on income, excluding financially

delinquent wages

Step 6: Step 4 Short Step 5

Stage 7: Discount for late payment 89 = Stage 3 short Stage 6 (if

positive, however, nil)

Step 8: Current assessment year for purchased taxes = Step 1, Short Step 7