Download Excel-based all-in-one automated income tax preparation software for government and non-government (private) employees for new and old tax systems for the tax year 2022-23

Finance Minister Nirmala Sitharaman

announced the inclusion of a new provision in the 2020 Union Budget, known as

115BAC, in the Income Tax Act. The second BAC 115, after the 2020-21 tax year,

establishes a new discretionary income tax structure for Hindu individuals and

Undivided Families (HUF).

Let's understand the fees for the

new plates, the eligibility criteria for the new system, and the allowances

allowed or denied under Section 114 BAC. Plus, we'll help you compare the two

tires so you can choose the right one for you.

What is Section 115 BAC?

Section 115 BAC is a provision

recently introduced in the Income Tax Act of 1961, which guarantees a new

income tax system. This alternative financial provision and discipline was

introduced in the Union Budget for 2020 and relates to Hindu Individuals and

Undivided Families (HUF). An important component of this new system is that the

income tax rate has been significantly reduced. However, the new rates come at

the expense of various basic income tax exclusions and exemptions, which are

now accessible under the old (current) income tax framework. The attached table

shows the price of the new plates referred to in article 115 BAC.

Feature of this Excel Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2022

3)

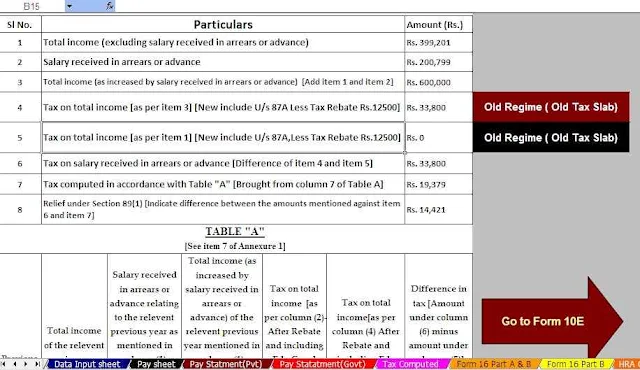

Automated Income Tax Arrears Relief Calculation U/s 89(1) with Form 10E for the

F.Y.2022-23

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

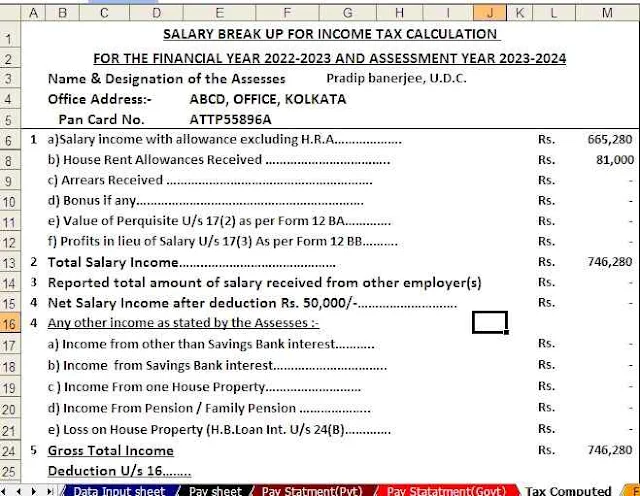

Individual Salary Structure as per the Govt and Non-Govt (Private) Concern’s

Salary Pattern

6)

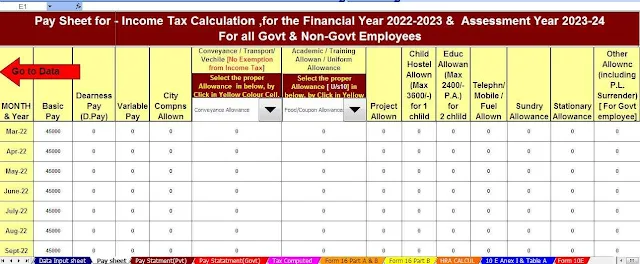

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount into the in-words without any Excel Formula